Estate Planning for Hong Kong Real Estate: Avoiding Probate Delays

📋 Key Facts at a Glance

- No Estate Duty: Hong Kong abolished estate duty in 2006 – no inheritance tax on property transfers

- Stamp Duty Applies: Property transfers, even as gifts, trigger stamp duty based on market value

- Probate Delays: Court backlogs can extend property transfers by 6-12 months or more

- Joint Ownership Solution: Joint tenancy with right of survivorship bypasses probate entirely

- Trust Structures: Property held in trust transfers outside probate, ensuring privacy and speed

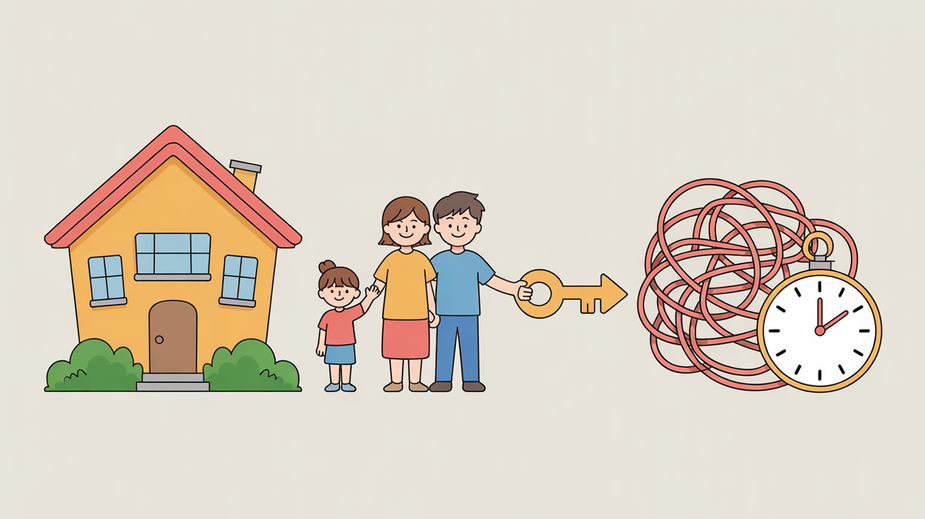

What happens to your Hong Kong property when you pass away? While Hong Kong abolished estate duty in 2006, making it one of the few jurisdictions with no inheritance tax, the probate process can still tie up your property for months or even years. With Hong Kong’s property market being one of the world’s most valuable, understanding how to navigate estate planning effectively is crucial for protecting your assets and ensuring a smooth transition for your beneficiaries.

Why Probate Delays Hong Kong Property Transfers

The probate process in Hong Kong – the legal administration of a deceased person’s estate – can be surprisingly lengthy, especially when valuable real estate is involved. While Hong Kong doesn’t tax inheritances, the administrative hurdles can create significant delays for beneficiaries waiting to access their property.

The Three Main Bottlenecks in Hong Kong Probate

Several factors contribute to extended probate timelines for Hong Kong property:

| Challenge | Impact on Property Transfer | Typical Timeline Impact |

|---|---|---|

| Court Backlogs & Complex Ownership | Administrative delays, complex legal verification | 3-6 months additional |

| Family Disputes | Complete suspension until court resolution | 6-24 months or more |

| Mandatory Asset Freezing | Property cannot be sold or transferred | Entire probate period |

| Cross-Border Complications | Additional documentation, foreign recognition | 2-12 months additional |

Joint Ownership: The Simplest Probate Avoidance Strategy

For many Hong Kong property owners, joint ownership offers the most straightforward way to bypass probate delays. When structured as a joint tenancy with right of survivorship, the property automatically transfers to the surviving owner(s) upon death – no court involvement required.

How Joint Tenancy Works in Hong Kong

Under Hong Kong law, joint tenancy creates an “undivided interest” in the property for all owners. The key feature is the right of survivorship: when one owner dies, their share automatically passes to the surviving joint tenant(s). This happens by operation of law, completely outside the probate system.

