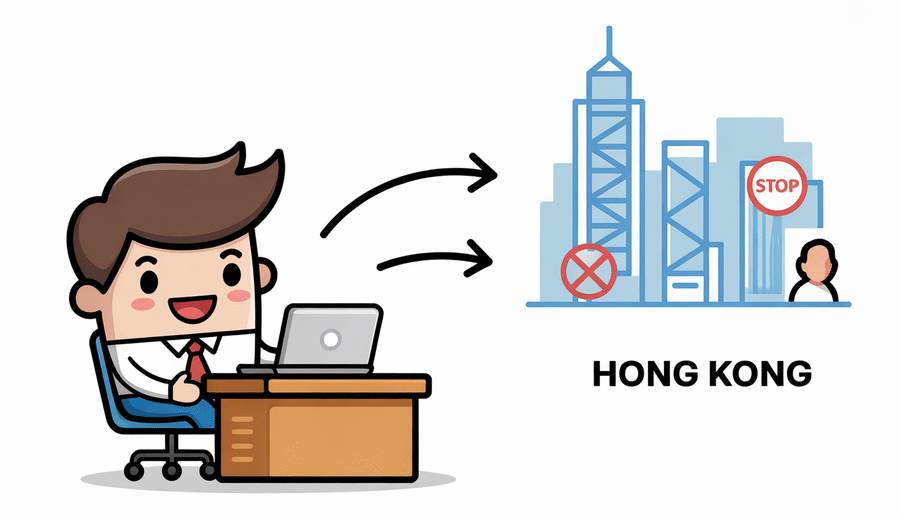

Understanding Permanent Establishment (PE) Basics in Hong Kong

Hong Kong operates under a territorial basis of taxation, meaning that only profits sourced within the territory are subject to profits tax. For non-resident entrepreneurs and businesses, this principle offers significant advantages. However, the concept of Permanent Establishment (PE) is a crucial element that can bring non-resident entities within the scope of Hong Kong taxation. Simply put, a PE signifies a sufficiently stable and enduring presence in Hong Kong through which a non-resident entity conducts its business activities.

If a non-resident entity is determined to have a Permanent Establishment in Hong Kong, the tax implications are substantial. It means that profits derived from or attributable to the business conducted through that PE become subject to Hong Kong profits tax. This typically necessitates potential registration with the Inland Revenue Department (IRD), filing tax returns, and paying tax on those attributable profits, effectively creating a taxable footprint. Understanding precisely what constitutes a PE is therefore essential for managing tax exposure and ensuring compliance.

A key factor in determining the existence of a PE is distinguishing between a temporary presence and a fixed place of business. Brief, occasional visits for meetings or short-term activities without establishing a stable base generally do not constitute a PE. In contrast, a fixed place of business implies a degree of permanence, stability, and regular availability of a specific location. This could take various forms, such as an office, branch, factory, workshop, or even certain sites like construction projects exceeding a specified duration. The stability of the presence and the nature of the activities conducted at that location are critical in determining if a non-resident’s connection to Hong Kong crosses the threshold from transient visits to a taxable presence.

Common PE Triggers for Foreign Business Operations

For non-resident entrepreneurs, identifying the specific activities that could inadvertently create a Permanent Establishment (PE) in Hong Kong is paramount. Certain common scenarios can trigger PE status, potentially leading to unexpected tax obligations under the territory’s tax system. Recognizing these potential pitfalls allows businesses to proactively structure their operations and mitigate associated risks.

One significant trigger is the establishment of a physical presence. This includes actions such as leasing office space, even a modest service office, or hiring local employees who perform core, income-generating business functions. Such steps can indicate either a fixed place of business or the presence of a dependent agent regularly concluding contracts on behalf of the non-resident entity – both classic definitions of a PE that attract tax liability on attributable profits.

The nature and location of business activities, particularly patterns related to contract negotiation and conclusion, also pose a risk. If a non-resident business consistently conducts substantial contract negotiations or signs agreements within Hong Kong, tax authorities may interpret this pattern as carrying on business through a deemed taxable presence, even without a formal office structure.

