Understanding Hong Kong's Tax Year Structure For small and medium-sized enterprises (SMEs) in Hong Kong,......

Understanding Nominee Property Arrangements in Hong Kong Navigating property acquisitions in Hong Kong often involves......

Understanding Hong Kong's Favorable Tax Landscape Hong Kong is widely recognised for operating one of......

Why Offshore Claims Attract Scrutiny in Hong Kong Hong Kong operates under a distinct territorial......

Foundations of Tax Dispute Systems in Hong Kong and Mainland China Understanding the fundamental legal......

Understanding Customs Audit Risks in Hong Kong Businesses operating internationally, particularly through dynamic trade hubs......

Understanding Hong Kong’s Customs Framework Hong Kong holds a distinctive position in global trade primarily......

Hong Kong’s Unique Tax Framework Explained Hong Kong distinguishes itself globally with a notably straightforward......

Understanding CRS & FATCA Reporting Obligations in Hong Kong Financial institutions operating in Hong Kong......

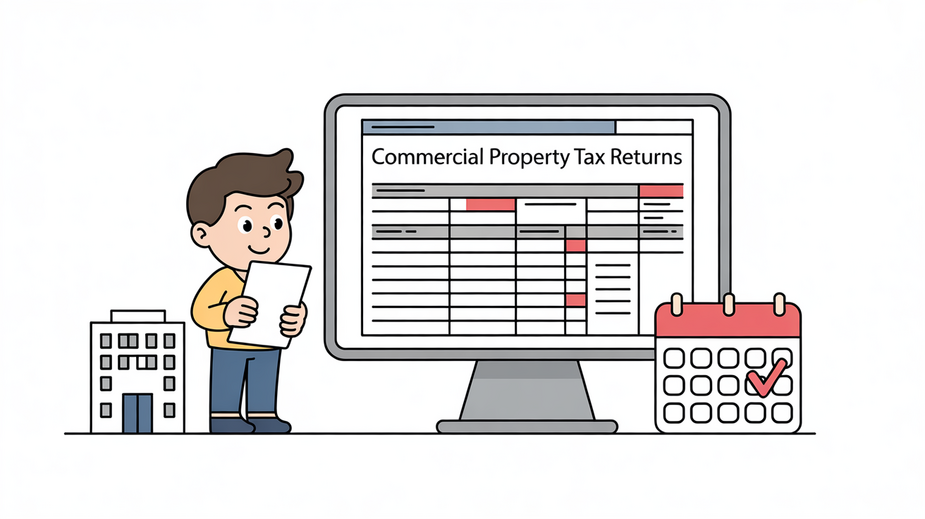

Understanding Hong Kong's Commercial Property Tax Navigating the specifics of Hong Kong's property tax system......

Understanding Hong Kong’s Territorial Tax Principle Hong Kong's tax system is founded on a distinct......

The Strategic Value of Intellectual Property for Tech Startups In the intensely competitive landscape of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308