Trust Fundamentals for Wealth Preservation For entrepreneurs in Hong Kong focused on securing their legacy,......

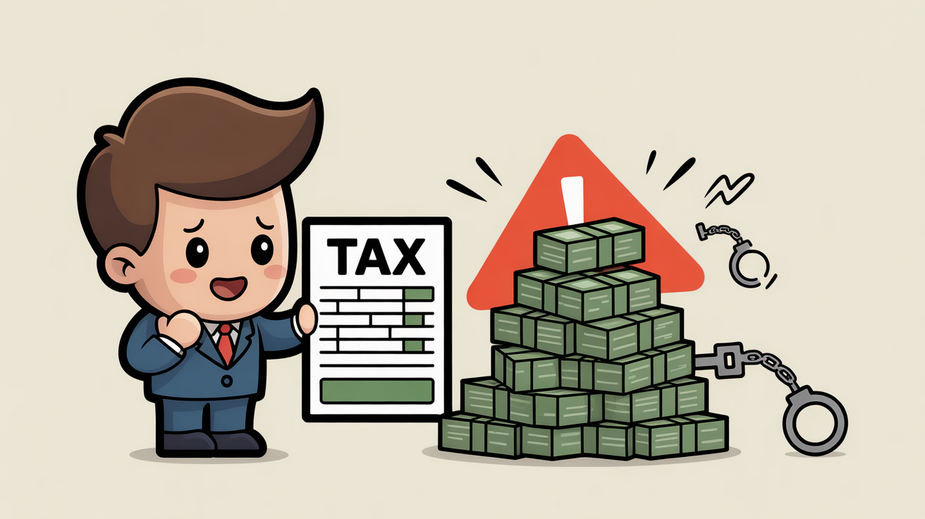

The Critical Risks of Tax Non-Compliance in Hong Kong Navigating the landscape of tax obligations......

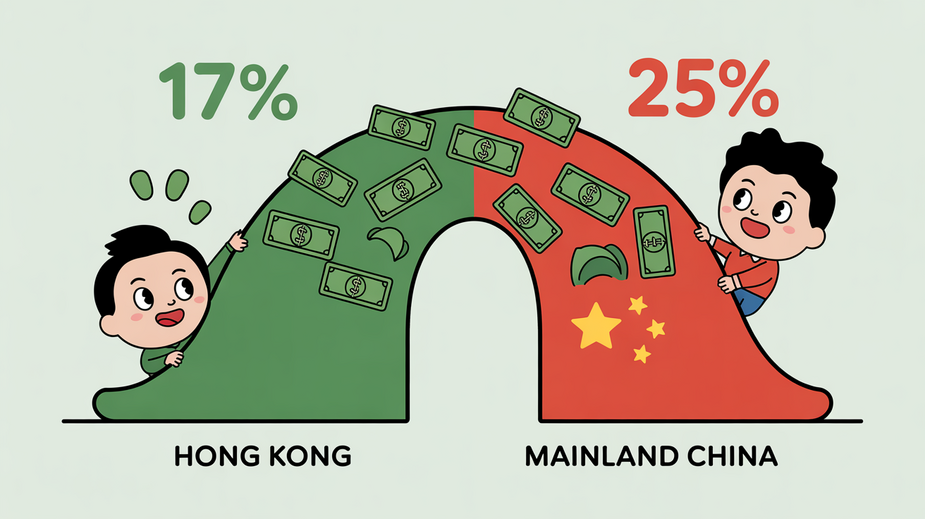

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

Identifying Potential Issues in Hong Kong Tax Assessments Reviewing a tax assessment carefully is a......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

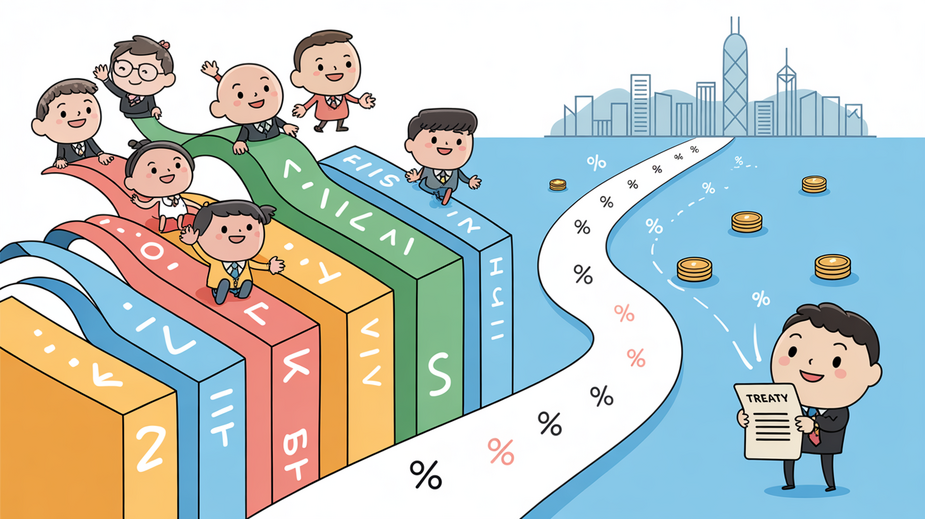

Understanding the Core Treaty Framework The comprehensive Double Taxation Arrangement (DTA) established in 2006 between......

Hong Kong's Tax Fundamentals for Cross-Border Structures Understanding the foundational principles of Hong Kong's tax......

Hong Kong’s Unique Tax Framework Explained Hong Kong distinguishes itself globally with a notably straightforward......

Hong Kong's Advantageous Tax Framework for SMEs Hong Kong's tax system offers distinct advantages for......

Hong Kong Trusts as Cross-Border Wealth Management Tools Hong Kong trusts, built upon robust English......

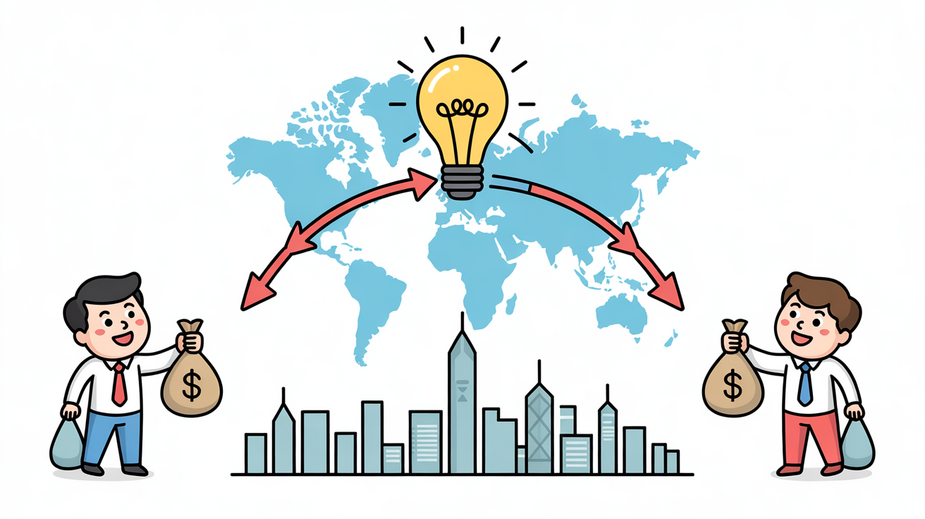

Global Royalty Income: A Core Component of Modern Business In today's hyper-connected global economy, income......

Comparing Mainland and Hong Kong Pension Structures Understanding the fundamental differences between Mainland China's pension......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308