Utilizing storage facilities can also potentially trigger a PE. While merely maintaining a warehouse solely for storage or display of goods is generally exempt, exceeding specific time limits or conducting related activities from the facility, such as processing orders, packaging, or delivering goods, can transform it into a taxable fixed place of business. The critical distinction lies between purely preparatory or auxiliary activities and core business functions performed from a location.

| Trigger Type | Example Activities | Potential PE Risk |

|---|---|---|

| Physical Presence | Leasing office space, hiring local employees with authority | Fixed place of business, dependent agent PE |

| Business Activities | Habitual contract negotiation/signing in HK, local sales force concluding deals | Carrying on business through a deemed presence |

| Storage Facilities | Warehousing beyond temporary limits, order processing/fulfillment from HK facility | Exceeding preparatory/auxiliary status |

Businesses must carefully assess their operational footprint and activity levels in Hong Kong against these common triggers. Proactive evaluation and careful structuring of activities are essential preventative measures to avoid unintentionally creating a Permanent Establishment and incurring unexpected tax burdens.

Strategic Business Structuring to Minimize PE Exposure

Avoiding the creation of a Permanent Establishment (PE) in Hong Kong requires proactive and strategic business structuring, particularly for non-resident entrepreneurs operating remotely or with cross-border teams. A fundamental strategy involves implementing clear policies for remote work and personnel location. By ensuring employees or contractors are based and primarily perform their duties outside of Hong Kong, and that they do not establish a stable or fixed base within the territory on behalf of the non-resident entity, companies can significantly reduce the risk of triggering a PE through employee presence. This necessitates carefully drafted employment or service agreements specifying work locations and limiting any activities within Hong Kong to functions deemed preparatory or auxiliary.

Another crucial element in structural risk mitigation is the careful selection and engagement of local representatives. Engaging genuinely independent agents rather than dependent representatives is a key distinction in PE analysis. An independent agent typically operates in their own name, assumes entrepreneurial risk, acts independently of detailed control by the non-resident company, and, importantly, does not possess or habitually exercise the authority to conclude contracts in the foreign enterprise’s name. Conversely, a dependent representative who habitually exercises contract-concluding authority or maintains a stock of goods for order fulfillment on behalf of the non-resident company can easily create a PE. Structuring relationships with local facilitators strictly as independent contractors, with clear contractual terms reflecting their autonomy and lack of binding authority, is therefore vital.

Furthermore, the duration and nature of any physical presence related to specific projects or activities must be meticulously managed. While purely temporary visits or activities might not constitute a PE, a series of consecutive projects or activities that, in aggregate, suggest a stable or continuous presence could potentially be viewed as such by tax authorities. Strategic planning of project timelines and the physical location where significant project-related activities occur is essential. Businesses should structure operations and project execution methods to avoid establishing a fixed place of business or having key personnel habitually present in Hong Kong for extended or recurring periods that could be deemed significant or continuous, thereby proactively managing PE exposure.

Compliance Essentials for Non-Resident Entities

For non-resident entrepreneurs with activities touching upon Hong Kong, maintaining stringent compliance protocols is not just administrative procedure but a critical safeguard against unintended Permanent Establishment (PE) exposure. Robust compliance practices serve to demonstrate to tax authorities that your business activities align with your non-resident status and do not constitute a taxable presence within the jurisdiction. Adhering to these essentials helps solidify your operational boundaries and provides the necessary documentation to support your tax position should it be questioned.

A fundamental compliance step involves maintaining a clear and demonstrable separation between any limited local activities and your core overseas operations. This separation should be evident throughout your organizational structure, contracts, financial accounts, and even the defined roles of personnel. Ensure that employees or representatives present in Hong Kong perform only preparatory or auxiliary functions and explicitly lack the authority to conclude contracts or manage the business’s primary income-generating activities. Visible distinctions prevent the accidental blurring of lines that could inadvertently lead to a PE determination.

Detailed and accurate documentation of all business activities is paramount. It is essential to meticulously record the location and timing of key actions, such as meetings, contract negotiations, sales calls, and service delivery. Utilizing location data and timestamps in digital records can provide concrete evidence of your operational footprint. This thorough documentation serves as a vital audit trail, enabling you to clearly demonstrate that substantial business decisions, contract signings, and core operational management are executed from outside Hong Kong, thereby supporting your non-resident status.

