Unique Advantages of Private Trust Companies for Sophisticated Wealth Management

While traditional trusts remain valuable instruments for wealth transfer, Private Trust Companies (PTCs) represent a sophisticated evolution, offering distinct advantages particularly relevant for high-net-worth individuals navigating complex financial landscapes. A primary distinction lies in the ability for families to retain significant oversight and influence over trust administration. In contrast to appointing an external corporate trustee, which typically involves ceding substantial decision-making authority, a PTC structure enables designated family members or trusted advisors to actively participate in or directly oversee the management and distribution of trust assets. This deep level of involvement ensures that the stewardship of wealth stays closely aligned with the family’s core values, long-term objectives, and unique circumstances, providing reassurance and preserving legacy objectives across generations.

Beyond shared control, PTCs offer unparalleled flexibility in crafting bespoke governance structures precisely tailored to a family’s specific assets. This capability is particularly vital when wealth includes non-traditional or complex holdings such as operating businesses, extensive real estate portfolios, significant art collections, or specialized investments that may not fit neatly within standard institutional trust templates. A PTC can be meticulously designed with customized provisions, specialized committees, or by appointing directors with specific industry expertise. This ensures these unique and intricate assets are managed effectively based on the family’s intimate knowledge and strategic vision, rather than being subjected to generic institutional policies or limitations.

Furthermore, in a world characterized by dynamic regulations and evolving financial environments, PTCs provide superior agility. Large institutional trustees often operate under rigid internal procedures and slower decision-making cycles due to their scale and standardized processes. Conversely, a PTC, being a dedicated entity focused exclusively on one or a limited number of related family trusts, can adapt far more rapidly to changes in tax laws, compliance requirements, and other regulatory shifts. This capacity for swift, informed responsiveness is critical for maintaining the integrity and effectiveness of the asset protection structure, facilitating proactive adjustments that safeguard wealth against unforeseen legal or economic challenges and ensure ongoing compliance with evolving global standards.

| Feature | Private Trust Company (PTC) | Traditional Corporate Trust |

|---|---|---|

| Family Control & Involvement | High – Family members or trusted advisors actively participate in or oversee administration and decisions. | Lower – Authority and decision-making primarily delegated to the corporate trustee. |

| Governance Customization | Highly Tailored – Structure, committees, and expertise can be customized for complex or unique assets. | Standardized – Often relies on established templates; less flexible for highly specific asset types. |

| Adaptability & Agility | More Agile – Designed for focused responsiveness to regulatory and market changes. | Can be Slower – Institutional scale and procedures may lead to longer decision cycles. |

Establishing Robust Legal Separation for Asset Protection

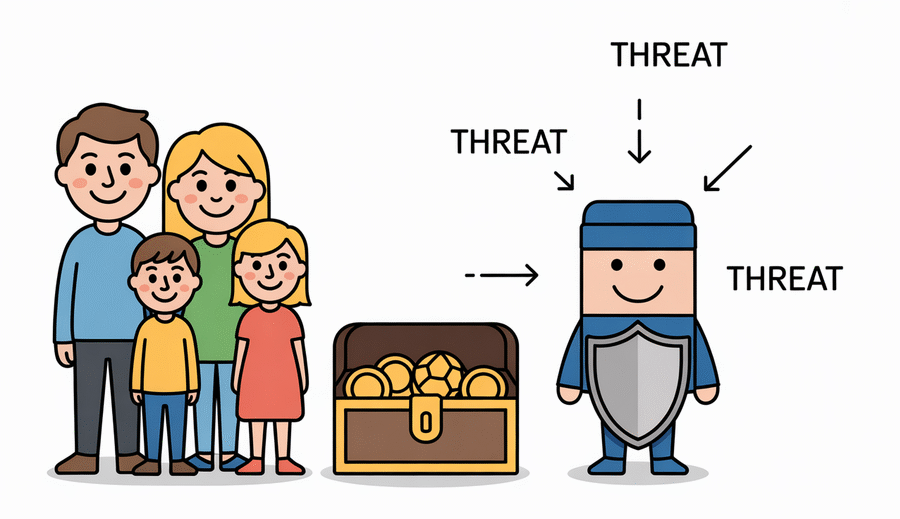

A cornerstone of effective asset protection for high-net-worth individuals involves creating a clear and legally enforceable separation between personal wealth and the individuals intended to benefit from it. Private Trust Companies (PTCs) are exceptionally well-suited to facilitate this fundamental distinction. Rather than holding assets directly in personal names or through simpler, less robust structures, placing wealth under the ownership and administration of a PTC establishes a separate and distinct legal entity. This separation is paramount for insulating wealth from a range of potential external threats and liabilities.

