How to Avoid Common Pitfalls in Hong Kong’s MPF Rollover Process

📋 Key Facts at a Glance

- Tax-Neutral Rollovers: MPF transfers between approved schemes are tax-free events in Hong Kong, maintaining your retirement savings’ tax-privileged status.

- Maximum Tax Deduction: MPF contributions are tax-deductible up to HK$18,000 annually for the 2024-25 tax year.

- Preserved Benefits: MPF funds must remain in the system until retirement (age 65) or other qualifying conditions like permanent departure from Hong Kong.

Are you considering consolidating your MPF accounts after changing jobs? Every year, thousands of Hong Kong professionals navigate the MPF rollover process, but many encounter avoidable pitfalls that delay their retirement savings transfer. Whether you’re switching employers, consolidating multiple accounts, or simply seeking better investment options, understanding the MPF rollover process can save you time, frustration, and potential financial setbacks. This comprehensive guide will walk you through the essential steps to ensure a smooth transition of your hard-earned retirement funds.

Understanding the MPF Rollover Fundamentals

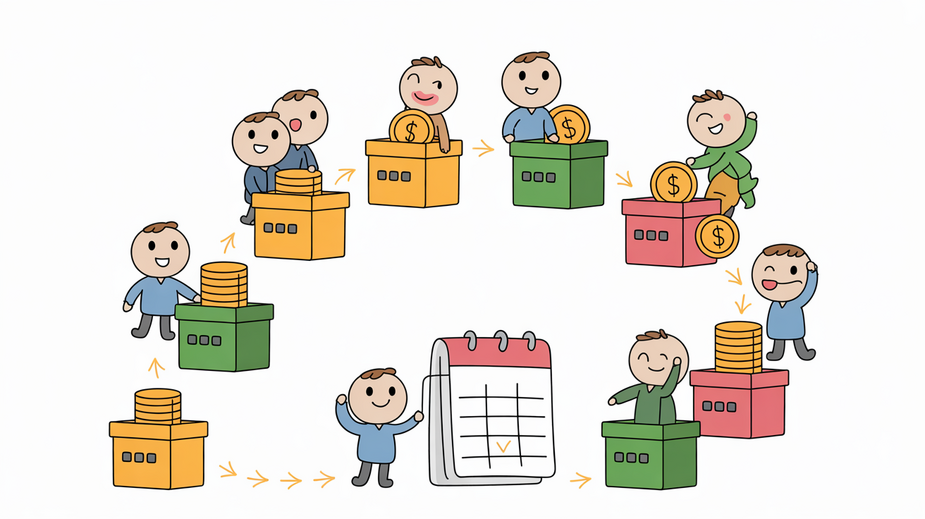

The Mandatory Provident Fund (MPF) system is Hong Kong’s compulsory retirement savings scheme, designed to help the working population build financial security for their golden years. A rollover refers to transferring your accumulated MPF benefits from one approved scheme to another, typically triggered by employment changes or when consolidating multiple accounts for better management.

| Party | Key Responsibilities in MPF System |

|---|---|

| Employer | Enrolling eligible employees, calculating & deducting contributions, contributing employer share (5% of relevant income), remitting funds to trustee, providing statements |

| Employee | Providing accurate information, monitoring contributions (5% of relevant income), reviewing statements, making fund choices, initiating rollovers when eligible |

Eligibility Criteria: When Can You Roll Over Your MPF?

Not every situation qualifies for an MPF rollover. Understanding the specific eligibility criteria is crucial to avoid application rejections and unnecessary delays. The most common qualifying event is a change in employment status, but there are other circumstances that may trigger rollover eligibility.

Qualifying Events for Rollover

- Cessation of Employment: Resignation, contract termination, or job change

- Consolidation of Multiple Accounts: Combining MPF accounts from previous employers

- Scheme Provider Change: Switching to a different MPF trustee for better services or lower fees

- Preserved Account Management: Moving preserved benefits to a more suitable scheme

Critical Deadlines and Timing Considerations

Timing is everything in the MPF rollover process. Missing key deadlines can derail your transfer, causing unnecessary delays and complications. Trustees typically have specific processing windows, and understanding these timeframes is essential for a smooth transition.

| Action Area | Timing Considerations | Recommended Action |

|---|---|---|

| Initiating Transfer | Within 30 days of employment cessation or qualifying event | Start process immediately after eligibility confirmed |

| Trustee Processing | Typically 30 business days from complete documentation | Follow up after 3 weeks if no confirmation |

| Document Submission | Account for trustee cut-off times (often 4-5 PM) | Submit early in the day, avoid Fridays |

Remember that business days exclude weekends and public holidays. A deadline that falls on a Saturday effectively moves to the following Monday. Always check with your specific trustee about their exact processing times and any special considerations.

