Hong Kong’s Distinctive Territorial Tax System

Hong Kong’s enduring appeal as a strategic gateway for businesses expanding into Mainland China is fundamentally rooted in its exceptionally straightforward and business-friendly tax framework. Central to this system is the principle of territorial taxation, a core concept stipulating that taxes are imposed solely on income or profits genuinely sourced within Hong Kong. In contrast to many other jurisdictions that levy tax on resident entities’ and individuals’ worldwide earnings, regardless of their origin, Hong Kong’s focus remains exclusively on the geographical source of the income. This provides a significant advantage, enabling international businesses operating through a Hong Kong entity to potentially isolate offshore-sourced profits from Hong Kong tax liabilities.

Adding to its attractiveness, Hong Kong conspicuously omits several taxes commonly found in other major economies, including Mainland China. Businesses here are not subject to sales tax, Value Added Tax (VAT), or capital gains tax obligations. The absence of VAT simplifies cross-border transactions and reduces administrative burdens, while the lack of a capital gains tax is particularly beneficial for investment holding structures and asset management, encouraging capital flow and facilitating corporate reorganizations without triggering major tax events.

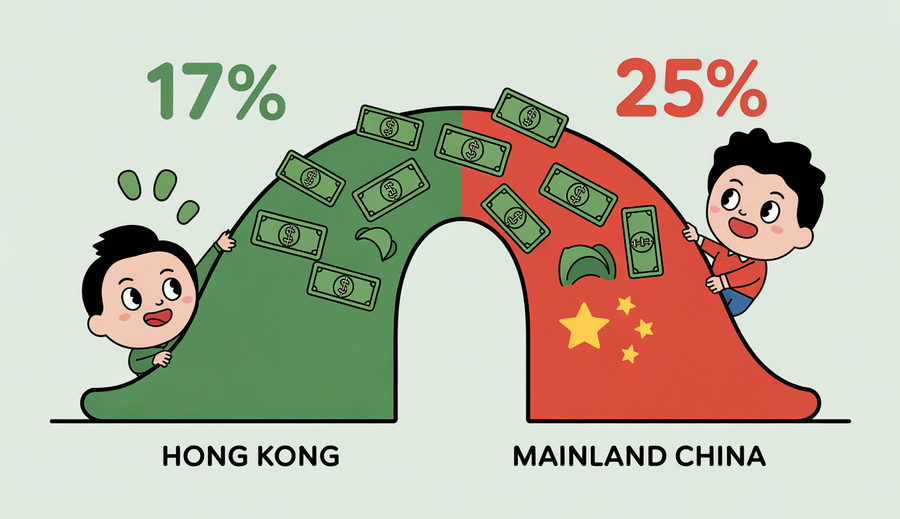

Direct operating costs are further minimized by Hong Kong’s highly competitive corporate profits tax regime. The standard rate is 16.5%, with a preferential two-tiered system applying an 8.25% rate to the first HKD 2 million of assessable profits. This compares favorably with the standard corporate income tax rate of 25% in Mainland China. Such a considerable difference in headline rates directly impacts a company’s profitability, potentially freeing up capital for reinvestment or repatriation and positioning Hong Kong as an efficient base for establishing regional headquarters or holding entities.

Collectively, the territorial principle, the absence of key transaction and capital taxes, and competitive corporate rates forge a powerful fiscal landscape. This structure not only lessens the overall tax burden for companies channeling their Mainland China engagement through Hong Kong but also streamlines compliance and enhances predictability, allowing businesses to prioritize growth and expansion over navigating intricate tax regulations. The following table illustrates some key tax rate differences:

| Tax Type | Hong Kong | Mainland China (Standard) |

|---|---|---|

| Corporate Profits Tax Rate | 16.5% (Standard) | 25% |

| Sales Tax / VAT | None | Applicable |

| Capital Gains Tax | None | Applicable in certain scenarios |

Understanding and leveraging this system is crucial for companies aiming to optimize their tax position while capitalizing on the extensive opportunities presented by the Mainland China market.

Leveraging the Double Taxation Arrangement with Mainland China

Navigating cross-border business expansion inevitably involves complex tax considerations. For companies focused on the Mainland China market, the comprehensive Double Taxation Arrangement (DTA) between Hong Kong and Mainland China stands as a crucial advantage. This agreement is specifically designed to mitigate or eliminate the risk of the same income being taxed in both jurisdictions, thereby fostering a more predictable and beneficial tax environment for cross-border trade and investment. It provides a clear framework that helps businesses structure their activities efficiently and reduces potential tax burdens that could impede growth and profit repatriation.