This legal barrier serves multiple critical functions within sophisticated wealth planning. By holding assets within the corporate structure of a PTC, wealth can be significantly shielded from personal creditor claims that might arise against the settlor or individual beneficiaries. The assets legally belong to the trust, managed by the PTC, rather than being part of an individual’s personal estate. This arrangement substantially limits exposure in instances of litigation, bankruptcy, or other financial disputes impacting family members, creating a vital layer of defense.

Furthermore, leveraging a PTC structure permits strategic domiciliation in stable, reputable jurisdictions. This provides a powerful mechanism to insulate valuable assets from the potential impacts of geopolitical instability, such as abrupt changes in government, civil unrest, risks of expropriation, or the imposition of restrictive capital controls in regions where family members might reside or hold citizenship. The careful selection of the PTC’s jurisdiction thus acts as a crucial protective layer in itself, enhancing the security of assets against external political and economic risks.

Another significant advantage of this legal separation, particularly when the PTC and the underlying trust are established in a jurisdiction with favorable laws, is the ability to effectively navigate or even prevent challenges related to forced heirship. In many countries, laws mandate how a specific portion of an individual’s estate must be distributed among designated heirs, potentially overriding the deceased’s explicit wishes. Assets placed into a trust administered by a PTC in a jurisdiction that does not recognize such forced heirship laws can be distributed strictly according to the terms outlined in the trust deed, ensuring the settlor’s legacy plan is executed precisely as intended, free from statutory constraints.

Ultimately, the legal separation achieved through a thoughtfully structured PTC provides a formidable defense against a wide spectrum of potential threats to family wealth. It creates a clear, legally recognized boundary between the assets and individual beneficiaries, significantly enhancing the security, control, and intended distribution path of wealth for future generations.

| Area of Protection Enhanced by Separation | How a PTC Facilitates This |

|---|---|

| Protection Against Personal Creditor Claims | Assets are legally held by the distinct PTC entity as trustee, separate from the personal estates of the settlor or beneficiaries, creating a robust barrier against individual liabilities and lawsuits. |

| Mitigation of Geopolitical Risks | Allows strategic incorporation and administration of the PTC and trust in stable, low-risk jurisdictions, insulating assets from political or economic volatility elsewhere. |

| Navigating Forced Heirship Rules | Structuring the trust under the laws of jurisdictions that do not enforce forced heirship enables distribution according to the trust deed’s terms, preserving testamentary intent. |

By acting as the legal owner and independent administrator, the PTC fundamentally reinforces this separation, offering a level of asset protection that is both comprehensive and highly adaptable to the complex and evolving needs of high-net-worth families.

Empowering Families to Maintain Enduring Control Across Generations

One of the most compelling reasons for high-net-worth families to establish a Private Trust Company (PTC) is the sustained ability to retain direct influence and control over their generational wealth and legacy. Unlike delegating authority to an external, independent institutional trustee, a PTC is specifically structured to keep governance decisions within the direct oversight of the family or their most trusted, long-standing advisors. This framework empowers the family to guide the trust’s administration, investment philosophy, and strategic direction over the long term, dynamically adapting to changing circumstances and family needs.

A core mechanism for achieving this enduring control is the explicit ability to appoint family members, or individuals who possess an intimate understanding of the family’s values, business interests, and long-term objectives, as directors of the PTC. These directors actively participate in and shape key decisions regarding asset management, distribution strategies, and the overall direction of the trust. This direct involvement ensures that the trust’s operations and outcomes consistently remain aligned with the family’s specific needs, philosophies, and evolving circumstances across the succession of generations.

Furthermore, the structure of a PTC inherently necessitates and facilitates the implementation of clear, formalized succession protocols for leadership roles within the company itself. This proactive planning is crucial for ensuring seamless transitions of governance authority, guaranteeing that the stewardship structure remains stable, effective, and aligned with generational transfer principles as leadership passes from one era of the family to the next. Establishing transparent procedures for appointing successor directors ensures continuity and prevents potential disputes over control.

Finally, the inherent flexibility of a PTC allows for the development and implementation of highly tailored family governance frameworks. These frameworks can formally codify deeply held family values, define specific criteria or guidelines for beneficiary distributions, and outline structured processes for communication and conflict resolution among family stakeholders. By embedding these precise rules, philosophies, and operational guidelines directly into the governance structure of the PTC, families can ensure their legacy is managed and perpetuated according to their exact wishes, fostering family unity and shared purpose alongside the preservation of financial wealth for generations to come.

