Decoding Hong Kong's Partnership Business Framework Hong Kong provides a diverse array of business structures,......

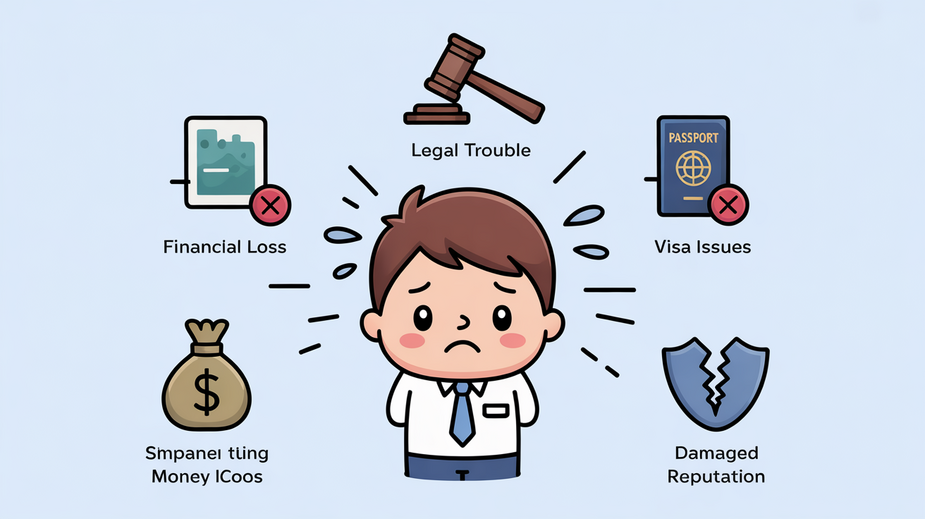

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

Growing Cross-Border Transfer Pricing Complexity The deepening economic integration between Hong Kong and Mainland China......

BEPS 101: Reshaping Global Tax Governance The Base Erosion and Profit Shifting (BEPS) initiative, spearheaded......

Understanding Customs Duty Fundamentals Customs duties represent a significant, often underestimated, element of the total......

Understanding the HK-Australia DTA Framework The Double Taxation Agreement (DTA) between Hong Kong and Australia......

Why Tax Treaty Revisions Matter for Entrepreneurs in Hong Kong For entrepreneurs operating from Hong......

Hong Kong’s Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

Hong Kong’s Strategic Tax Treaty Network Hong Kong has strategically developed an extensive network of......

Understanding Hong Kong’s Salaries Tax System: Progressive vs. Standard Rates Hong Kong’s Salaries Tax system......

Hong Kong's Evolving Tax Landscape for Tech SMEs Hong Kong has solidified its position as......

Understanding Stock Loans and Repos Basics In the intricate landscape of financial markets, securities lending......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308