香港の税制がBEPS第2行動項目に基づくハイブリッド・ミスマッチに対処する方法

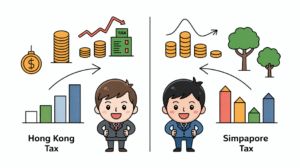

📋 ポイント早見 ターゲット型アプローチ: 香港は包括的なBEPS第2項目のハイブリッド・ミスマッチ規則を採用せず、代わりにFSIE制度内にターゲット型の反ハイブリッド条項を導入しています。 FSIE制度: 外国源泉所得免税制度は2023年1月1日発効、2024年1月1日に適用範囲が拡大され、配当、利子、知的財産所得、譲渡益を対象としています。 反ハイブリッド規則: 配当支払いが被投資会社の税務計算上控除可能な場合、参加免税は適用されません。これにより、控除/非課税ミスマッチを防止します。 第2の柱の導入: 15%のグローバル最低税が2025年6月6日に成立し、収益7.5億ユーロ以上の多国籍企業グループに対して2025年1月1日から遡って適用されます。 移転価格税制の成文化: 2018年制定の「税務(改正)(第6号)条例」により、OECD基準に沿った包括的な移転価格税制が確立されました。 多国籍企業は、巧妙なクロスボーダー構造を通じて税の抜け穴を利用しているのでしょうか?香港は、競争力のある源泉地主義税制を維持しつつ、ターゲット型の反ハイブリッド・ミスマッチ規則を導入することで、国際的な税務環境における戦略的な位置づけを確立しています。OECDのBEPS(税源浸食と利益移転)イニシアチブの下で国際的な税務基準が進化する中、国境を越えて事業を展開する企業にとって、香港のハイブリッド・ミスマッチ取引に対する微妙なアプローチを理解することは極めて重要です。 ハイブリッド・ミスマッチ取引の理解 ハイブリッド・ミスマッチ取引は、国際的な税務計画において最も洗練された分野の一つです。これらの構造は、異なる国が法人、金融商品、または取引をどのように分類するかの違いを利用し、二重非課税または無期限の税繰延を引き起こす可能性があります。OECDはこれらの取引を、そのBEPSイニシアチブの下での改革の優先分野と特定し、第2項目でその無効化を特に目標としています。 二つの主要なハイブリッド・ミスマッチの種類 BEPS第2項目は、不公平な優位性を生み出す二つの主要な税務ミスマッチのカテゴリーに焦点を当てています: 控除/非課税(D/NI)取引: 支払いが一方の管轄区域で税務控除を生み出し、他方の管轄区域では課税対象所得として対応する計上が行われない場合です。 二重控除(DD)取引:…