A primary benefit of the DTA is the substantial reduction in withholding taxes applied to specific types of income flowing from Mainland China to Hong Kong. Without the DTA, standard withholding tax rates on dividends, royalties, and interest can be high. However, under the arrangement, qualifying Hong Kong resident companies receiving dividends from Mainland China subsidiaries can typically benefit from a reduced withholding tax rate of 5%, provided they hold a significant shareholding (usually 25% or more). Similarly, withholding taxes on royalties and interest payments are also reduced compared to standard domestic rates, making the repatriation of profits and the structuring of licensing and financing agreements considerably more tax-efficient.

Furthermore, the DTA incorporates robust tax credit mechanisms. These provisions ensure that taxes already paid in one jurisdiction on income originating from that jurisdiction can be credited against the tax liability in the other jurisdiction. This directly prevents the same income stream from being subject to taxation in both Hong Kong and Mainland China, a common challenge in international business operations. By enabling businesses to claim credits for taxes previously paid, the DTA ensures that the overall tax burden is managed effectively, promoting fairness and encouraging cross-border investment by removing the penalty of double taxation.

Finally, the Double Taxation Arrangement provides essential clarity regarding the tax residency of companies operating between the two regions. Situations can arise where a company might be considered a resident of both Hong Kong and Mainland China under each jurisdiction’s domestic tax laws, potentially leading to dual taxation and administrative complexities. The DTA includes specific “tie-breaker” rules, often based on factors like the place of effective management, to determine a single country of residence for tax purposes. These rules prevent dual residency conflicts and offer businesses certainty about where their primary tax obligations lie.

The combined effect of these DTA provisions – reduced withholding taxes, effective tax credit mechanisms, and clear residency rules – makes it a cornerstone of Hong Kong’s appeal for Mainland China expansion. Effectively understanding and utilizing this agreement is vital for companies seeking tax efficiency and compliance in their cross-border activities, directly impacting operational costs and investment profitability.

| Income Type | Standard Mainland WHT Rate | Typical Rate under HK-Mainland DTA |

|---|---|---|

| Dividends | 10% | 5% (for qualifying holdings, typically 25%+ shareholding) |

| Royalties | 10% | 7% or 10% (depending on type) |

| Interest | 10% | 7% |

Optimal Corporate Structures for Mainland China Market Entry

Successfully entering the extensive Mainland China market necessitates careful strategic planning, particularly concerning the legal and corporate structure adopted. Hong Kong’s unique positioning and tax system make it an exceptionally attractive jurisdiction for establishing the optimal entity. The choice of structure is not merely an administrative decision; it holds significant implications for asset protection, operational efficiency, and tax liabilities when conducting business across the border. Leveraging Hong Kong’s robust framework allows businesses to build a resilient foundation for their Mainland expansion efforts.

A frequently employed and highly effective strategy involves establishing a holding company in Hong Kong. This model provides a critical layer of asset protection for investments made into Mainland China subsidiaries or joint ventures. By routing ownership of Mainland assets or shares through a Hong Kong entity, businesses can benefit from Hong Kong’s well-established legal system and reliable dispute resolution mechanisms, offering a valuable degree of separation and protection from potential risks within the Mainland market. This structure facilitates centralized ownership and management while potentially mitigating the direct exposure of the ultimate parent company to Mainland operational liabilities.

Utilizing Hong Kong as a regional headquarters presents distinct advantages, particularly regarding the repatriation of profits generated by Mainland operations. Profits can be efficiently distributed from the Mainland subsidiary to the Hong Kong regional HQ. Hong Kong’s lack of exchange controls and its generally straightforward regulatory environment for capital flows simplify and expedite the process of moving funds out of the Mainland. When combined with the beneficial provisions of the Double Taxation Arrangement between Hong Kong and Mainland China, this structure can substantially reduce withholding taxes on dividends paid from Mainland subsidiaries to the Hong Kong entity, making profit repatriation considerably more tax-efficient compared to direct transfers to other jurisdictions.

Furthermore, specific corporate structures can strategically capitalize on Hong Kong’s territorial tax system, especially concerning trading activities. If a Hong Kong entity conducts trading business involving Mainland China but the profits are determined to be “offshore sourced” according to Hong Kong tax principles – meaning the primary activities generating the profit (such as securing contracts, negotiating terms, and managing client relationships) occur outside of Hong Kong – those profits may potentially be exempt from Hong Kong profits tax. While requiring careful structuring and thorough documentation to substantiate that relevant activities took place outside Hong Kong, this approach offers a significant opportunity for tax efficiency in cross-border trade facilitated via a Hong Kong entity.

