Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Why Global Tax Alignment Drives Business Success In today's interconnected global economy, a company's tax......

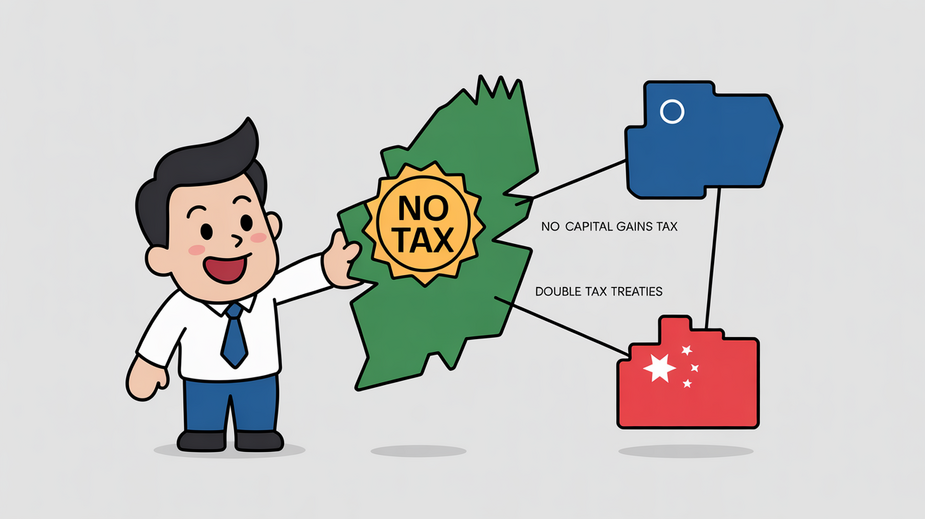

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

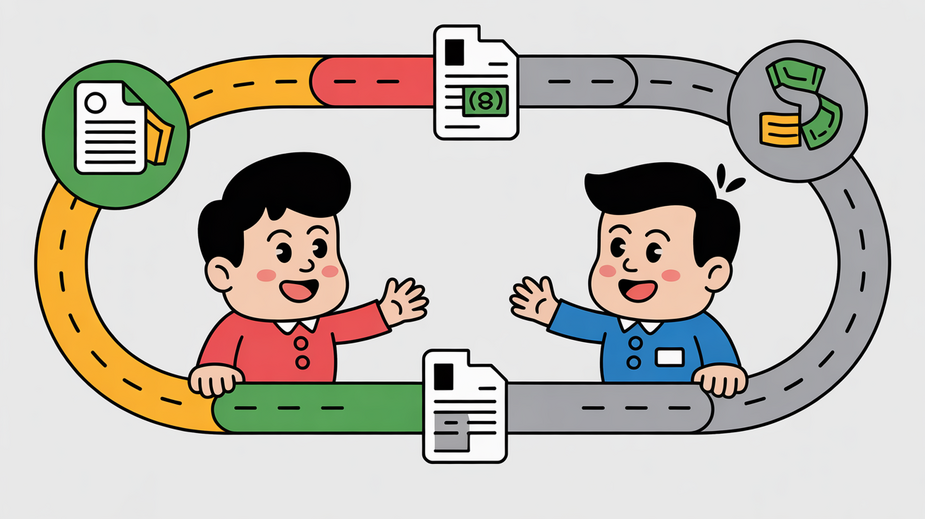

The Tax Workflow Bottleneck in Modern Businesses Modern businesses, irrespective of size, frequently face significant......

Hong Kong's Territorial Tax System Explained Hong Kong distinguishes itself globally through its territorial basis......

The Real Cost of Customs Duty Miscalculations Navigating international trade requires a precise understanding and......

Understanding Hong Kong’s Framework for Charitable Trusts Establishing a charitable trust in Hong Kong provides......

Stamp Duty Mechanics in Hong Kong Equities Stamp duty is a fundamental component of the......

Hong Kong Property Tax Basics for Owners Understanding the fundamental aspects of Hong Kong's Property......

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

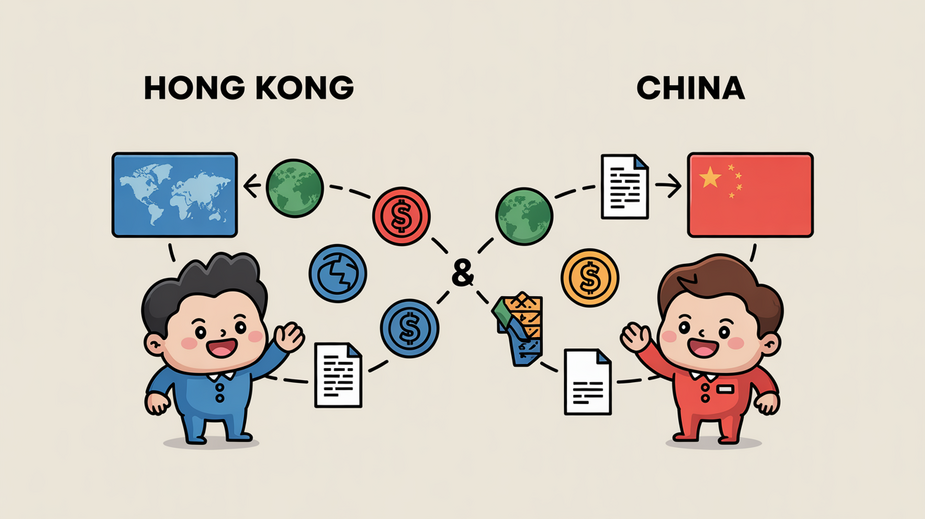

Understanding Dual Tax Regimes: Hong Kong vs Mainland China Operating a business with entities in......

Why the HK-Mainland DTA Matters for Businesses The Arrangement for the Avoidance of Double Taxation......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308