Hong Kong's Appeal for Family Offices and Underlying Tax Complexities Hong Kong has firmly established......

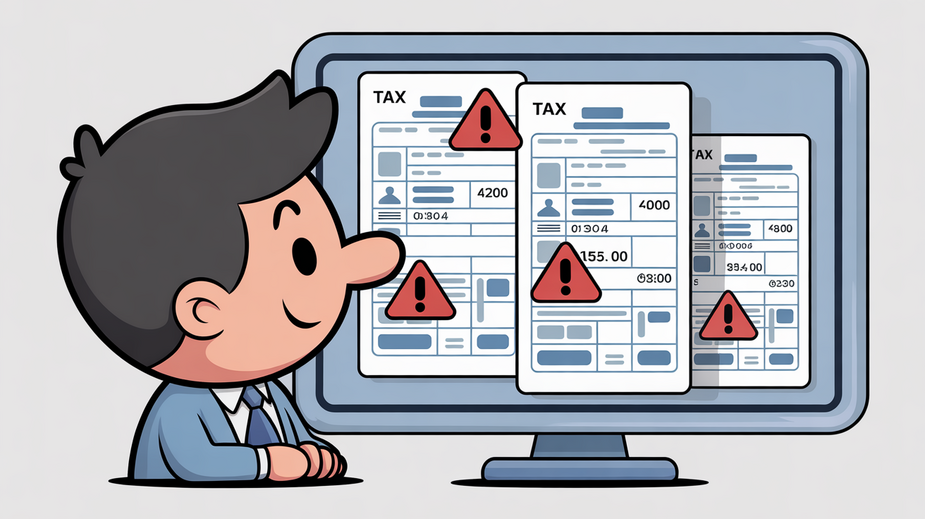

Common Errors That Trigger Amendments Even with advancements in digital filing systems like eTAX, accurately......

```html Understanding Tax Residency in Hong Kong For expatriates living and working in Hong Kong,......

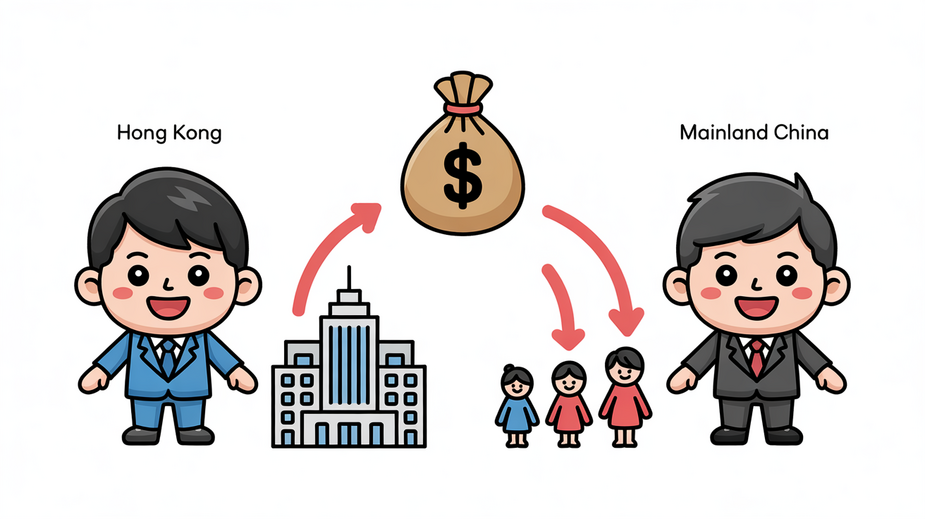

Foundations of Legal Systems Compared Understanding the fundamental legal systems governing Hong Kong and mainland......

Common Digital Filing Errors That Raise Alerts Even in the era of digital tax submission,......

Hong Kong's Retirement Savings Challenge Hong Kong, renowned for its economic dynamism, presents a significant......

Hong Kong's Tax Advantage Landscape Hong Kong is renowned for its business-friendly environment, anchored by......

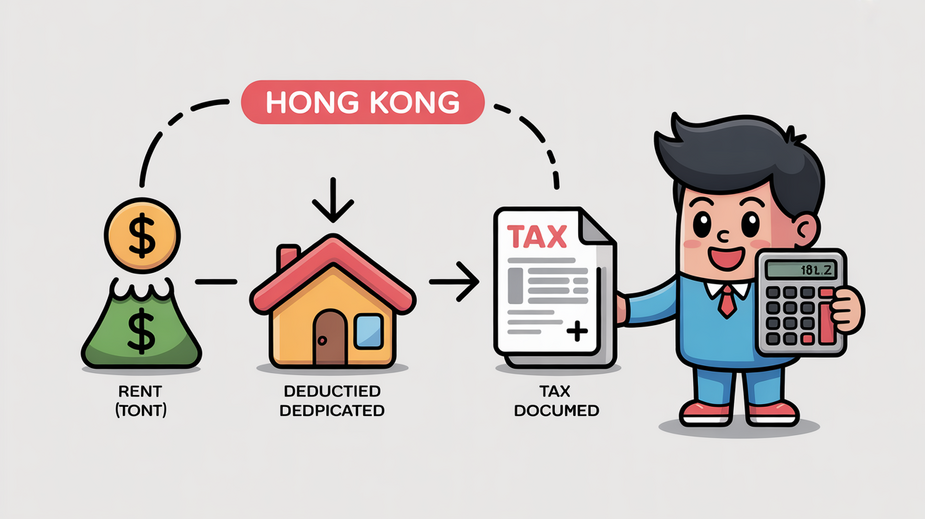

Understanding Hong Kong's Property Tax Framework Navigating the taxation of rental income in Hong Kong......

Deadline-Driven Deductions to Prioritize As the calendar year approaches its end, taxpayers in Hong Kong......

Foundations of Common Law in Hong Kong Jurisprudence Hong Kong's legal system is fundamentally shaped......

Eligibility Criteria for Overseas Tax Deductions Understanding the specific eligibility criteria is a fundamental step......

Profits Tax Fundamentals for Hong Kong Businesses Operating a business in Hong Kong requires a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308