Hong Kong’s Tax Framework for Trusts and Estates

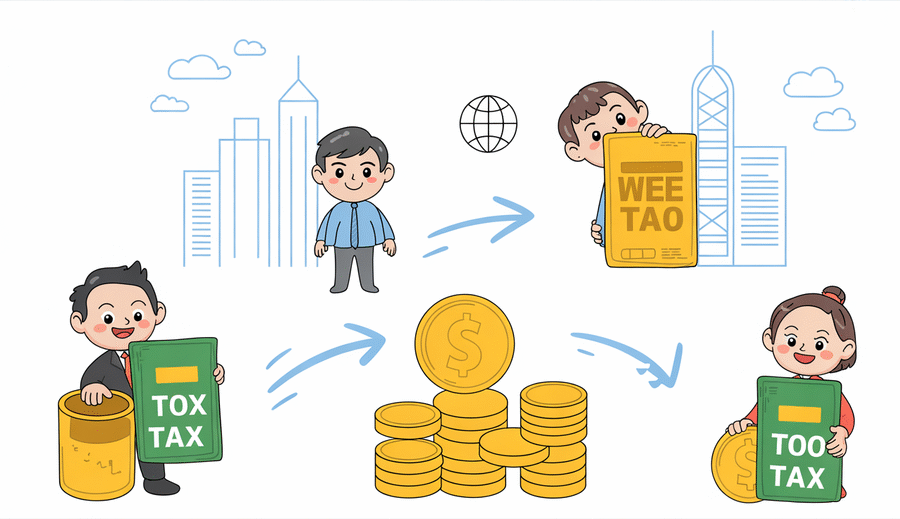

Hong Kong operates under a territorial basis of taxation, a foundational principle dictating that generally only income or profits sourced within Hong Kong are subject to tax. This core concept is pivotal in understanding the tax treatment of both trusts and estates within the jurisdiction. Unlike many tax systems that levy tax based on the residency of the entity or individuals globally, Hong Kong primarily focuses on the geographical source of the income. This rule is particularly significant when dealing with structures involving non-residents, as their tax liability hinges on whether the income is deemed to arise in or be derived from Hong Kong.

While both trusts and estates involve managing assets for the benefit of others, they possess distinct legal characteristics that significantly influence their tax considerations. An estate arises upon an individual’s death and involves administering and distributing their assets according to their will or intestacy laws. In contrast, a trust is typically established during a person’s lifetime or upon death through a trust deed, involving the transfer of assets to a trustee to be held and managed for specified beneficiaries under defined terms. These fundamental structural and operational differences lead to varied administrative and tax implications under Hong Kong’s Inland Revenue Ordinance.

The distinct nature and administration of trusts versus estates can be summarized as follows:

| Feature | Trust | Estate |

|---|---|---|

| Legal Basis | Trust deed or declaration | Will or intestacy laws |

| Creation Event | Settlor transfers assets to trustee (typically inter vivos or upon death) | Death of an individual |

| Purpose | Ongoing management and distribution of assets for beneficiaries | Administering assets and settling liabilities of deceased, then distributing residue |

| Duration | Can exist for a prolonged period (subject to perpetuity rules) | Generally temporary, ending upon final distribution of assets |

Building on the territorial principle and the distinction between trusts and estates, a critical determinant within Hong Kong’s tax framework is the residency status of the parties involved. While the source of income remains the primary factor due to the territorial system, the residency of the deceased (for estates), or the settlor, trustees, or beneficiaries (for trusts) can influence how the source is determined or whether certain tax exemptions might apply. For estates, the deceased’s domicile is relevant for probate and inheritance considerations, although Hong Kong itself does not impose estate duty. For trusts, the residency of the trustee, and sometimes the settlor or beneficiaries, can impact the trust’s tax residency and the application of the territorial principle to the trust’s income streams. Navigating these nuances of residency alongside the source rules is essential for accurate tax assessment and compliance.

Understanding these foundational concepts—the territorial basis of taxation, the specific legal differences between trusts and estates, and the critical role of residency status in applying the source rules—provides the necessary framework for evaluating the specific tax implications for non-residents involved in such structures in Hong Kong.