Navigating Hong Kong Offshore Tax Claims: Avoiding Common Pitfalls Businesses operating internationally often seek to......

Common Misconceptions About Related-Party Property Transfers and Stamp Duty in Hong Kong Transferring property between......

Leveraging Hong Kong's Territorial Tax System A foundational element for structuring tax efficiency when operating......

Understanding Capital Allowances in Hong Kong Navigating business finances effectively requires a clear understanding of......

Understanding Hong Kong Salaries Tax: Source vs. Residency Navigating Salaries Tax in Hong Kong requires......

Hong Kong's Strategic Position for Wealth Management Hong Kong has long cemented its status as......

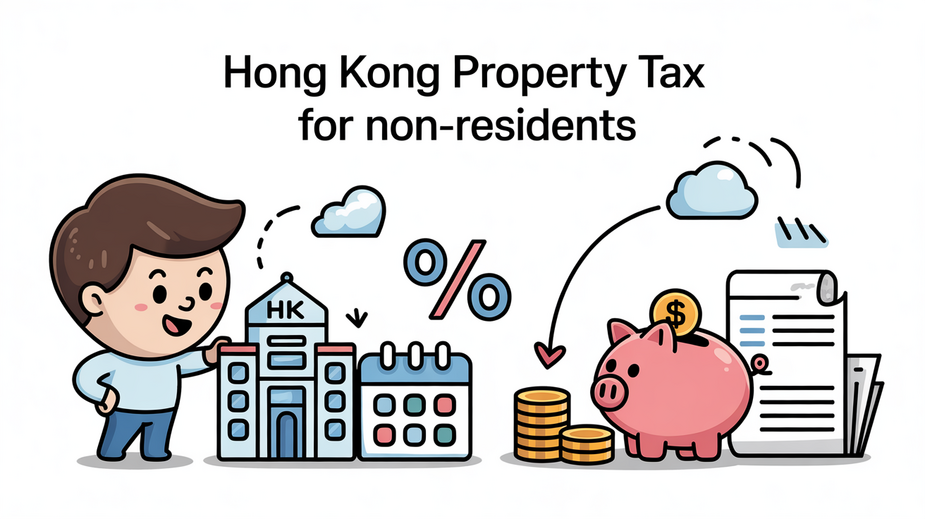

Hong Kong Property Tax Considerations for Non-Residents Navigating property ownership in Hong Kong as a......

Hong Kong's E-Commerce Boom and Transfer Pricing Significance Hong Kong is experiencing a remarkable surge......

Hong Kong's Retirement Tax Advantages for Global Employers Foreign companies considering or expanding their presence......

The Expanding Landscape of Cross-Border Employment in the Greater Bay Area The rapid economic integration......

Understanding Cross-Border Transaction Fundamentals for Hong Kong Businesses For businesses operating in Hong Kong, engaging......

The BEPS Framework and Its Global Impact on Corporate Taxation The OECD's Base Erosion and......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308