Hong Kong's Territorial Principle of Taxation Hong Kong employs a territorial basis for taxation, a......

Understanding the Proposed Luxury Goods Tax in Hong Kong Hong Kong's established position as a......

Why Domicile Status Matters in Hong Kong Understanding your domicile status is fundamental for effective......

Key Updates to Hong Kong Stamp Duty Recent legislative changes in Hong Kong have significantly......

Understanding BEPS and Its Global Impact Base Erosion and Profit Shifting (BEPS) refers to sophisticated......

The Evolving Global Tax Landscape and its Impact on Hong Kong The international tax system......

Hong Kong's Excise Duty Framework Explained Understanding Hong Kong's excise duty system is essential for......

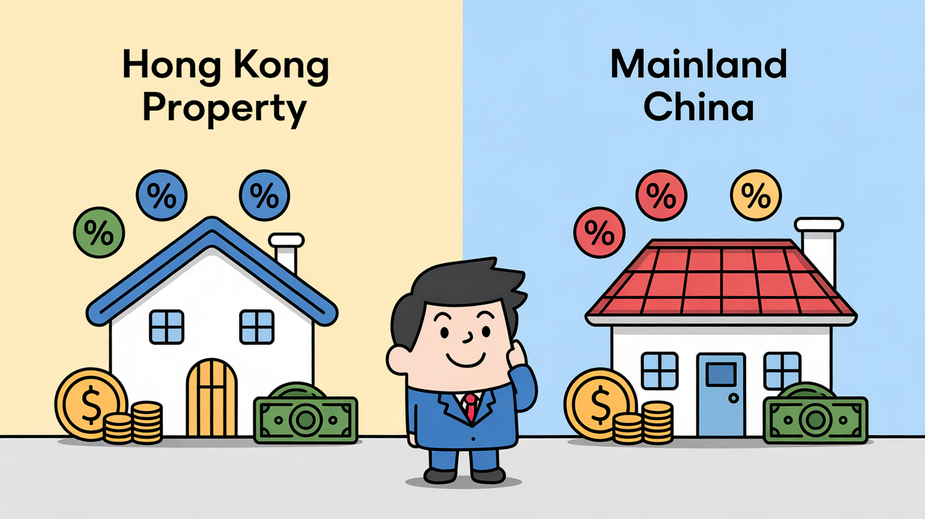

Cross-Border Property Investment Tax Landscape The evolving economic relationship between Hong Kong and Mainland China......

Strategic Significance of the HK-Netherlands DTA The Double Taxation Agreement (DTA) between Hong Kong and......

Why Customs Duties Impact E-Commerce Profitability For Hong Kong online sellers venturing into international markets,......

Understanding Hong Kong's Capital Gains Tax Exemption for Real Estate Investors Hong Kong operates under......

Understanding Hong Kong's Customs Framework Navigating the complexities of international trade requires a firm grasp......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308