Immediate Steps Following an IRD Query Receiving official correspondence from the Inland Revenue Department (IRD)......

Common Errors That Trigger Amendments Even with advancements in digital filing systems like eTAX, accurately......

Understanding Property Rates Concessions in Hong Kong In Hong Kong, property ownership involves two key......

Understanding Hong Kong's Rental Income Tax Scope In Hong Kong, income earned from letting land......

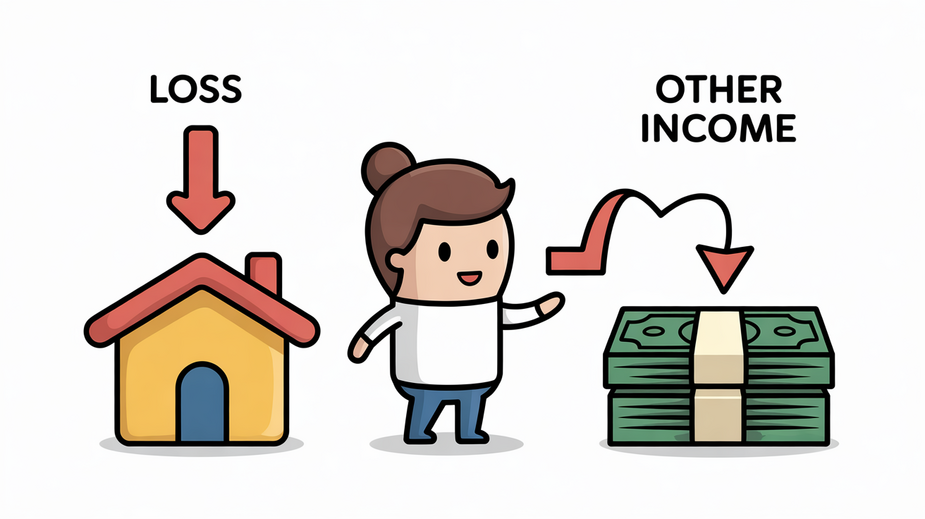

Understanding Rental Losses in Hong Kong Property Tax In Hong Kong's property tax system, a......

Understanding Advanced Pricing Agreements (APAs) and Hong Kong's Framework Advanced Pricing Agreements (APAs) represent a......

Understanding Tax Implications of Marriage in Hong Kong Entering into marriage significantly alters various aspects......

Hong Kong Estate Duty Principles: Historical Context and Current Relevance for Probate Understanding the foundational......

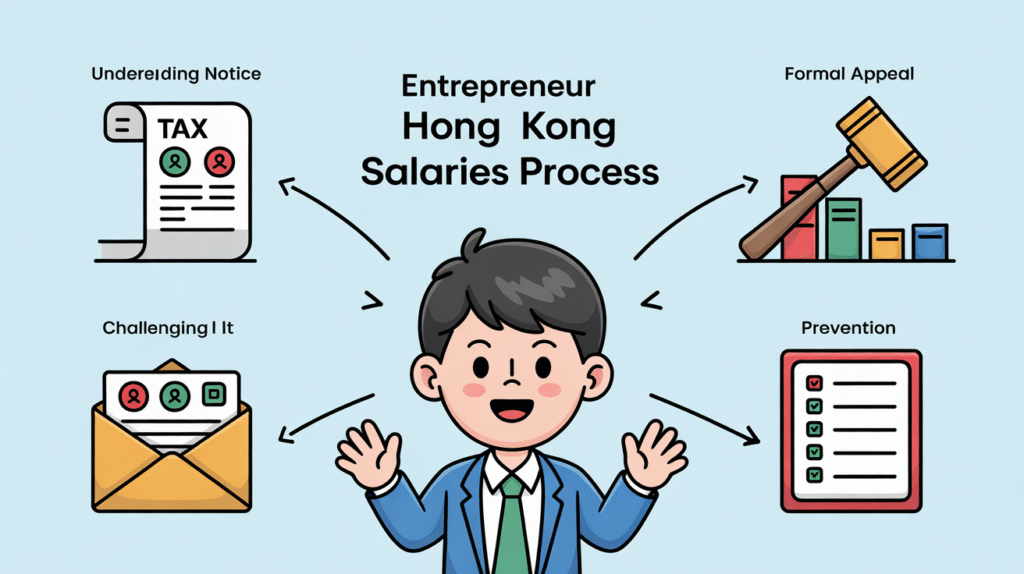

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

Understanding Transfer Pricing Fundamentals Transfer pricing is a critical component of international taxation, governing how......

Overhauling Hong Kong's Tax Dispute Framework Hong Kong is undertaking a substantial modernization of its......

Property Tax Fundamentals in Hong Kong Understanding the foundational principles of Property Tax in Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308