Understanding Triggers for Tax Investigations in Hong Kong Facing an unexpected tax investigation by the......

Understanding Hong Kong’s Salaries Tax System: Progressive vs. Standard Rates Hong Kong’s Salaries Tax system......

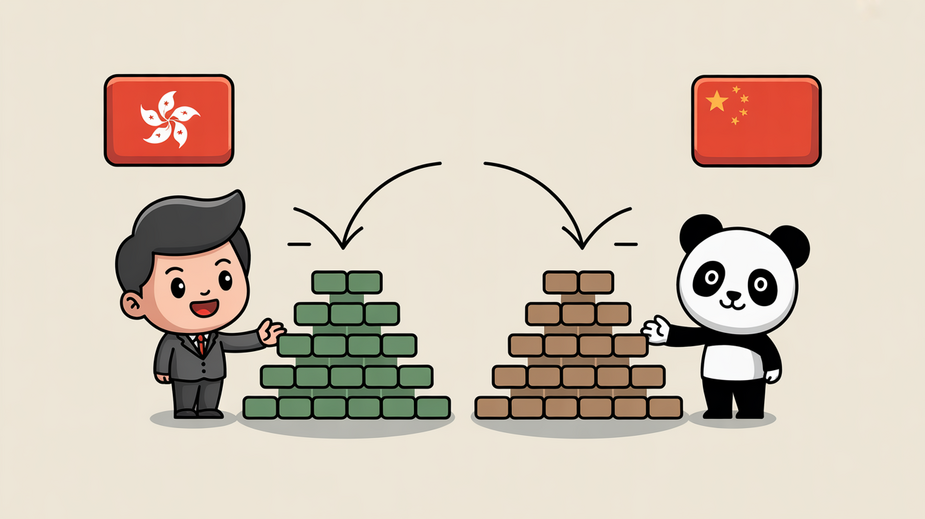

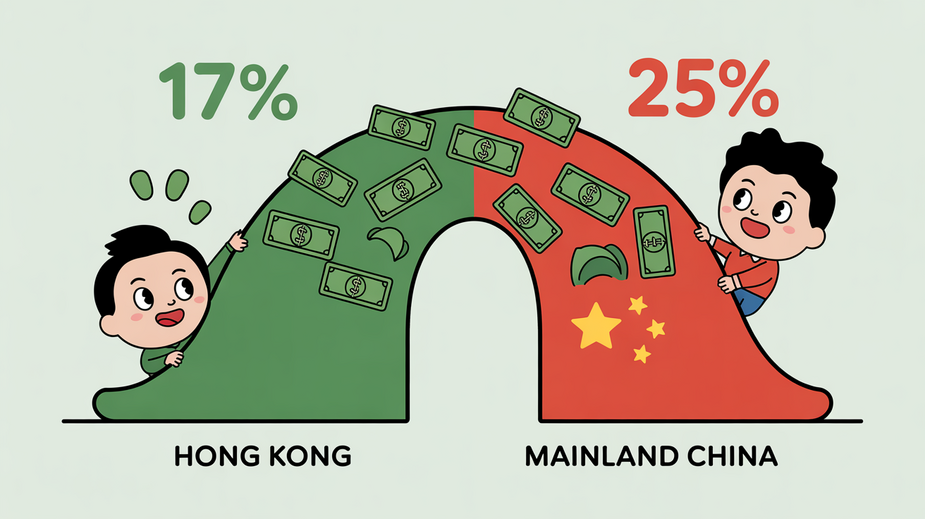

Understanding Core Tax Structures When evaluating corporate tax environments, the foundational tax structures of Hong......

Why Hong Kong for Offshore Holding Structures Establishing an offshore holding structure is a strategic......

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

Understanding Offshore Claims and Their Benefits Navigating Hong Kong's distinctive territorial tax system is crucial......

Why Hong Kong Demands Strategic Succession Planning Preserving wealth across multiple generations presents a significant......

Understanding Tax Disputes: A Real-World Scenario Examining concrete situations offers valuable insight into the complexities......

Hong Kong’s Evolving Transfer Pricing Regulatory Landscape Hong Kong's transfer pricing framework, particularly concerning intellectual......

Hong Kong's Evolving Charity Tax Framework Hong Kong has recently implemented significant revisions to its......

Hong Kong’s Distinct Tax Framework for Regional Operations Hong Kong stands as a leading international......

Navigating Transfer Pricing Challenges in Global Operations Multinational enterprises operating through Hong Kong face complex......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308