Furthermore, non-resident entities should integrate regular PE risk assessments into their ongoing compliance routine. Business models evolve, client engagements change, and personnel assignments may shift, all of which can subtly alter a company’s PE exposure profile. Periodic assessments allow you to proactively identify potential new triggers, review existing arrangements for continued compliance, and adjust practices as needed to mitigate risks before they could potentially manifest as a tax liability. Consulting with tax professionals specializing in international taxation and Hong Kong’s specific rules during these assessments is highly recommended to ensure thoroughness and accuracy.

Implementing these compliance essentials—maintaining clear operational separation, documenting activities diligently, and conducting regular risk assessments—forms a solid foundation for non-resident businesses operating in relation to Hong Kong. These practices collectively provide the transparency and evidence required to demonstrate adherence to tax regulations and successfully navigate potential PE challenges.

Leveraging Double Taxation Agreements (DTAs)

For non-resident entrepreneurs operating in Hong Kong, understanding and effectively utilizing Double Taxation Agreements (DTAs) is a critical strategy for mitigating Permanent Establishment (PE) risks. These are bilateral treaties signed between Hong Kong and numerous other jurisdictions, primarily aimed at preventing the double taxation of income and capital gains. Significantly, most DTAs include specific clauses defining Permanent Establishment, which can override or modify the domestic tax laws of one or both treaty partners. Identifying whether a DTA exists between Hong Kong and your country of residence, and subsequently understanding its specific terms, is the foundational step in leveraging these agreements for potential PE protection.

DTAs often provide clearer definitions or introduce specific thresholds that must be met for a PE to be deemed to exist. Unlike domestic rules which might be more general or subject to interpretation, a DTA might stipulate a minimum duration for construction projects, explicitly exclude certain preparatory or auxiliary activities (like storage or purchasing goods) from the PE definition, or define more precisely under what circumstances an agent constitutes a PE. Therefore, it is crucial to consult the applicable DTA to understand these potential PE exemption thresholds or carve-outs. Knowledge of these specific treaty provisions allows non-resident businesses to structure their activities in Hong Kong in a manner that stays below the DTA’s PE threshold, thereby potentially avoiding a taxable presence even if domestic rules might otherwise suggest one.

Furthermore, leveraging DTA benefits requires careful coordination with tax compliance obligations in your home country. While a DTA might provide relief from Hong Kong tax by confirming that no PE exists, you will still need to report your worldwide income and potentially claim treaty benefits or foreign tax credits in your country of residence, depending on its tax system. Proper documentation demonstrating that your activities in Hong Kong fall within a DTA’s PE exemption is essential to support your position. This integrated approach, combining an understanding of the DTA’s specific provisions with meticulous reporting and compliance in your home jurisdiction, ensures you effectively utilize the treaty’s protection against PE risk and potential double taxation.

Technology Solutions for Cross-Border Operations

Operating across international borders presents unique challenges for non-resident entrepreneurs, particularly regarding the potential for inadvertently creating a taxable presence like a Permanent Establishment (PE). Fortunately, modern technology offers powerful solutions to mitigate these risks by enabling businesses to function effectively without requiring significant physical infrastructure or a fixed place of business in a jurisdiction like Hong Kong. Leveraging the right digital tools is not merely about efficiency; it is a strategic imperative for maintaining your non-resident status for tax purposes.

A primary advantage technology provides is the ability to minimize or eliminate the need for physical infrastructure in Hong Kong. Cloud-based services, such as Software-as-a-Service (SaaS) applications, cloud storage, and virtual collaboration platforms, allow teams to work together seamlessly from geographically dispersed locations. By hosting data and running applications in the cloud, companies can avoid the necessity of leasing local server space or establishing a physical office purely for administrative functions or data housing. Remote desktop solutions and virtual meeting tools further facilitate operations without requiring personnel to have a consistent physical presence in the target jurisdiction.

Furthermore, implementing robust activity-tracking systems is crucial for creating verifiable audit trails. Tools that log employee work hours, project progress, client communications, and task completion provide concrete, timestamped evidence of where and when business activities are performed. This documentation can be invaluable in demonstrating to tax authorities that key functions, management decisions, or substantive operations are taking place outside of Hong Kong, thereby strongly supporting your claim of not having a Permanent Establishment there. Such systems offer transparency and accountability, significantly strengthening your compliance posture.

