Hong Kong vs. Mainland China: Key Differences in Inheritance Laws for Business Owners

📋 Key Facts at a Glance

- Tax-Free Inheritance: Hong Kong abolished estate duty in 2006 – no inheritance tax on business assets or personal estates

- Legal Systems: Hong Kong follows common law with testamentary freedom, while Mainland China uses civil law with forced heirship provisions

- Business Succession: Hong Kong offers flexibility through wills and shareholder agreements; Mainland China emphasizes family inheritance to statutory heirs

- Cross-Border Complexity: Probate grants from one jurisdiction aren’t automatically recognized in the other – separate applications required

- Asset Transfer Taxes: Mainland China may impose transaction taxes on business transfers; Hong Kong has no such inheritance-related taxes

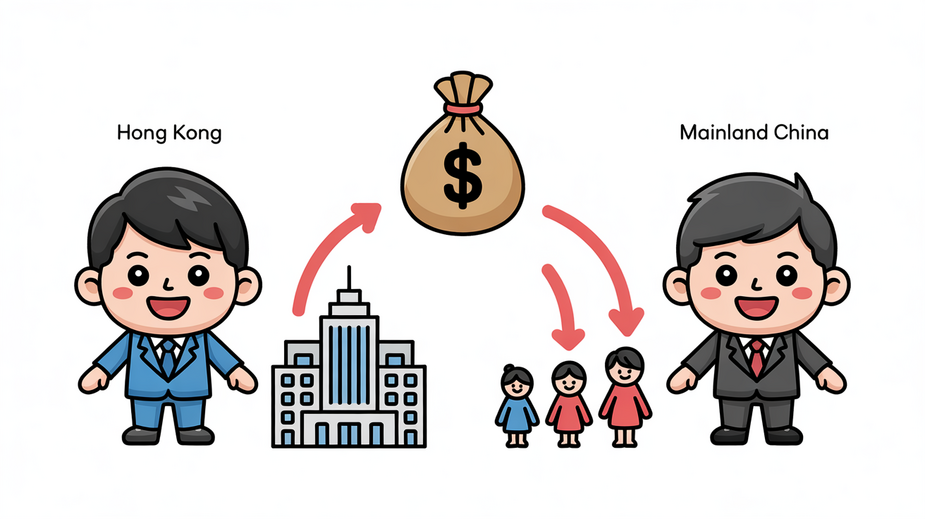

What happens to your Hong Kong-based business when you pass away? If you have operations or assets in both Hong Kong and Mainland China, the answer depends on which side of the border your assets sit. With over 300,000 Hong Kong residents owning property or businesses in Mainland China, understanding the stark differences between these two legal systems isn’t just academic – it’s essential for protecting your business legacy and ensuring your family’s financial security.

Two Worlds, Two Legal Systems

Hong Kong and Mainland China operate under fundamentally different legal frameworks that shape every aspect of inheritance planning. Hong Kong’s common law system, inherited from British colonial rule, relies on judicial precedents and case law, offering flexibility and adaptability. In contrast, Mainland China’s civil law tradition is built on comprehensive, codified statutes like the Civil Code, aiming for predictability through written rules.

| Legal Feature | Hong Kong | Mainland China |

|---|---|---|

| Legal System | Common Law | Civil Law (Codified) |

| Primary Basis | Judicial Precedent & Case Law | Codified Statutes (Civil Code) |

| Jurisdiction Principle | Primarily Territorial | Incorporates Nationality Aspect |

| Business Entity Recognition | Clear common law framework | Specific rules for enterprises |

Forced Heirship vs. Testamentary Freedom: The Core Conflict

This is where the rubber meets the road for business owners. Mainland China’s Civil Code includes elements of forced heirship – a legal principle that mandates specific portions of your estate must go to designated statutory heirs, regardless of your wishes expressed in a will. Your spouse, children, and parents are entitled to mandatory shares that substantially limit your ability to freely distribute your business assets.

Hong Kong’s Testamentary Freedom Advantage

In stark contrast, Hong Kong’s common law heritage upholds testamentary freedom. If you’re domiciled in Hong Kong, you have extensive power to dispose of your assets as you see fit through a valid will. While the Inheritance (Provision for Family and Dependants) Ordinance allows certain dependents to petition the court for reasonable financial provision, this is discretionary and doesn’t establish mandatory fixed shares like Mainland China’s system.

| Inheritance Feature | Mainland China | Hong Kong |

|---|---|---|

| Forced Heirship | Yes – mandatory shares for legal spouse, children, parents | No – testamentary freedom is primary principle |

| Testamentary Freedom | Limited by statutory mandatory shares | Broad power to distribute assets via will |

| Unmarried Partners | Generally no automatic inheritance rights | No automatic rights, but may claim under dependency ordinance |

| Court Intervention | Limited – statutory shares prevail | Discretionary – court may provide for dependents |

Business Succession: Family vs. Flexibility

For business owners, this is where inheritance planning gets particularly complex. Mainland China’s framework for business succession within private enterprises often emphasizes family inheritance. While legal provisions exist for wills, societal norms and the forced heirship system frequently result in businesses passing to statutory heirs – typically spouses and children – regardless of their business acumen or involvement.

