Maximizing Home Loan Tax Relief in Hong Kong: Understanding Overlooked Opportunities Many homeowners in Hong......

Core Mechanics of Double Tax Relief Navigating international commerce often involves the risk of the......

Hong Kong's Transfer Pricing Regulatory Framework Hong Kong has established a comprehensive transfer pricing regulatory......

📋 Key Facts at a Glance Court of Appeal Landmark Ruling: October 2024 decision refined......

Understanding Eligible Self-Education Expenses for Tax Deduction in Hong Kong Navigating tax deductions for self-education......

Navigating Hong Kong's Allowable Tax Deductions for Independent Professionals Understanding the framework of allowable tax......

Understanding Double Taxation Risks in Global Business Navigating the international business landscape offers significant opportunities......

Core Tax Obligations for Cross-Border E-Commerce Hong Kong businesses aiming to access the significant consumer......

Hong Kong's Capital Gains Tax: An Overview A notable characteristic of Hong Kong's tax framework,......

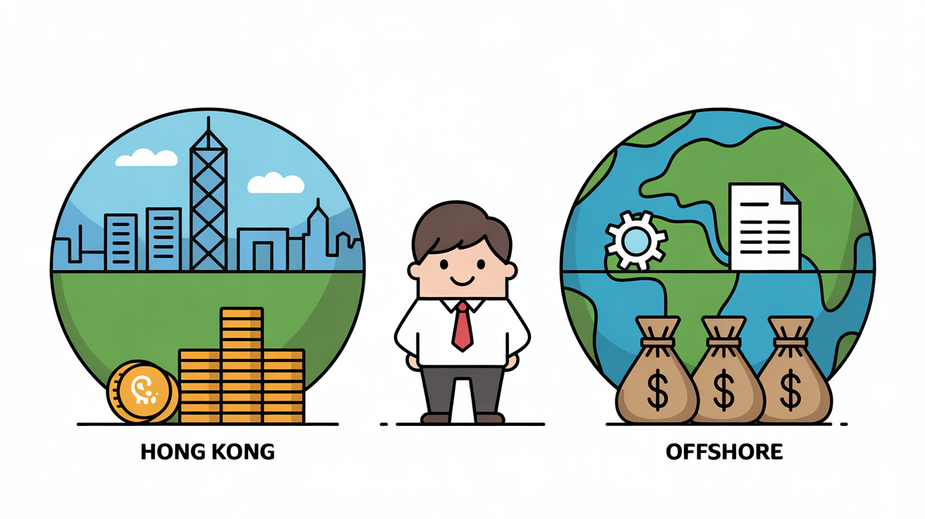

Understanding Dual Tax Regimes: Hong Kong vs Mainland China Operating a business with entities in......

Understanding Hong Kong's Territorial Tax System Hong Kong operates a distinct territorial basis of taxation......

📋 Key Facts at a Glance Immediate 5% surcharge: Applied immediately on unpaid tax after......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308