Enhancing Confidentiality and Discretion in Wealth Management

For high-net-worth individuals, preserving privacy and discretion is often as critical as achieving financial growth and robust asset protection. Managing significant wealth inherently involves dealing with complex financial structures, sensitive personal information, and potentially confidential family dynamics. Private Trust Companies (PTCs) offer distinct and significant advantages in maintaining a high degree of confidentiality, a paramount concern when managing high-stakes wealth and family affairs. This enhanced level of privacy provides a crucial layer of security and discretion that is frequently more challenging to achieve through more public or conventionally structured wealth management vehicles.

A key benefit contributing to the confidentiality offered by PTCs is the potential to avoid public trust registry disclosures. Unlike some jurisdictions or trust structures that may require registration in a public database, potentially exposing the existence of the trust, detailing its assets, or even identifying beneficiaries, PTCs can often be established and administered in jurisdictions that do not mandate such public filings. This strategic choice allows the sensitive details of the trust structure, its asset holdings, and beneficiary information to remain private and accessible only within the family and its designated, trusted advisors, safely away from public scrutiny or unwanted attention.

Moreover, PTCs inherently limit the pathways and the number of individuals through which sensitive financial and family information is shared. When utilizing a large corporate trustee, information about family assets, distribution specifics, and governance decisions may traverse numerous departments and personnel within the large institution, increasing touchpoints and potential exposure. With a PTC, however, the control over who has access to this highly sensitive information rests squarely with the PTC’s board of directors, which is typically composed of carefully selected family members and their most trusted professional advisors. This centralized and tightly controlled flow of information significantly reduces the risk of leaks or unintended disclosures, ensuring sensitive details remain confined to a highly managed and discreet circle.

The strategic use of discretionary distribution mechanisms within a trust administered by a PTC further contributes significantly to preserving privacy. Rather than adhering to rigid, predefined payout rules that might necessitate formal reporting or could trigger public knowledge of wealth transfers, a discretionary trust structure empowers the PTC board to make distribution decisions based on circumstances, privately, flexibly, and often without public record. This discretion ensures that the specific details regarding how, when, and to whom funds are distributed remain internal decisions, thereby maintaining the privacy of both the trust’s financial status and the specific receipts of the beneficiaries. Collectively, these features combine to create a highly confidential and secure environment for managing, protecting, and transferring complex family wealth across generations.

Optimizing Tax Efficiency Through Strategic Jurisdiction Selection

For high-net-worth individuals and families, proactive management of tax liabilities is a critical element of long-term wealth preservation and growth. Private Trust Companies (PTCs) offer a sophisticated and highly effective mechanism to achieve enhanced tax efficiency, primarily through the careful and strategic selection of the jurisdiction where the PTC is established and operates. By incorporating a PTC in a location specifically chosen for its favorable legal and tax regime pertaining to trusts and holding structures, families can significantly optimize their overall tax burden on trust assets, accumulated income, and distributions, thereby aligning their wealth structure with global tax landscapes in a beneficial manner.

A primary advantage in this regard lies in the ability to strategically leverage low-tax or even zero-tax jurisdictions for the PTC itself and potentially the underlying trusts it administers. Certain international financial centers have intentionally designed their legal and tax frameworks to be highly attractive to international trust and corporate structures. These jurisdictions often offer compelling advantages such as no income tax, no capital gains tax, and no inheritance or gift tax on foreign-sourced income or assets held within trust structures managed by a local PTC. This foundational strategic choice of domicile serves as a powerful tool for mitigating potential tax erosion on wealth across multiple generations.

Furthermore, a PTC structure situated in a carefully selected, tax-advantageous jurisdiction can assist in navigating or even minimizing complexities often associated with international double taxation treaties. While tax treaties are designed to prevent income from being taxed twice in different countries, they can also introduce intricate rules, limitations, and reporting requirements. By appropriately situating the PTC and structuring assets and distributions according to the chosen jurisdiction’s laws and its network of double taxation agreements, if any, families can work with expert advisors to minimize withholding taxes, navigate complex international tax rules, and reduce other cross-border tax frictions, ensuring a greater portion of the generated wealth is preserved within the family structure.

Crucially, the pursuit of tax efficiency through strategic jurisdiction must always be carefully balanced with stringent and evolving international compliance requirements. The global tax landscape is in a state of constant flux, characterized by increasing demands for transparency and international cooperation among tax authorities. A well-managed PTC, advised by experienced professionals, is instrumental in assisting families in maintaining this delicate balance. It ensures that while they rightfully benefit from the legitimate tax advantages of their chosen jurisdiction, they remain fully compliant with all applicable reporting obligations and regulatory mandates in their countries of residence, operation, and wherever assets are located. This diligent and proactive approach to compliance within a strategically selected jurisdiction is absolutely key to achieving sustainable, legitimate, and tax-efficient wealth management for the long term.

