Misinterpreting Basic Allowance Eligibility Accurately understanding the foundational criteria for claiming the basic personal allowance......

Hong Kong’s Top Tax-Efficient Investment Vehicles for Foreign Entrepreneurs Hong Kong stands as a premier......

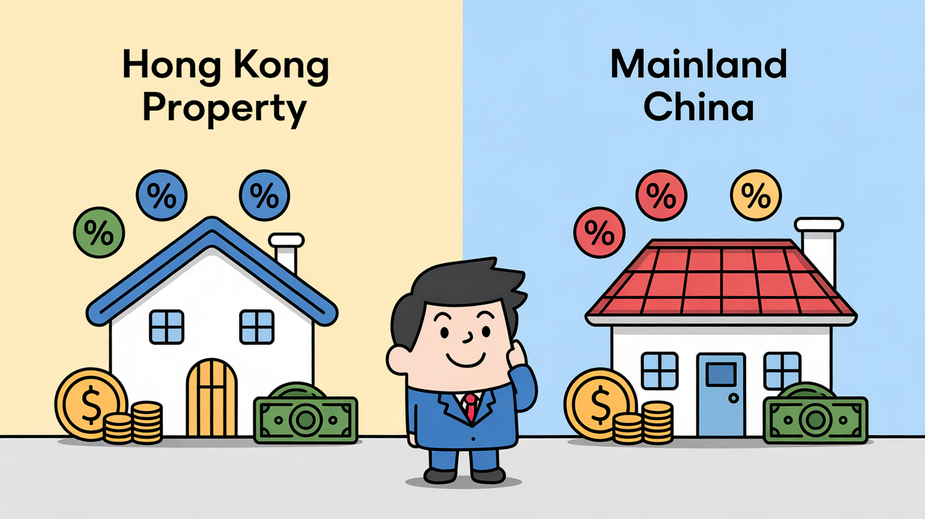

Understanding the Scope of Hong Kong Property Tax Navigating the tax landscape for property in......

Understanding Hong Kong's Rental Income Tax Scope In Hong Kong, income earned from letting land......

Pre-Pandemic Hong Kong Property Market Baseline Before the global health crisis reshaped economies, Hong Kong's......

Qualifying Marketing Expenses Defined Understanding which marketing and advertising costs can be legitimately claimed as......

Core Principles of Profits Tax Deductibility Minimizing tax liability under Hong Kong's Profits Tax system......

Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances Understanding the intricacies......

Cross-Border Property Investment Tax Landscape The evolving economic relationship between Hong Kong and Mainland China......

Depreciation Allowances: Definition and Core Purpose In the landscape of Hong Kong Profits Tax, depreciation......

Understanding Hong Kong's Tax Deduction Framework for Charitable Giving Navigating the landscape of tax benefits......

Transfer Pricing Fundamentals for Asian Hubs Transfer pricing, the mechanism by which multinational enterprises (MNEs)......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308