Finally, automating transaction documentation processes streamlines operations and enhances your ability to demonstrate remote management and a lack of local PE triggers. Automated invoicing, digital contract management platforms, and integrated financial record-keeping systems ensure that transactions are consistently recorded with relevant details, including location and timestamps where applicable. This automation reduces reliance on localized administrative activities that could potentially trigger a local presence and provides clear, auditable records that support your non-resident status by showing that core business processes are handled efficiently and remotely. Utilizing these technological safeguards forms a vital layer of protection against unintended Permanent Establishment risks in the digital age.

Legal Safeguards and Contractual Best Practices

Establishing clear legal safeguards and adopting meticulous contractual practices are paramount for non-resident entrepreneurs operating in or with Hong Kong to effectively mitigate Permanent Establishment (PE) risks. Proactive legal measures can significantly reduce potential tax liabilities and compliance burdens. One critical strategy involves the careful drafting of service agreements and contracts with clients, suppliers, or partners in Hong Kong. These documents should ideally include specific clauses explicitly stating that the activities undertaken by the non-resident entity or its representatives do not intend to and should not be construed as creating a PE in Hong Kong under local tax laws and any applicable double taxation agreements. While not a standalone guarantee, such clauses demonstrate clear intent and can support your position in the event of a tax authority inquiry.

Equally vital is the correct classification and contractual engagement of individuals performing services on behalf of the non-resident business within Hong Kong. It is essential to clearly establish terms for engaging independent contractors that genuinely reflect an arm’s-length relationship and avoid characteristics that might imply a dependent agent or employee relationship – a common PE trigger. Contracts should precisely define the scope of work, payment terms, and critically, specify that the contractor operates independently, is not subject to the detailed direction and control typically associated with employment, and does not have the authority to habitually conclude contracts binding the non-resident company. Maintaining meticulous records supporting the independent nature of the relationship is also crucial.

Despite best efforts in structuring and contracting, disagreements or audits with tax authorities can sometimes occur. Therefore, having developed protocols for potential dispute resolution with tax authorities is a prudent safeguard. This includes understanding the process for responding to official inquiries, challenging potential assessments, and, if necessary, navigating mutual agreement procedures available under relevant double taxation agreements. Preparedness involves maintaining robust documentation of all business activities, contractual relationships, and the rationale behind the chosen operating model. Engaging local legal and tax professionals specializing in international tax law and Hong Kong’s specific regulations is highly recommended to ensure all contractual arrangements and potential dispute resolution strategies are sound and aligned with current legal standards and practices.

Evolving Regulations in the Digital Economy Era

The landscape of international taxation is undergoing significant transformation, particularly in response to the burgeoning global digital economy. Non-resident entrepreneurs operating in or with Hong Kong must remain vigilant regarding these changes, as they can profoundly impact Permanent Establishment (PE) risk assessment. A key aspect involves closely monitoring global developments driven by international bodies like the OECD.

The Organisation for Economic Co-operation and Development (OECD) has been at the forefront of developing frameworks to address the tax challenges arising from digitalization, notably through the Base Erosion and Profit Shifting (BEPS) project and the ongoing work on Pillars One and Two. While Hong Kong operates a territorial tax system, these international guidelines increasingly influence how jurisdictions interpret traditional tax concepts, including PE, in a world less reliant on physical presence. Staying informed about proposed changes to PE definitions, particularly those considering factors like significant digital presence or economic nexus, is crucial for anticipating future compliance demands.

Furthermore, there is increasing global scrutiny on the taxation of digital services. Even if a non-resident business successfully avoids triggering a traditional PE under Hong Kong law based on physical presence or dependent agents, the very nature of digital transactions means activities can still attract attention from tax authorities focused on where value is created or consumers are located. Preparing for this potential scrutiny involves meticulous record-keeping and a recognition that tax frameworks worldwide are adapting to capture economic activity that transcends physical borders.

Hong Kong itself is also refining its anti-avoidance measures to align with international best practices and address modern business models. These evolving domestic regulations can impact how activities previously considered outside the scope of a PE are now viewed. Non-resident entrepreneurs need to adapt their operational structures and documentation processes proactively to ensure that their activities genuinely fall outside any redefined or more stringently interpreted PE triggers under current and future Hong Kong tax law. Remaining flexible and responsive to these significant regulatory shifts is paramount for long-term compliance and effective risk mitigation.