The Role of Hong Kong as a Tax-Efficient Gateway for Mainland China Expansion

📋 Key Facts at a Glance

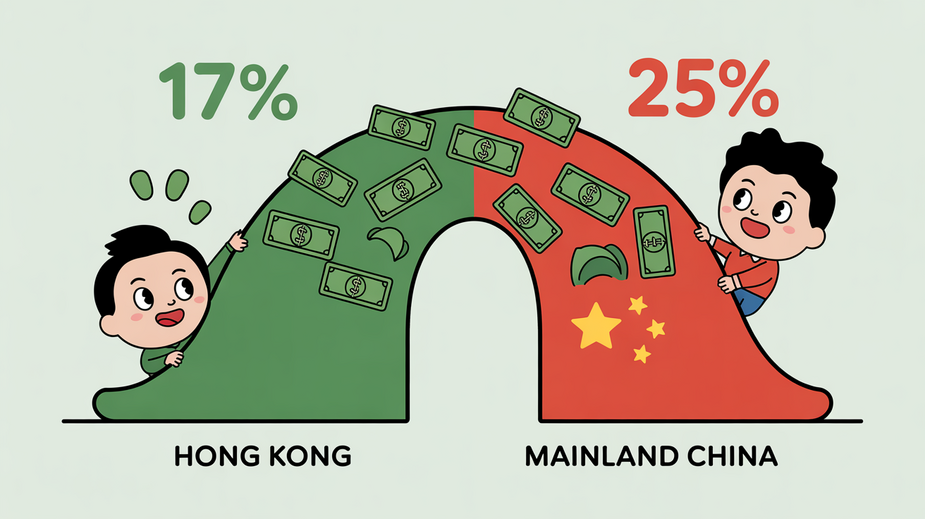

- Tax Rate Advantage: Hong Kong’s corporate tax rate is 16.5% (with 8.25% on first HK$2 million) vs. Mainland China’s 25%

- DTA Benefits: Hong Kong-Mainland Double Taxation Arrangement reduces withholding taxes to 5% on dividends (vs. 10% standard)

- Tax-Free Advantages: Hong Kong has no capital gains tax, VAT, or inheritance tax

- GBA Incentives: Greater Bay Area zones like Qianhai offer reduced 15% corporate tax for qualifying businesses

Imagine expanding your business into the world’s second-largest economy while paying up to 40% less in corporate taxes. This isn’t a theoretical scenario—it’s the reality for thousands of companies using Hong Kong as their strategic gateway to Mainland China. With its unique territorial tax system, favorable double taxation agreements, and business-friendly environment, Hong Kong offers one of the most tax-efficient pathways to access the vast Chinese market. But how exactly does this work, and what specific advantages can your business leverage in 2024-2025?

Hong Kong’s Competitive Tax Advantages for China Expansion

Hong Kong’s appeal as a gateway to Mainland China begins with its fundamentally different tax philosophy. Unlike most jurisdictions that tax worldwide income, Hong Kong operates on a territorial basis—only profits sourced within Hong Kong are taxable. This simple but powerful principle creates multiple advantages for businesses expanding into China.

The Two-Tiered Profits Tax Advantage

Hong Kong’s corporate tax structure is exceptionally competitive. For the 2024-2025 tax year, corporations pay just 8.25% on the first HK$2 million of assessable profits, and 16.5% on the remainder. Unincorporated businesses enjoy even lower rates of 7.5% and 15% respectively. Compare this to Mainland China’s standard 25% corporate income tax rate, and the advantage becomes clear.

| Tax Type | Hong Kong (2024-2025) | Mainland China (Standard) |

|---|---|---|

| Corporate Profits Tax | 8.25% on first HK$2M, 16.5% thereafter | 25% |

| Capital Gains Tax | None | Applicable in certain scenarios |

| Sales Tax/VAT | None | Applicable (typically 13%) |

| Dividend Withholding Tax | None | 10% (reduced under DTA) |

What Hong Kong Doesn’t Tax

Beyond competitive rates, Hong Kong’s tax system is notable for what it excludes:

- No Capital Gains Tax: Profits from selling assets, investments, or businesses are generally tax-free

- No Dividend Withholding Tax: Dividends paid to shareholders aren’t subject to withholding tax

- No VAT or Sales Tax: Simplifies cross-border transactions and reduces administrative burden

- No Estate or Inheritance Tax: Facilitates wealth transfer and succession planning

Maximizing the Hong Kong-Mainland Double Taxation Arrangement

The comprehensive Double Taxation Arrangement (DTA) between Hong Kong and Mainland China is arguably the single most important tool for tax-efficient China expansion. This agreement prevents the same income from being taxed twice and provides specific benefits for cross-border business.

