How Private Trust Companies Can Enhance Asset Protection for High-Net-Worth Individuals

📋 Key Facts at a Glance

- Family Office Tax Concession: Hong Kong’s FIHV regime offers 0% tax on qualifying income for family investment holding vehicles with minimum HK$240 million AUM

- Territorial Tax System: Hong Kong only taxes profits sourced in Hong Kong, not foreign-sourced income (subject to FSIE rules)

- No Capital Gains Tax: Hong Kong does not tax capital gains, dividends, or inheritance, making it ideal for trust structures

- Two-Tier Profits Tax: Corporations pay 8.25% on first HK$2 million, 16.5% on remainder; unincorporated businesses pay 7.5% and 15% respectively

Imagine having complete control over your family’s wealth while enjoying Hong Kong’s favorable tax environment. For high-net-worth individuals managing complex global assets, Private Trust Companies (PTCs) offer a sophisticated solution that combines family governance with strategic tax optimization. With Hong Kong’s recent introduction of the Family Investment Holding Vehicle (FIHV) regime and its territorial tax system, establishing a PTC in Hong Kong has become an increasingly attractive option for preserving and growing generational wealth.

Why Hong Kong PTCs Offer Superior Wealth Management

Private Trust Companies represent a significant evolution beyond traditional trust structures, offering families unprecedented control, flexibility, and strategic advantages. Unlike conventional corporate trustees that operate with standardized procedures, PTCs allow families to retain direct oversight while leveraging Hong Kong’s favorable tax environment and legal framework.

| Feature | Private Trust Company (PTC) | Traditional Corporate Trust |

|---|---|---|

| Family Control | High – Family members actively participate in administration | Limited – Authority delegated to corporate trustee |

| Governance Flexibility | Highly customizable for complex assets | Standardized templates and procedures |

| Tax Optimization | Can leverage Hong Kong’s FIHV regime (0% tax) | Subject to standard corporate tax rates |

| Decision Speed | Agile – Quick response to market changes | Slower – Institutional procedures and approvals |

Hong Kong’s Tax Advantages for Family Wealth Structures

Hong Kong’s tax system offers several compelling advantages for PTCs and family wealth structures:

- Territorial Taxation: Only Hong Kong-sourced profits are taxable, not foreign-sourced income

- No Capital Gains Tax: Profits from asset disposals are generally not taxed

- No Dividend Withholding Tax: Dividends paid to beneficiaries are not subject to withholding tax

- No Inheritance/Estate Tax: Wealth transfers between generations are not taxed

- FIHV Regime: 0% tax on qualifying income for eligible family investment vehicles

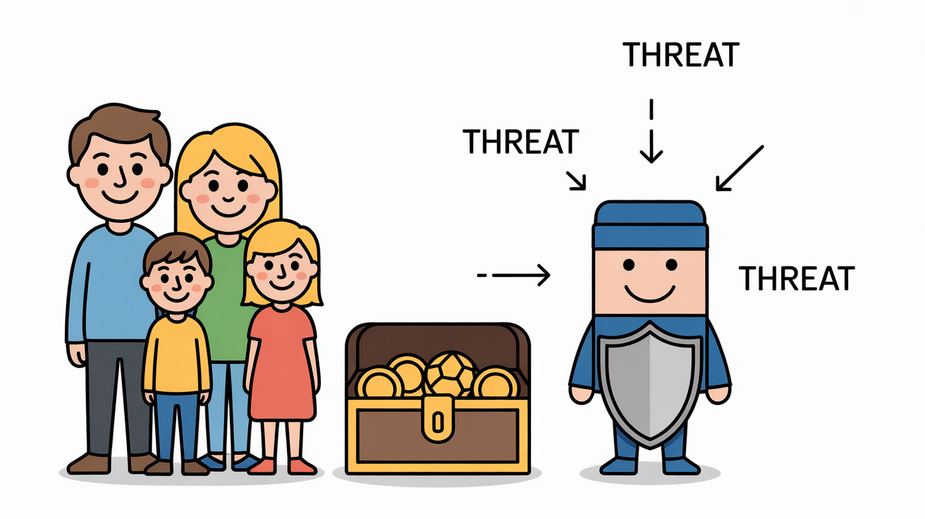

Asset Protection Through Legal Separation

A PTC creates a clear legal separation between personal wealth and beneficiaries, providing robust protection against various risks. This separation is particularly valuable in Hong Kong’s stable legal environment, which offers strong creditor protection and predictable legal outcomes.

