Tax-Efficient Exit Strategies: Selling Your Hong Kong Business vs. Assets

📋 Key Facts at a Glance

- Capital Gains Advantage: Hong Kong has no general capital gains tax, making share sales potentially tax-free for individual sellers

- Stamp Duty Savings: Share transfers now cost just 0.2% total (0.1% buyer + 0.1% seller), with property cooling measures abolished in February 2024

- Two-Tier Profits Tax: Corporations pay 8.25% on first HK$2 million, 16.5% on remainder; unincorporated businesses pay 7.5% and 15% respectively

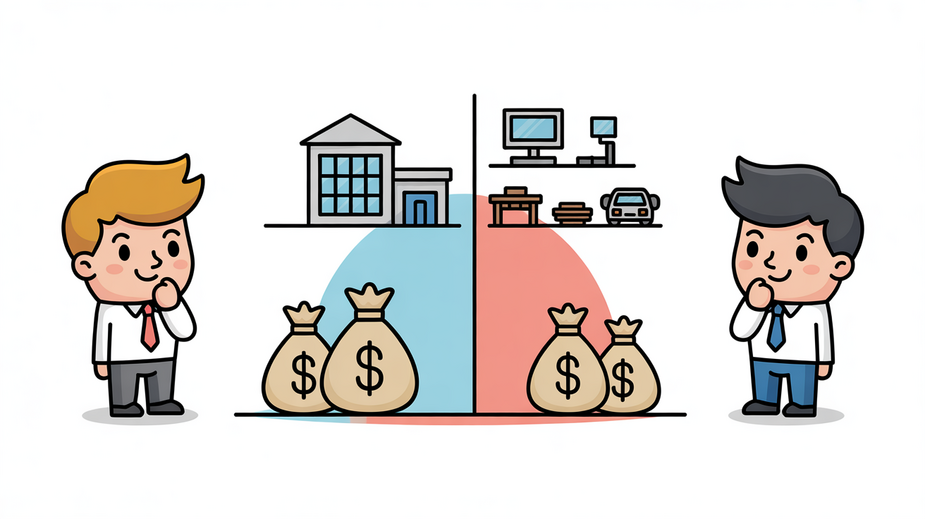

Are you planning to sell your Hong Kong business in 2024-2025? The difference between selling shares versus assets could mean hundreds of thousands—or even millions—in tax savings. With recent stamp duty reforms and Hong Kong’s unique tax advantages, choosing the right exit strategy has never been more critical. This guide breaks down exactly how to structure your business exit for maximum tax efficiency.

The Hong Kong Exit Advantage: Why Structure Matters

Hong Kong offers one of the world’s most business-friendly tax environments, but navigating an exit requires understanding three critical advantages: no capital gains tax, low stamp duties, and territorial taxation. Unlike many jurisdictions, Hong Kong generally doesn’t tax capital gains, meaning selling shares can be tax-free for individual shareholders. However, this benefit disappears if you’re deemed to be trading shares as a business.

Recent Regulatory Changes You Need to Know

Several key changes in 2023-2024 have reshaped Hong Kong’s exit landscape:

- Stamp Duty Reduction: Share transfer stamp duty decreased to 0.1% each for buyer and seller (0.2% total) from November 17, 2023

- Property Cooling Measures Abolished: Special Stamp Duty (SSD), Buyer’s Stamp Duty (BSD), and New Residential Stamp Duty (NRSD) were all abolished on February 28, 2024

- Tax Certainty Enhancement: New schemes provide clarity on tax treatment of equity disposal gains

Entity Sale: Selling Your Business Shares

An entity sale involves transferring ownership of your company’s shares to the buyer. The business continues operating as the same legal entity, just with new shareholders. This structure offers significant tax advantages but comes with specific complexities.

Tax Benefits of Share Sales

For individual shareholders, selling shares typically qualifies as a capital gain, which Hong Kong doesn’t tax. This means you could potentially receive the entire sale proceeds tax-free. The stamp duty cost is also relatively low:

| Tax Type | Entity Sale (Share Transfer) | Rate/Amount |

|---|---|---|

| Capital Gains Tax | Generally not taxable for individuals | 0% |

| Stamp Duty (Buyer) | 0.1% of consideration or NAV | 0.1% |

| Stamp Duty (Seller) | 0.1% of consideration or NAV | 0.1% |

| Fixed Duty | Per instrument | HK$5 |

Hidden Complexities and Buyer Concerns

While tax-efficient for sellers, entity sales transfer all historical liabilities to the buyer. This includes:

- Undisclosed tax liabilities from previous years

- Pending legal claims or disputes

- Environmental liabilities

- Employee claims and benefits obligations

Buyers typically respond with extensive due diligence, warranties, indemnities, and escrow arrangements. These can delay closing and reduce your net proceeds.