Reduced Withholding Tax Rates

The DTA significantly reduces withholding taxes on payments flowing from Mainland China to Hong Kong. This directly impacts your bottom line when repatriating profits or paying for services.

| Income Type | Standard Mainland WHT Rate | Rate under HK-Mainland DTA |

|---|---|---|

| Dividends | 10% | 5% (for 25%+ shareholding) |

| Royalties | 10% | 7% |

| Interest | 10% | 7% |

Tax Credit Mechanisms and Residency Rules

The DTA also provides mechanisms to avoid double taxation through tax credits. If your Hong Kong company pays tax in Mainland China on China-sourced income, you can claim a foreign tax credit against your Hong Kong tax liability. Additionally, the DTA includes “tie-breaker” rules to determine tax residency when a company could be considered resident in both jurisdictions.

Optimal Corporate Structures for China Market Entry

Choosing the right corporate structure is critical for maximizing tax efficiency and operational flexibility when entering the China market. Hong Kong offers several strategic options.

- Hong Kong Holding Company Structure: Establish a Hong Kong holding company that owns your Mainland China subsidiaries. This provides asset protection, facilitates profit repatriation, and allows you to benefit from the DTA’s reduced withholding taxes on dividends.

- Regional Headquarters Model: Use Hong Kong as your regional HQ for China operations. This structure centralizes management, takes advantage of Hong Kong’s free capital flows, and positions you to benefit from offshore sourcing rules.

- Trading Company Setup: If your Hong Kong entity’s profits are determined to be “offshore sourced” (key activities occur outside Hong Kong), those profits may be exempt from Hong Kong profits tax under the territorial principle.

Leveraging Greater Bay Area Integration

The Greater Bay Area (GBA) initiative, integrating Hong Kong, Macau, and nine Guangdong cities, creates unprecedented opportunities for tax-efficient China expansion. Several GBA zones offer specific incentives that complement Hong Kong’s advantages.

GBA Development Zone Incentives

Key GBA development zones offer targeted tax benefits:

- Qianhai (Shenzhen): Qualifying modern service enterprises can enjoy a reduced 15% corporate income tax rate (vs. standard 25%)

- Nansha (Guangzhou): Offers preferential policies for technology, finance, and advanced manufacturing sectors

- Cross-border Talent Tax Allowances: Special tax subsidies for professionals working across GBA jurisdictions

Intellectual Property and Royalty Strategies

Hong Kong offers excellent opportunities for tax-efficient IP management in China operations. Consider these strategies:

- Royalty Payment Structures: Route royalty payments from Mainland China to a Hong Kong IP holding company, benefiting from the DTA’s reduced 7% withholding tax rate

- IP Holding Companies: Hold valuable IP assets in Hong Kong to benefit from no capital gains tax on eventual disposal

- R&D Collaboration: Structure R&D activities to qualify for incentives in both Hong Kong and GBA zones

Essential Compliance and Risk Management

While Hong Kong offers significant tax advantages, proper compliance is essential to maintain these benefits and avoid penalties.

Key Compliance Areas

- Transfer Pricing Documentation: Maintain proper documentation for intercompany transactions between Hong Kong and Mainland entities

- Substance Requirements: Ensure your Hong Kong company has genuine economic substance to qualify for DTA benefits and FSIE exemptions

- Mainland China CFC Rules: Be aware of Mainland China’s controlled foreign corporation rules that may attribute profits back to China

- Record Retention: Maintain business records for at least 7 years as required by Hong Kong law

✅ Key Takeaways

- Hong Kong’s two-tiered profits tax (8.25%/16.5%) offers significant savings versus Mainland China’s 25% rate

- The HK-Mainland DTA reduces withholding taxes to 5% on dividends and 7% on royalties/interest

- Hong Kong’s territorial system and absence of capital gains tax/VAT create unique advantages

- Proper corporate structuring and substance are essential to maximize benefits and ensure compliance

- Greater Bay Area incentives provide additional opportunities for tax-efficient China expansion

Hong Kong remains one of the world’s most effective gateways for Mainland China expansion, offering a compelling combination of low taxes, strategic location, and favorable agreements. By understanding and leveraging Hong Kong’s territorial tax system, double taxation arrangements, and integration with the Greater Bay Area, businesses can significantly reduce their overall tax burden while accessing the vast Chinese market. The key to success lies in careful planning, proper structuring, and ongoing compliance—ensuring your China expansion is not only successful but also tax-efficient for years to come.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Profits Tax Guide – Corporate tax rates and two-tiered system

- IRD FSIE Regime – Foreign-sourced income exemption rules

- Greater Bay Area Portal – GBA integration policies and incentives

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.