Pros and Cons of Joint Ownership

- Advantages: Immediate transfer, no probate costs, simple to establish

- Disadvantages: Shared control, potential for disputes, difficult to change unilaterally

- Best for: Spouses, close family members with aligned interests

Trust Structures: Professional Estate Management

For more complex estates or when you want professional management, trusts offer a sophisticated solution. By placing your Hong Kong property into a trust, you appoint a trustee to manage it for your beneficiaries according to your specific instructions.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | Can be changed or revoked | Generally cannot be changed |

| Probate Avoidance | Yes – property not in estate | Yes – property not in estate |

| Asset Protection | Limited protection | Strong protection |

| Control | Grantor retains control | Trustee controls assets |

| Best For | Flexibility seekers | Asset protection needs |

When to Consider a Trust for Hong Kong Property

- Multiple Beneficiaries: When property will be shared among several heirs

- Minor Beneficiaries: When heirs are too young to manage property

- Special Needs: When beneficiaries require ongoing management

- Privacy Concerns: Trusts keep asset details out of public probate records

- Professional Management: When you want expert oversight of the property

Strategic Gifting: Reducing Your Probate Estate

Transferring property during your lifetime can significantly reduce the assets subject to probate. While Hong Kong has no estate duty, gifting property still has important tax implications you need to understand.

Life Estate Arrangements: Gift with Benefits

A powerful strategy is to gift property while retaining usage rights. You transfer legal ownership to your beneficiaries now (triggering stamp duty), but retain the right to live in or use the property for your lifetime. Upon your death, full ownership automatically transfers to the beneficiaries – no probate required.

Crafting an Effective Will for Hong Kong Property

Even with other strategies in place, a well-drafted will is essential for any Hong Kong property owner. It serves as your primary instruction document and covers assets not addressed through joint ownership or trusts.

| Will Component | Importance for HK Property | Common Mistakes to Avoid |

|---|---|---|

| Clear Asset Identification | Precisely identify properties by address and title | Vague descriptions causing disputes |

| Executor Appointment | Name trusted individuals familiar with HK law | Overseas executors without local support |

| Beneficiary Details | Full legal names and contact information | Outdated information, missing alternates |

| Language Requirements | English or Chinese, or certified translation | Foreign language wills without proper authentication |

| Digital Assets | Include access to online accounts | Overlooking digital property and records |

Navigating Cross-Border Inheritance Issues

With Hong Kong’s international population, many estates involve beneficiaries in different countries. This adds complexity but can be managed with proper planning.

Key Cross-Border Considerations

- Dual Taxation Risk: While Hong Kong has no estate duty, beneficiaries may face taxes in their home country

- Document Recognition: Ensure wills and other documents meet requirements for all relevant jurisdictions

- Executor Challenges: Foreign executors may need to apply to Hong Kong courts for authority

- Mainland China Considerations: Special agreements exist for recognizing Hong Kong probate in Mainland China

Future-Proofing Your Hong Kong Estate Plan

Your estate plan should evolve with your life circumstances and Hong Kong’s changing property landscape. Regular reviews ensure your plan remains effective.

When to Review Your Estate Plan

- Property Value Changes: Significant appreciation or depreciation

- Family Changes: Marriage, divorce, births, or deaths

- Lease Renewals: Approaching lease expiry dates (common in Hong Kong)

- Regulatory Changes: New laws affecting property or inheritance

- Every 3-5 Years: Regular scheduled reviews

✅ Key Takeaways

- Hong Kong has no estate duty, but probate delays can tie up property for months or years

- Joint tenancy with right of survivorship provides immediate transfer outside probate

- Trusts offer professional management and privacy for complex estates

- All property transfers, including gifts, trigger stamp duty based on market value

- Cross-border estates require special planning for document recognition and executor authority

- Regular reviews ensure your estate plan adapts to life changes and property value fluctuations

Effective estate planning for Hong Kong property isn’t just about avoiding taxes – it’s about ensuring your assets transfer smoothly to your loved ones without unnecessary delays. By combining strategies like joint ownership, trusts, and well-drafted wills, you can create a comprehensive plan that protects your property and provides peace of mind for your beneficiaries. Remember to consult with qualified legal professionals who understand both Hong Kong property law and estate planning to implement the right strategies for your specific situation.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Stamp Duty Guide – Current stamp duty rates and regulations

- Hong Kong Judiciary – Probate Registry – Official probate procedures and requirements

- GovHK Stamp Duty Rates – Official stamp duty rate tables

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.