Asset Sale: Selling Business Components

An asset sale involves your company selling individual business assets—property, equipment, inventory, intellectual property, and goodwill. The company then distributes proceeds to shareholders, often through liquidation.

Tax Implications of Asset Disposals

Unlike share sales, asset sales trigger immediate profits tax liabilities for the selling company. The two-tier profits tax rates apply:

| Business Type | First HK$2M Profits | Remaining Profits |

|---|---|---|

| Corporations | 8.25% | 16.5% |

| Unincorporated | 7.5% | 15% |

Key asset sale tax considerations include:

- Depreciation Recapture: Selling depreciated assets above their tax written-down value triggers tax on previously claimed allowances

- Trading Stock Gains: Inventory sold above cost creates taxable trading profits

- Property Transfers: Hong Kong property transfers attract stamp duty based on new progressive rates (since Feb 2024)

Strategic Advantages of Asset Sales

Despite higher immediate taxes, asset sales offer strategic benefits:

- Liability Isolation: Buyers don’t inherit historical company liabilities

- Selective Disposal: Sell only valuable assets, retain others

- Timing Control: Sequence asset sales to manage tax recognition

- Price Allocation: Negotiate allocation to optimize both parties’ tax positions

Side-by-Side Tax Comparison

Let’s compare a HK$10 million business sale under both structures:

| Consideration | Entity Sale | Asset Sale |

|---|---|---|

| Seller’s Tax (Individual) | HK$0 (capital gain) | Company pays profits tax first |

| Company Profits Tax | Not applicable to sale | 8.25% on first HK$2M, 16.5% on remainder |

| Stamp Duty Cost | HK$20,000 (0.2% total) | Varies by asset type |

| Liability Transfer | Full transfer to buyer | Limited to specific assets |

| Due Diligence Intensity | Extensive (full company history) | Focused (specific assets only) |

Cross-Border Exit Strategies

Selling to international buyers adds complexity but offers planning opportunities:

Double Taxation Treaty Network

Hong Kong has comprehensive double taxation agreements (DTAs) with 45+ jurisdictions. These treaties can:

- Reduce or eliminate withholding taxes on sale proceeds

- Provide clarity on capital gains treatment

- Prevent double taxation across jurisdictions

Holding Company Structures

Strategic holding company placement can optimize cross-border exits:

- Hong Kong Holding Company: Benefits from Hong Kong’s territorial tax system and DTA network

- Treaty-Shopping Considerations: Ensure substance requirements are met to access treaty benefits

- FSIE Compliance: Foreign-sourced income exemption regime requires economic substance in Hong Kong

Future-Proofing Your Exit Strategy

Emerging regulations will impact future business exits:

| Emerging Factor | Impact on Business Exits | Timeline |

|---|---|---|

| Global Minimum Tax (Pillar Two) | 15% minimum effective tax for large MNEs; enacted June 2025, effective Jan 2025 | 2025 onward |

| FSIE Regime Expansion | Phase 2 expanded to dividends, interest, disposal gains, IP income (Jan 2024) | Current |

| ESG Reporting Requirements | Increasing buyer due diligence on sustainability and governance | Evolving |

✅ Key Takeaways

- Share sales generally offer better tax efficiency for individual sellers due to Hong Kong’s no capital gains tax policy

- Asset sales provide liability protection but trigger immediate profits tax at 8.25%/16.5% rates

- Recent stamp duty reforms (0.2% total for shares, abolished property cooling measures) reduce transaction costs

- Cross-border exits require careful DTA planning and consideration of FSIE substance requirements

- Future regulations like Global Minimum Tax will impact multinational business sales from 2025

Choosing between an entity sale and asset sale involves balancing immediate tax savings against long-term liability protection and buyer preferences. While share sales typically offer superior tax outcomes for Hong Kong-based sellers, asset sales may be necessary for businesses with complex liabilities or when buyers demand cleaner acquisitions. The optimal strategy depends on your specific business circumstances, tax position, and negotiation leverage. Early professional advice can help structure your exit to maximize after-tax proceeds while minimizing risks.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Profits Tax Guide – Two-tier profits tax rates and business tax rules

- IRD Stamp Duty Guide – Current stamp duty rates and regulations

- IRD FSIE Regime – Foreign-sourced income exemption requirements

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.