Documentation Checklist: Getting Your Paperwork Right

Paperwork errors are the leading cause of MPF rollover delays. Submitting incomplete or incorrect documentation can set your transfer back by weeks. Here’s your essential documentation checklist to ensure everything is in order:

- Certified Identity Proof: Provide certified true copies of your Hong Kong Identity Card or passport. Photocopies alone are insufficient—they must be certified by an authorized person (bank manager, lawyer, notary public, etc.).

- Completed Section 6E Form: This is the primary transfer form for preserved benefits. Ensure every section is filled accurately, including personal details, transfer instructions, and fund allocation choices.

- Employment Proof: Documentation confirming your employment cessation (resignation letter, termination notice, or final payslip).

- MPF Account Details: Information about both your existing account (to be transferred from) and your new account (to be transferred to).

- Contribution Records: While not always required, having your own copies of MPF statements helps verify amounts and resolve discrepancies.

Tax Implications: Understanding the Financial Impact

One of the most reassuring aspects of MPF rollovers in Hong Kong is their tax-neutral status. When executed correctly between approved MPF schemes, rollovers do not trigger immediate tax liabilities. However, understanding the broader tax context is essential for comprehensive retirement planning.

Tax Treatment of MPF Rollovers

MPF rollovers maintain the tax-privileged status of your retirement savings. The key points to remember:

- Tax-Free Transfers: Moving funds between approved MPF schemes is not a taxable event

- Investment Returns: Capital gains, dividends, and interest earned within MPF schemes remain tax-exempt

- Preserved Benefits: The tax-deferred status continues when transferring preserved benefits

- Withdrawal Taxation: Most MPF withdrawals at retirement (age 65) are also tax-free in Hong Kong

International Considerations

If you’re planning to leave Hong Kong permanently, different rules apply. MPF withdrawal upon permanent departure is one of the specific conditions allowing access to preserved benefits before age 65. While Hong Kong doesn’t tax these withdrawals, your new country of residence may have different tax rules regarding foreign retirement account distributions.

Choosing the Right MPF Service Provider

Your choice of MPF provider significantly impacts your retirement outcomes through fees, investment options, and service quality. When selecting a new provider during a rollover, consider these critical factors:

| Evaluation Factor | What to Look For | Why It Matters |

|---|---|---|

| Fee Structure | Management fees, expense ratios, administrative charges | Fees compound over decades, significantly impacting final returns |

| Investment Performance | Historical returns across market cycles, consistency vs. benchmarks | Indicates fund management expertise and strategy effectiveness |

| Fund Options | Diversity of asset classes, risk profiles, investment themes | Enables proper portfolio diversification aligned with your goals |

| Regulatory Compliance | SFC authorization, MPFA registration, clean regulatory record | Ensures legal protection and adherence to investor safeguards |

| Digital Services | Online portal, mobile app, e-statements, investment tools | Facilitates easy monitoring and management of your account |

Future-Proofing Your Retirement Strategy

A successful MPF rollover is just the beginning of effective retirement planning. To maximize your retirement outcomes, implement these ongoing management practices:

| Action | Purpose | Suggested Frequency |

|---|---|---|

| Portfolio Rebalancing | Maintain target asset allocation, manage risk exposure | Annually or after major market movements |

| Statement Review | Verify contributions, track performance, check fees | Quarterly review, detailed annual analysis |

| Risk Assessment | Align investments with changing life circumstances | Every 3-5 years or after major life events |

| Contribution Optimization | Maximize tax benefits while building retirement savings | Annual tax planning season |

Utilize digital tools provided by your MPF trustee—most offer mobile apps and online portals that provide real-time account information, performance tracking, and investment analysis tools. Regular monitoring helps you stay informed and make timely adjustments as needed.

✅ Key Takeaways

- MPF rollovers between approved schemes are tax-neutral events that maintain your retirement savings’ tax-privileged status

- Always verify eligibility (typically employment cessation) and submit complete, certified documentation to avoid delays

- Pay close attention to trustee processing deadlines and account for business days excluding weekends and holidays

- Choose your new MPF provider carefully based on fees, performance, fund options, and regulatory compliance

- Implement ongoing portfolio management practices including regular rebalancing and statement reviews

- Remember that MPF contributions up to HK$18,000 are tax-deductible for the 2024-25 tax year

Successfully navigating the MPF rollover process requires careful planning, attention to detail, and proactive management. By following these guidelines, you can ensure a smooth transition of your retirement savings while avoiding common pitfalls that delay the process. Remember that your MPF represents a significant portion of your retirement security—taking the time to manage it properly today will pay dividends in your financial future. For complex situations or specific concerns about tax implications, consider consulting with a qualified financial advisor or tax professional who specializes in Hong Kong retirement planning.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD MPF FAQ – Official guidance on MPF tax treatment and regulations

- GovHK MPF Deductions – Official information on MPF contribution tax deductions

- Mandatory Provident Fund Schemes Authority (MPFA) – Regulatory body for MPF schemes

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.