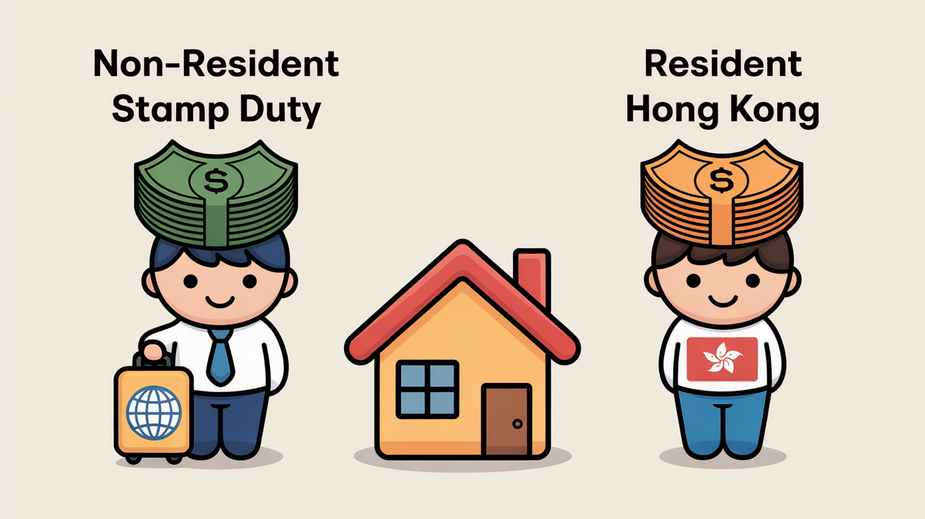

📋 Key Facts at a Glance Stamp Duty System: Hong Kong operates under the Stamp......

Hong Kong's Tax Framework for M&A Transactions Hong Kong's tax system is fundamentally based on......

📋 Key Facts at a Glance Automatic Extension: eTAX filers receive an automatic 1-month filing......

Essential Tax Allowances for Hong Kong Freelancers Navigating the tax landscape as a self-employed professional......

📋 Key Facts at a Glance Business Registration: Must be completed within 1 month of......

📋 Key Facts at a Glance Territorial Tax System: Only Hong Kong-sourced profits are taxable......

📋 Key Facts at a Glance Interest on held-over tax: 8.25% per annum from July......

Hong Kong Stamp Duty Framework Explained Understanding Hong Kong's stamp duty framework is essential for......

📋 Key Facts at a Glance Four Dutiable Commodities: Hong Kong taxes only liquor, tobacco,......

Cross-Border M&A Growth Trends in Greater Bay Area The Greater Bay Area (GBA), encompassing Hong......

Hong Kong's Tax Framework Essentials Navigating financial obligations in Hong Kong requires a clear understanding......

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308