📋 Key Facts at a Glance Zero Tax on Capital Gains: Hong Kong has no......

📋 Key Facts at a Glance Stamp Duty Simplified: All extra duties (SSD, BSD, NRSD)......

Avoiding Common Pitfalls in Hong Kong Individual Tax Filing Navigating the annual process of filing......

Hong Kong's Unique Tax Landscape for Investors Hong Kong is renowned for its clear, low-rate......

Navigating Inland Revenue Department Audits in Hong Kong Preparing for a potential Inland Revenue Department......

📋 Key Facts at a Glance Fact 1: MPF is a defined contribution scheme where......

Understanding Hong Kong's Territorial Tax System Hong Kong distinguishes itself with a territorial tax system,......

BEPS 2.0: Fundamentals for Global Businesses The Base Erosion and Profit Shifting (BEPS) 2.0 initiative,......

📋 Key Facts at a Glance Computerized Risk Assessment: The IRD uses sophisticated "Assess First......

📋 Key Facts at a Glance Territorial Principle: Hong Kong only taxes profits sourced within......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

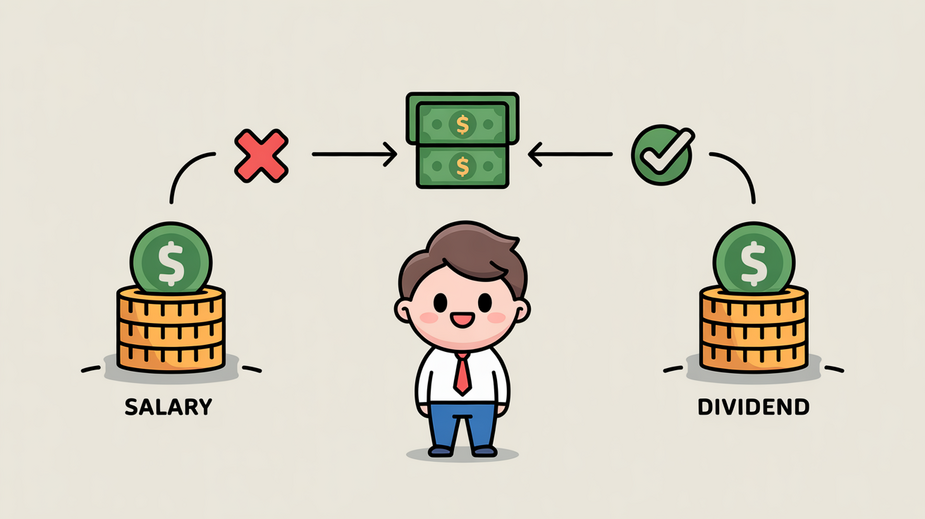

Understanding Hong Kong’s Tax-Efficient Dividend Framework Hong Kong presents a highly attractive tax environment, particularly......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308