Fundamental Principles of Discretionary Trusts

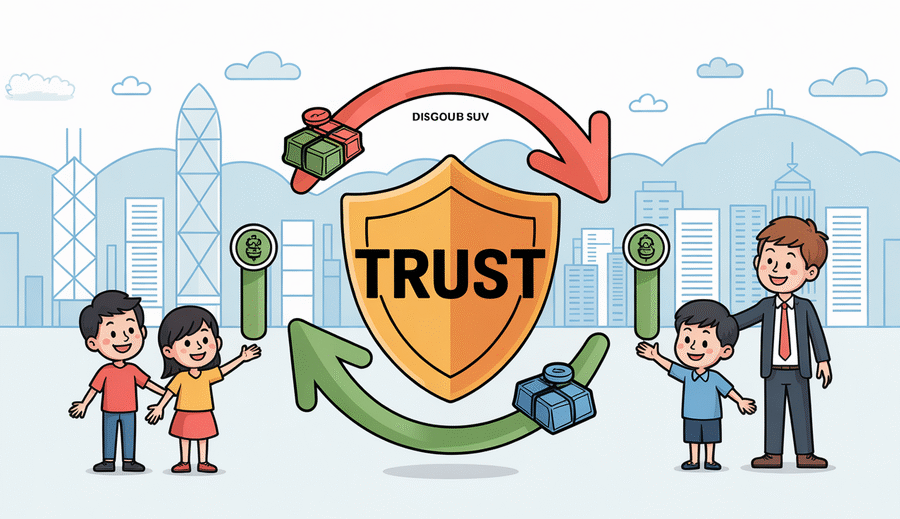

Understanding the foundational concepts of discretionary trusts is essential for grasping their potential, particularly concerning wealth management and asset protection in Hong Kong. At its core, a discretionary trust establishes a legal arrangement where assets are entrusted to a trustee for the benefit of a designated class of beneficiaries. A key characteristic differentiating this structure from fixed trusts is the inherent flexibility granted to the trustee. Unlike scenarios where beneficiary entitlements are predetermined, the trustee of a discretionary trust possesses the power to decide which beneficiaries receive distributions, the timing of these distributions, and the specific amounts or assets allocated, guided by the stipulations within the trust deed. This adaptability is a defining feature, enabling dynamic responses to evolving financial landscapes and beneficiary needs.

The broad authority vested in the trustee represents a cornerstone of the discretionary trust structure. These powers, meticulously outlined within the trust deed and governed by relevant trust legislation in Hong Kong, typically encompass comprehensive discretion over managing and investing the trust assets. Furthermore, the trustee holds the critical power to determine the distribution of both income and capital generated by the trust property. This empowers the trustee to act as a fiduciary steward, making decisions deemed to be in the collective best interests of the beneficiaries, without being bound by rigid obligations to any single individual. This discretionary capacity is invaluable for navigating uncertain futures and tailoring support to beneficiaries based on their changing life circumstances or financial requirements.

Beyond the trustee’s discretionary powers, a fundamental principle underpinning any trust, including a discretionary one, is the strict legal separation between the legal ownership of the trust assets and their beneficial ownership. Within this arrangement, the trustee holds the legal title to the trust property, granting them the rights and imposing the responsibilities associated with its management and administration. Conversely, the benefits derived from these assets, whether income streams or capital growth, are intended for the beneficiaries. The beneficiaries hold beneficial ownership, representing their equitable right to the trust property or its proceeds, contingent upon the trustee’s exercise of discretion. This distinction is more than a technicality; it is foundational to the trust’s operation and profoundly influences critical aspects such as asset protection and, significantly, the tax treatment of the trust’s assets and income, as legal title is held by the trustee rather than directly by the individual beneficiaries.