Understanding Most Favored Nation (MFN) Clauses in Hong Kong Tax Treaties In the complex realm......

Hong Kong Property Tax Overview Hong Kong maintains a reputation for a simple and low-rate......

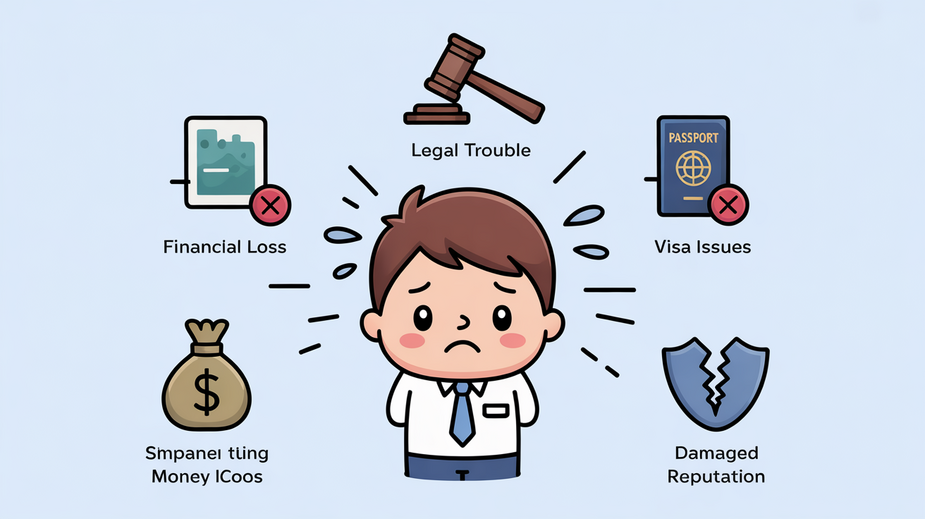

Immediate Consequences of Late Salaries Tax Filing in Hong Kong Failing to submit your Salaries......

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

📋 Key Facts at a Glance Historic Change: All residential property "cooling measures" abolished on......

Navigating Tax Differences: Hong Kong's Territorial vs. Mainland China's Progressive System Understanding the fundamental differences......

📋 Key Facts at a Glance Strict Deadlines: You must file objections within 1 month......

📋 Key Facts at a Glance No Capital Gains Tax: Profits from cryptocurrency held as......

Hong Kong’s Territorial Tax System and Offshore Exemption A fundamental element underpinning Hong Kong's attractiveness......

Qualifying for Business Expense Deductions in Hong Kong For side hustlers operating in Hong Kong,......

Understanding Hong Kong's Territorial Tax System A defining characteristic and significant appeal of Hong Kong's......

📋 Key Facts at a Glance Vacant land is NOT rateable: Under Hong Kong's Rating......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308