Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances Understanding the intricacies......

Understanding Capital Allowances in Hong Kong Navigating business finances effectively requires a clear understanding of......

Core Income Documentation for Employees Accurately preparing your Hong Kong tax return as an employee......

Redefining Inheritance in a Dynamic Financial Landscape The concept of inheritance is undergoing a fundamental......

Understanding Tax Nexus in Hong Kong's Digital Economy For businesses operating internationally, particularly in the......

Core Tax Systems: Territorial vs. Worldwide Understanding the fundamental tax systems of Hong Kong and......

Navigating the Cross-Border Tax Challenges for Startups For a burgeoning startup based in the United......

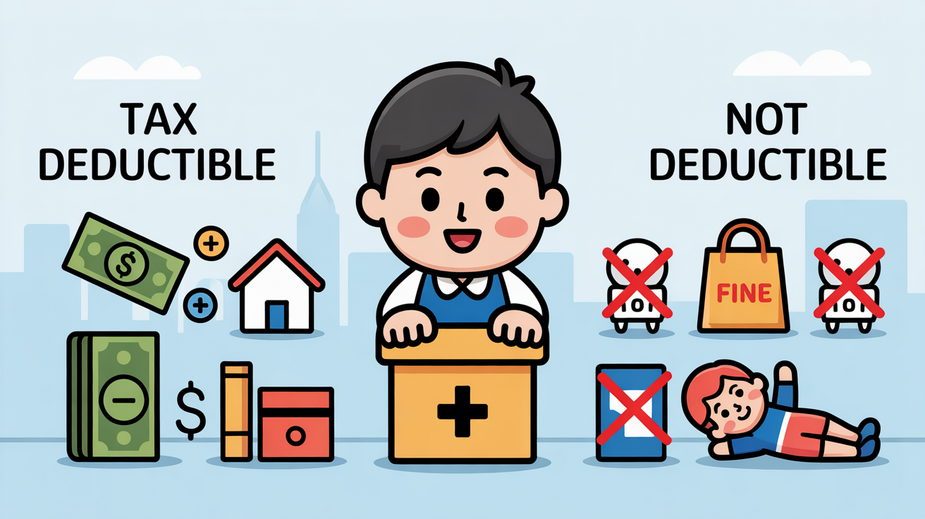

Unlocking Hidden Tax Savings in Hong Kong Many Hong Kong residents diligently file their annual......

Core Tax Obligations for Cross-Border E-Commerce Hong Kong businesses aiming to access the significant consumer......

Navigating the Complexities of Estate Planning for Hong Kong's HNW Families High-net-worth (HNW) families in......

Understanding Hong Kong's Education Tax Relief Framework Hong Kong's tax system provides specific provisions offering......

Essential Tax Allowances for Hong Kong Freelancers Navigating the tax landscape as a self-employed professional......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308