Hong Kong's Tax Framework for Intellectual Property: An Overview Hong Kong's tax system operates on......

Decoding Hong Kong's Partnership Business Framework Hong Kong provides a diverse array of business structures,......

Core Principles of Hong Kong's Profits Tax System Navigating the landscape of business taxation in......

Navigating Hong Kong's 2024 Tax Relief Landscape for SMEs Hong Kong's 2024 budget introduces significant......

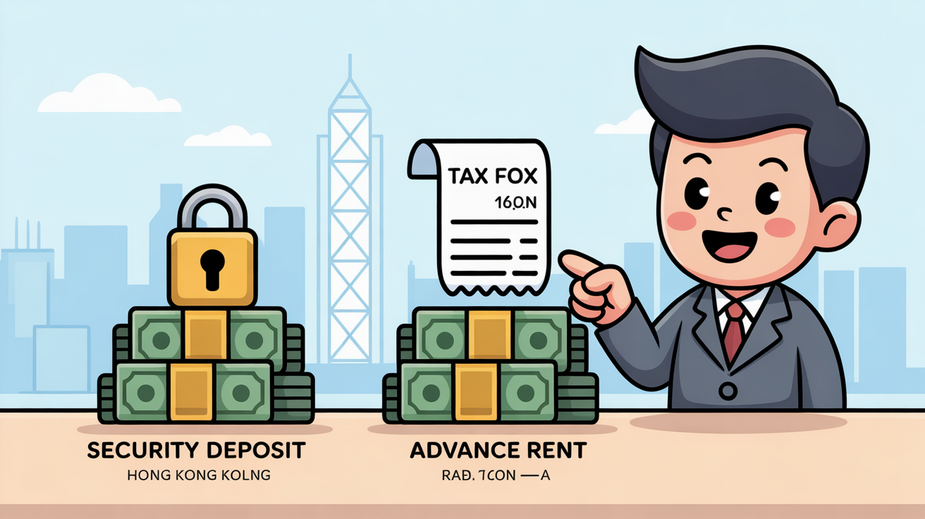

Understanding Security Deposits vs. Advance Rent in Hong Kong Taxation Navigating the tax landscape for......

E-Commerce Growth and Hong Kong's Digital Landscape Hong Kong's economy is undergoing a significant transformation,......

Understanding Eligibility for Dependent Parent and Grandparent Allowances in Hong Kong Claiming dependent parent and......

Hong Kong Stamp Duty Fundamentals for Inherited Property In Hong Kong, stamp duty is a......

Why Hong Kong Attracts Global Family Offices Hong Kong stands as a premier international financial......

Navigating Wealth Transfer in Hong Kong: A Comprehensive Guide Effective financial planning involves more than......

Hong Kong's Capital Gains Tax Stance Explained Hong Kong operates under a territorial principle of......

Understanding Hong Kong’s e-Filing Landscape Hong Kong's Inland Revenue Department (IRD) is progressively rolling out......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308