Defining Intellectual Property Income Under Hong Kong Tax Law Understanding the tax implications for income......

Immediate Financial Consequences of Tax Dispute Losses Losing a tax dispute in Hong Kong triggers......

Understanding Hong Kong's Territorial Tax Framework Hong Kong distinguishes itself on the global economic stage......

Understanding Hong Kong Profits Tax Losses and Carry-Forwards Under the Hong Kong Profits Tax system,......

Understanding Dutiable Commodities in Hong Kong For any entrepreneur navigating the complexities of Hong Kong's......

Hong Kong's Robust Trust Framework for Wealth Defense Hong Kong is recognized as a leading......

Hong Kong’s Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

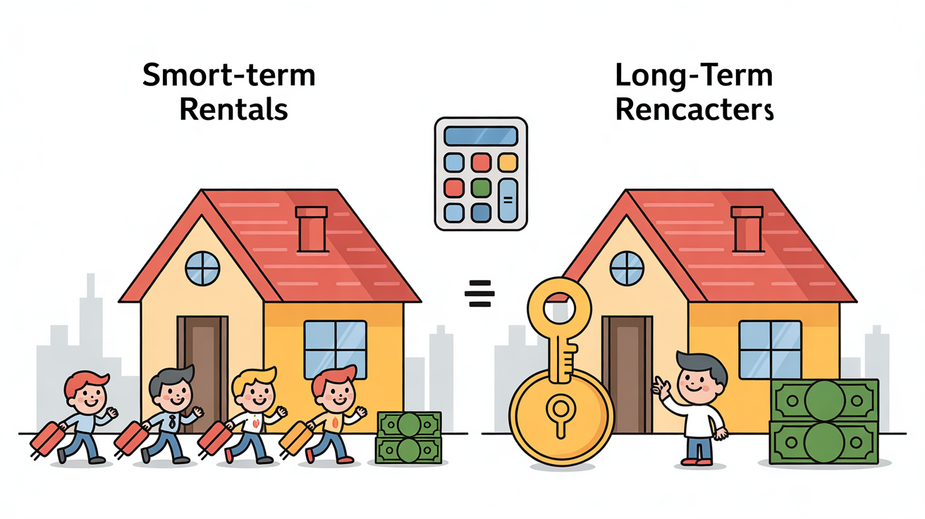

Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

Hong Kong's Tax Advantages for Regional Operations Establishing a corporate presence in Hong Kong offers......

Understanding Hong Kong's Stamp Duty Framework Navigating the Hong Kong property market involves various costs,......

Understanding Hong Kong's Tax Digitalization Framework Hong Kong's Inland Revenue Department (IRD) has significantly advanced......

Understanding Hong Kong’s Tax Framework and the Role of Deductions Hong Kong implements a distinctive......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308