| Protection Area | How Hong Kong PTC Helps |

|---|---|

| Creditor Claims | Assets held by PTC are separate from personal estates, creating barriers against individual liabilities |

| Geopolitical Risks | Hong Kong’s stable legal system and international recognition provide security |

| Forced Heirship Rules | Hong Kong trusts can override statutory inheritance rules in other jurisdictions |

| Family Disputes | Clear governance structures prevent conflicts over asset management |

Navigating Hong Kong’s FSIE Regime

Hong Kong’s Foreign-Sourced Income Exemption (FSIE) regime, expanded in January 2024, affects how PTCs handle foreign income. Understanding these rules is crucial for tax optimization:

- Phase 1 (2023): Covers dividends, interest, disposal gains, and IP income

- Phase 2 (2024): Expanded to include other disposal gains

- Economic Substance Requirement: To claim exemption, PTCs must have substantial activities in Hong Kong

- Participation Exemption: Available for qualifying equity disposal gains

Multi-Generational Control and Governance

PTCs empower families to maintain control across generations through structured governance frameworks. This is particularly valuable in Hong Kong, where family businesses and wealth preservation are deeply ingrained cultural values.

- Family Director Appointments: Designate family members or trusted advisors as PTC directors to maintain alignment with family values

- Structured Succession Planning: Implement clear protocols for transitioning leadership to next generations

- Customized Distribution Policies: Create tailored guidelines for beneficiary distributions based on family objectives

- Family Governance Frameworks: Formalize family values, communication protocols, and conflict resolution mechanisms

Integrating with Hong Kong’s Family Office Ecosystem

Hong Kong has actively developed its family office ecosystem, making it easier to establish and operate PTCs:

- Dedicated Family Office Team: Hong Kong government provides support for family office establishment

- Professional Services: Extensive network of legal, tax, and wealth management experts

- Investment Opportunities: Access to Asian markets and investment products

- Regulatory Support: Streamlined processes for family office licensing where required

Tax Efficiency Strategies for Hong Kong PTCs

Optimizing tax efficiency requires strategic planning within Hong Kong’s regulatory framework:

| Strategy | Hong Kong Advantage | Considerations |

|---|---|---|

| FIHV Registration | 0% tax on qualifying income | Minimum HK$240M AUM, substantial activities required |

| FSIE Optimization | Exemption for foreign-sourced income | Economic substance requirements must be met |

| Asset Location Strategy | No capital gains tax on disposals | Proper documentation of asset sourcing required |

| Double Tax Treaty Network | 45+ comprehensive double tax agreements | Treaty benefits require proper substance and compliance |

Future-Proofing Family Wealth in Hong Kong

Hong Kong’s evolving regulatory landscape requires PTCs to be adaptable and forward-looking:

- Emerging Asset Integration: PTCs can accommodate cryptocurrencies, NFTs, and other digital assets within Hong Kong’s regulatory framework

- Regulatory Compliance: Stay current with FSIE, FIHV, and global tax transparency requirements

- Next-Generation Engagement: Involve younger family members in governance to ensure continuity

- Technology Adoption: Leverage Hong Kong’s fintech ecosystem for enhanced wealth management

✅ Key Takeaways

- Hong Kong PTCs offer superior control and flexibility compared to traditional corporate trustees

- The FIHV regime provides 0% tax on qualifying income for eligible family investment vehicles

- Proper substance in Hong Kong is essential for FSIE benefits and regulatory compliance

- Hong Kong’s territorial tax system and absence of capital gains tax create favorable conditions

- Multi-generational governance structures ensure family values are preserved across generations

- Strategic jurisdiction selection within Hong Kong’s framework optimizes asset protection and tax efficiency

Establishing a Private Trust Company in Hong Kong represents a sophisticated approach to wealth preservation that combines family governance with strategic tax optimization. With Hong Kong’s favorable tax environment, stable legal system, and evolving family office ecosystem, PTCs offer high-net-worth families a powerful tool for protecting and growing wealth across generations. However, success requires careful planning, proper substance establishment, and ongoing compliance with Hong Kong’s regulatory requirements. Consulting with experienced Hong Kong tax and legal professionals is essential to navigate the complexities and maximize the benefits of this sophisticated wealth management structure.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD FIHV Regime – Family Investment Holding Vehicle tax concessions

- IRD FSIE Regime – Foreign-Sourced Income Exemption rules

- IRD Profits Tax Guide – Corporate tax rates and regulations

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.