Hong Kong’s Foundational Legal Framework for Asset Protection Hong Kong's legal system, deeply rooted in......

Understanding Government Rent vs. Property Rates Navigating the financial obligations associated with commercial property ownership......

Understanding Hong Kong's Tax Treaty Network for Retirement Planning For individuals strategically planning their retirement......

BEPS 2.0: Fundamentals for Global Businesses The Base Erosion and Profit Shifting (BEPS) 2.0 initiative,......

Understanding the Double Taxation Arrangement Framework The Double Taxation Arrangement (DTA) between Hong Kong and......

Unlocking Tax Savings: Overlooked Operational Expenses for Hong Kong SMEs Navigating the complexities of tax......

Hong Kong's Robust Trust Framework for Wealth Defense Hong Kong is recognized as a leading......

Hong Kong's Distinctive Unit Trust Environment Hong Kong's strategic location and robust financial infrastructure create......

Understanding BEPS and its Impact on International Tax Governance The international tax environment has undergone......

Understanding the IRD's Decision-Making Framework Successfully navigating discussions with the Hong Kong Inland Revenue Department......

Understanding the Hong Kong-US Double Taxation Agreement (DTA) The Double Taxation Agreement (DTA) between Hong......

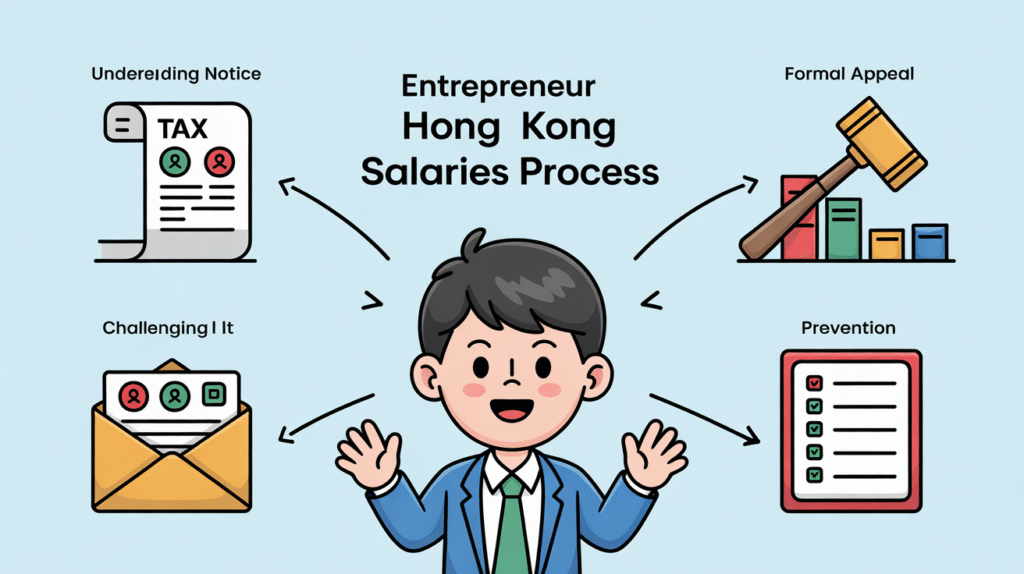

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308