Taxation of Trusts and Estates: Special Rules for Non-Residents in Hong Kong

📋 Key Facts at a Glance

- Territorial Taxation: Hong Kong only taxes income sourced within its borders, regardless of residency status

- No Estate Duty: Hong Kong abolished estate duty in 2006 – no inheritance tax applies to assets

- Trust Tax Rates: Trusts follow standard profits tax rates: 8.25% on first HK$2 million, 16.5% on remainder for corporations

- Non-Resident Benefits: Non-residents enjoy the same territorial tax benefits as residents for Hong Kong-sourced income

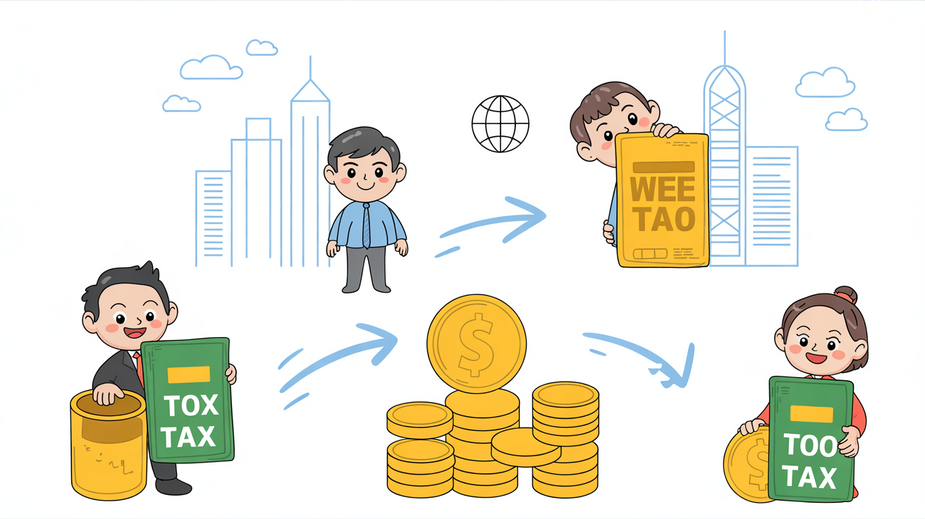

Are you a non-resident considering establishing a trust or managing an estate in Hong Kong? You might be surprised to learn that Hong Kong’s tax system offers significant advantages for international families and investors. With its territorial taxation principle and absence of inheritance taxes, Hong Kong has become a premier jurisdiction for cross-border wealth planning. This guide breaks down exactly how trusts and estates are taxed in Hong Kong, with special focus on the rules that apply to non-residents in 2024-2025.

Hong Kong’s Territorial Tax System: The Foundation

Hong Kong operates on a territorial basis of taxation, which means only income or profits sourced within Hong Kong are subject to tax. This principle applies equally to residents and non-residents, making Hong Kong exceptionally attractive for international wealth structures. The system doesn’t tax worldwide income, capital gains, dividends, or inheritance – only Hong Kong-sourced profits.

What Hong Kong Does NOT Tax

- Capital gains: Profits from selling assets (stocks, property, businesses)

- Dividends: Distributions from companies (no withholding tax)

- Interest income: Most interest earned (with some exceptions)

- Inheritance/estate duty: Abolished since 2006

- Sales tax/VAT/GST: No consumption taxes

Trusts vs. Estates: Understanding the Legal Distinctions

While both trusts and estates involve managing assets for beneficiaries, they have fundamentally different legal structures and tax implications. Understanding these differences is crucial for proper tax planning and compliance.

| Feature | Trust | Estate |

|---|---|---|

| Legal Basis | Trust deed or declaration | Will or intestacy laws |

| Creation Event | Settlor transfers assets to trustee (inter vivos or upon death) | Death of an individual |

| Purpose | Ongoing management and distribution for beneficiaries | Administer assets, settle liabilities, distribute residue |

| Duration | Can exist for prolonged periods (subject to perpetuity rules) | Temporary, ending upon final distribution |

| Tax Treatment | Taxed as separate entity on Hong Kong-sourced profits | Generally not taxed as separate entity (no estate duty) |

Taxation of Trusts: Special Rules for Non-Residents

Trusts in Hong Kong are generally treated as separate taxable entities. The tax treatment depends on whether the trust is carrying on a trade, business, or profession in Hong Kong. For non-resident settlors and beneficiaries, the territorial principle provides significant advantages.