Mitigating Risks and Enhancing Resilience in Volatile Economic Climates

In today’s economic environment, characterized by inherent unpredictability, rapid technological shifts, and increasing global interconnectedness, safeguarding substantial wealth demands robust strategies that extend beyond conventional approaches. Volatile economic climates present a unique array of challenges, ranging from localized economic downturns and widespread geopolitical instability to significant currency fluctuations and unforeseen global crises. Private Trust Companies (PTCs) offer a sophisticated and adaptable framework specifically designed to empower high-net-worth families to navigate these turbulent waters, providing structural advantages that fundamentally enhance resilience and protection against a broad spectrum of economic risks.

A primary mechanism leveraged by PTCs is their inherent ability to facilitate the diversification of asset portfolios across multiple jurisdictions. Unlike simpler trust structures that might be inherently tied to a single locale and its specific economic or regulatory environment, a PTC can be incorporated in a strategic, stable jurisdiction while concurrently holding and managing assets located in numerous different countries around the world. This deliberate geographic diversification significantly reduces concentration risk associated with the performance or regulatory changes of a single economy or region, effectively spreading exposure and insulating wealth from localized economic shocks, political instability, or adverse regulatory changes.

Furthermore, PTCs can play a crucial role in actively mitigating risks associated with currency fluctuations, which can significantly erode the real value of wealth held in a single currency. By facilitating the holding and management of assets denominated in a diverse array of currencies, or by strategically positioning the trust’s primary operational or reporting currency, families can effectively hedge against adverse movements in their primary currency of reference. This proactive and sophisticated management of currency risk is vital for preserving the purchasing power and real value of wealth, particularly for families with international ties or during periods of significant monetary instability.

Perhaps most critically during times of crisis, PTCs allow for the establishment of sophisticated and dynamic emergency provisions within the trust structure. These provisions can include pre-defined powers and guidelines for the trustees (who, within a PTC structure, are often trusted family members or advisors) to take swift, decisive action during specified crisis scenarios. Such actions might involve the rapid acquisition or disposition of certain asset types, the strategic relocation of assets to safer jurisdictions, or the execution of emergency distributions to beneficiaries facing immediate needs. This built-in adaptability and capacity for rapid, informed response are invaluable attributes during fast-moving economic downturns, market collapses, or unpredictable global events, ensuring that the wealth structure can react effectively and decisively to protect the underlying holdings and support the family.

Future-Proofing Family Wealth Through Dynamic Structures

In an era defined by continuous and often rapid change—be it technological advancements, evolving social norms, or shifts in global economics—ensuring the longevity, relevance, and resilience of family wealth requires structures that are not merely protective but also inherently dynamic and adaptable. Private Trust Companies (PTCs) offer a distinct and significant advantage in this critical regard, providing the necessary flexibility to anticipate and effectively navigate future complexities that more traditional, static trust arrangements may struggle to adequately address.

One crucial aspect of future-proofing involves the structure’s capacity to integrate emerging asset classes into the overall wealth plan. As the global financial and investment landscape evolves, novel asset types like cryptocurrencies, digital art (NFTs), or direct interests in innovative ventures become increasingly relevant components of sophisticated portfolios. Unlike many conventional institutional fiduciaries often constrained by conservative investment mandates and administrative limitations, a PTC, controlled by the family or its carefully chosen expert advisors, can be specifically empowered and equipped with the knowledge to understand, hold, manage, and strategically integrate these new types of assets seamlessly into the overall portfolio and long-term succession plan.

Furthermore, the global regulatory environment governing wealth, taxation, data privacy, and technology is in a state of constant flux, presenting ongoing challenges. A dynamic PTC structure is built with inherent adaptability in mind. Its governance framework can be designed to proactively react swiftly and effectively to legislative and regulatory changes in multiple jurisdictions, ensuring continuous compliance with evolving standards and thereby maintaining the intended protective barriers and tax efficiencies around the family’s assets. This proactive adaptability is essential for preventing potential disruptions, penalties, or unintended consequences and safeguarding wealth against unforeseen legal or tax challenges that may arise in the future.

Crucially, true future-proofing involves ensuring that the wealth structure remains relevant and aligned with the values, aspirations, and evolving circumstances of future generations. PTCs provide a structured and facilitated platform for ongoing family dialogue, education, and involvement in governance and decision-making processes. This engagement allows the structure and its objectives to evolve in a way that authentically resonates with the philanthropic goals, investment philosophies, entrepreneurial interests, and lifestyle choices of the next generation. By building governance frameworks that can incorporate these changing perspectives and foster continuity, PTCs help ensure that the family wealth continues to serve its purpose, support its members, and remains a unifying force for generations to come, ultimately creating a truly enduring and relevant legacy.