Hong Kong’s Corporate Succession Flexibility

Hong Kong’s common law system offers significantly greater flexibility. The focus shifts to the business entity structure itself, particularly limited companies. You have wide latitude to determine how your shares – and consequently control of the business – are transferred upon death. This can be explicitly stipulated in a will, allowing shares to be bequeathed to family members, business partners, employees, or unrelated parties.

| Business Succession Aspect | Mainland China | Hong Kong |

|---|---|---|

| Primary Focus | Family (Statutory Heirs) | Owner’s Will & Corporate Structure |

| Key Legal Framework | Civil Code & Related Laws | Common Law & Company Law |

| Shareholder Agreements | Complex interaction with family inheritance rules | Generally strongly upheld as binding contracts |

| Flexibility in Choosing Successor | Limited by forced heirship & family priority | High flexibility through wills & corporate tools |

Tax Implications: Hong Kong’s Clear Advantage

For business owners planning inheritance across both jurisdictions, tax implications represent one of the most significant differences. Hong Kong offers a remarkably straightforward tax environment for inherited business assets, while Mainland China presents potential transaction-based tax liabilities.

Hong Kong: No Inheritance Tax Since 2006

Hong Kong presents a clear contrast. Since the abolition of estate duty in 2006, no tax is levied on the value of a deceased person’s estate, including business assets. Assets passing via will or intestacy are explicitly free from estate or inheritance tax within the territory. This creates a simpler tax environment for beneficiaries inheriting business interests located in Hong Kong, removing a major potential financial burden at the point of succession.

Mainland China: Potential Transaction Taxes

In Mainland China, although a general inheritance tax is not widely applied, the legal basis for its future implementation exists. More importantly, transferring business assets or shares via inheritance can trigger other transaction-based taxes depending on the entity type and asset class. These may include:

- Income tax on deemed gains from asset transfers

- Stamp duty on document transfers

- Land value increment tax for real estate holdings

- Business tax on certain enterprise transfers

| Tax Feature | Mainland China | Hong Kong |

|---|---|---|

| Inheritance/Estate Tax | Framework exists; transaction/asset taxes possible on business transfer | No estate/inheritance tax since 2006 |

| Asset Valuation Context | Formal appraisals guided by state/tax rules for taxable transfers | Professional valuation for probate; not tax-driven |

| Business Asset Transfer | May trigger income tax, stamp duty, land value tax | No transfer taxes on inheritance |

Cross-Border Inheritance: Navigating the Divide

For business owners with holdings in both jurisdictions, inheritance planning requires addressing how assets under different legal systems will be handled. The fundamental differences create distinct challenges that demand strategic planning.

Dual-Will Strategy: One Size Doesn’t Fit All

Instead of a single complex will attempting to cover assets governed by disparate legal frameworks, consider creating separate wills:

- Hong Kong-specific will: Tailored for Hong Kong assets under its common law system

- Mainland China-specific will: Designed for mainland assets governed by the Civil Code

- Careful coordination: Ensure wills don’t conflict or accidentally revoke each other

Probate Recognition: The Enforcement Gap

A major hurdle is the limited mutual recognition of probate grants between Hong Kong and Mainland China. While agreements exist for civil and commercial judgments, inheritance matters often fall outside these frameworks. Securing a grant of probate in one jurisdiction doesn’t automatically make it enforceable in the other.

Foreign Exchange Controls: The Remittance Challenge

Transferring inherited funds from Mainland China to Hong Kong beneficiaries involves navigating China’s foreign exchange controls. While provisions exist for repatriating legally inherited funds, the process requires:

- Extensive documentation proving inheritance rights

- Approval through designated banks

- Adherence to conversion limits and capital control policies

- Potential time delays for significant amounts

Probate Processes: Notarization vs. Court Grants

The administrative journey after a business owner’s passing differs significantly between the two jurisdictions, impacting both complexity and timeline.

| Probate Feature | Mainland China | Hong Kong |

|---|---|---|

| Primary Mechanism | Notarization / Administrative Process | Grant of Probate / Letters of Administration (Court-based) |

| Authority | Notary Publics, Local Bureaus | High Court |

| Key Documentation | Extensive notarized proofs for various stages | Court application & judicial validation |

| Typical Duration | Can be slower due to administrative & notarization requirements | Often faster once court application progresses |

✅ Key Takeaways

- Hong Kong offers testamentary freedom and no inheritance tax, while Mainland China has forced heirship rules and potential transaction taxes

- Business succession in Hong Kong provides flexibility through wills and shareholder agreements; Mainland China emphasizes family inheritance to statutory heirs

- Cross-border inheritance requires separate wills and probate applications for each jurisdiction – no automatic recognition between Hong Kong and Mainland China

- Hong Kong’s court-based probate process is often faster than Mainland China’s notarization-heavy administrative system

- Professional legal advice in both jurisdictions is essential for business owners with assets spanning the border

The divide between Hong Kong and Mainland China’s inheritance systems creates both challenges and opportunities for business owners. While Hong Kong offers greater flexibility and tax advantages, Mainland China’s forced heirship rules demand careful navigation. The key to successful cross-border estate planning lies in understanding these fundamental differences, implementing jurisdiction-specific strategies, and seeking professional advice from experts familiar with both legal systems. Don’t leave your business legacy to chance – proactive planning today can ensure a smooth transition tomorrow.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Estate Duty Information – Official confirmation of estate duty abolition

- Cross-Border Inheritance Guide – Comparative analysis of Hong Kong and Mainland China inheritance laws

- Mainland China Inheritance Procedures – Practical guide for Hong Kong residents inheriting mainland assets

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.