Trust Tax Rates (2024-2025)

Trusts follow standard Hong Kong profits tax rates:

- Corporate trustees: 8.25% on first HK$2 million of assessable profits, 16.5% on remainder

- Unincorporated trustees: 7.5% on first HK$2 million, 15% on remainder

- Important: Only ONE entity per connected group can claim the lower tier rates

Common Trust Income Scenarios for Non-Residents

- Hong Kong Property Rental: If a trust owns Hong Kong property and receives rental income, this is Hong Kong-sourced and taxable at 15% property tax rate (after 20% statutory allowance)

- Hong Kong Business Operations: Profits from a business carried on in Hong Kong are taxable regardless of beneficiary residency

- Foreign Investments: Dividends, interest, and capital gains from foreign assets are generally not taxable in Hong Kong

- Distributions to Non-Resident Beneficiaries: Trust distributions to beneficiaries are generally not taxable in Hong Kong

Estates and Inheritance: No Estate Duty in Hong Kong

Hong Kong abolished estate duty in 2006, making it one of the few major financial centers without inheritance tax. This is particularly advantageous for non-residents with assets in Hong Kong.

Key Estate Administration Points

- No inheritance tax: Assets pass to beneficiaries without Hong Kong tax implications

- Probate still required: Legal process for administering estates still applies

- Income during administration: Any Hong Kong-sourced income generated during estate administration may be taxable

- Non-resident executors: Can administer Hong Kong estates, but may need local legal representation

Practical Considerations for Non-Residents

Documentation and Compliance Requirements

- Trust Deeds: Must clearly define terms, beneficiaries, and powers

- Tax Returns: Trusts with Hong Kong-sourced income must file annual tax returns

- Record Keeping: Maintain records for 7 years as required by Hong Kong law

- Professional Advice: Engage Hong Kong-based legal and tax advisors familiar with cross-border issues

Double Taxation Considerations

Hong Kong has comprehensive double taxation agreements (DTAs) with over 45 jurisdictions. For non-residents, these agreements can prevent double taxation on the same income. Key considerations include:

- Check if your home country has a DTA with Hong Kong

- Understand how trust distributions are treated in both jurisdictions

- Consider the Foreign-Sourced Income Exemption (FSIE) regime for certain types of income

- Be aware of information exchange agreements between jurisdictions

✅ Key Takeaways

- Hong Kong’s territorial tax system benefits non-residents equally – only Hong Kong-sourced income is taxed

- No estate duty or inheritance tax applies in Hong Kong, making it ideal for international wealth transfer

- Trusts are taxed as separate entities on Hong Kong-sourced profits at standard profits tax rates

- The residency of parties generally doesn’t affect tax liability, but can impact source determination

- Proper documentation and professional advice are essential for cross-border trust and estate planning

Hong Kong’s tax framework for trusts and estates offers significant advantages for non-residents, particularly with its territorial taxation system and absence of inheritance taxes. Whether you’re establishing a trust for international asset protection or administering an estate with Hong Kong assets, understanding these rules can lead to substantial tax efficiencies. However, cross-border wealth planning requires careful consideration of both Hong Kong rules and the tax laws of other relevant jurisdictions. Always consult with qualified Hong Kong tax and legal professionals to ensure your structures are properly established and compliant with all applicable regulations.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Estate Duty Information – Official guidance on abolished estate duty

- IRD Territorial Source Principle – Official explanation of Hong Kong’s territorial tax system

- IRD Profits Tax Guide – Current profits tax rates and regulations

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.