Leveraging Hong Kong’s Free Trade Port Status

Hong Kong’s long-standing status as a free trade port remains a foundational element of its appeal for businesses targeting the Mainland China market. This designation signifies minimal governmental interference in trade flows, typically low tariffs, and highly efficient customs procedures, creating an environment exceptionally conducive to international commerce and cross-border logistics. For companies planning expansion into or trade with Mainland China, understanding and effectively leveraging the advantages offered by this status is essential for optimizing operations and enhancing cost-efficiency.

A key component of this advantage is the Closer Economic Partnership Arrangement (CEPA) between Mainland China and Hong Kong. Under CEPA, qualifying goods considered to originate from Hong Kong can receive preferential, often duty-free, access to the vast Mainland market. This eliminates or reduces tariff burdens that goods from other jurisdictions might face, providing a direct cost advantage for businesses that manufacture or add significant value in Hong Kong before exporting to the Mainland. This preferential treatment under CEPA substantially enhances the competitiveness of Hong Kong-based operations and supply chains.

Furthermore, the free trade port status is synonymous with streamlined and highly efficient customs clearance procedures. Compared to the complexities sometimes encountered at other entry points, Hong Kong’s customs processes are designed for speed, transparency, and simplicity. This efficiency reduces transit times, minimizes delays, and lowers administrative costs associated with importing and exporting goods. The predictability and swiftness of clearance are invaluable for effective supply chain management and ensuring timely market delivery.

Beyond favorable tariffs and efficient clearance, Hong Kong functions as a premier logistics hub for regional distribution. Its world-class infrastructure, including one of the busiest air cargo terminals globally and highly efficient container ports, coupled with sophisticated logistics and warehousing services, positions it perfectly as a gateway. Businesses can efficiently consolidate, store, and redistribute goods throughout the Asia-Pacific region, benefiting from seamless connections to Mainland China. Leveraging this hub capability facilitates optimized inventory management and supports widespread market reach from a single strategic location.

Optimizing Intellectual Property Profit Extraction Strategies

Intellectual property represents significant value for businesses expanding into new markets, and its tax-efficient management is crucial when navigating cross-border operations between Mainland China and Hong Kong. Leveraging Hong Kong’s favorable tax environment can provide key advantages for structuring the flow of IP-related profits and managing IP assets.

One primary strategy involves establishing tax-efficient royalty payment structures. Companies can structure arrangements where royalty income derived from the use of intellectual property in Mainland China is paid to a Hong Kong entity that holds the IP rights. Under Hong Kong’s territorial tax system, such royalty income is generally subject to the standard corporate rate of 16.5% if considered sourced within Hong Kong. However, if it qualifies as offshore sourced under specific criteria, it may potentially be tax-exempt, although careful consideration of sourcing rules is required. This structure is particularly advantageous when combined with the benefits derived from the Double Taxation Arrangement between Mainland China and Hong Kong, which can significantly reduce withholding taxes on royalty payments made from the Mainland.

Collaboration in research and development activities between entities in Mainland China and Hong Kong can also be structured to potentially benefit from R&D incentives. While navigating specific incentives requires careful planning, utilizing Hong Kong as a base or partner for R&D linked to Mainland operations can align with government initiatives promoting innovation and cross-border collaboration within the Greater Bay Area, potentially yielding tax advantages or access to grants and funding programs.

Furthermore, using Hong Kong-based holding companies for owning intellectual property assets offers significant advantages regarding capital gains. A major benefit of Hong Kong’s tax system is the general absence of a capital gains tax. This means that if a company sells its intellectual property assets held by a Hong Kong entity, any profit realized from that sale is typically not subject to tax in Hong Kong. This provides a clear benefit compared to many other jurisdictions that impose substantial taxes on the disposal of valuable IP assets, making Hong Kong an attractive domicile for managing, holding, and eventually realizing the value of intellectual assets utilized in the region. These strategies collectively position Hong Kong as a smart choice for optimizing the tax impact of IP assets within cross-border structures.

Essential Tax Compliance and Risk Management

Navigating the tax landscape when operating between Hong Kong and Mainland China involves more than merely understanding preferential rates and strategic structures; robust tax compliance is equally critical. Effective management of cross-border tax obligations ensures legal adherence, mitigates potential risks, and optimizes tax positions. This section highlights key areas of compliance that businesses utilizing the Hong Kong gateway must address with diligence and precision.

A fundamental aspect of managing cross-border tax compliance involves adhering to transfer pricing documentation requirements. As companies establish related-party transactions between their Hong Kong entities and Mainland operations, it is imperative to ensure these transactions are conducted on an arm’s length basis. Both Hong Kong and Mainland China have regulations requiring businesses to prepare documentation demonstrating how their intercompany pricing is determined, validating that transactions occur as if they were between independent parties. Proper and contemporaneous documentation is vital to support tax positions during audits and avoid potential adjustments, penalties, or disputes with either tax authority.

For businesses involved in exporting goods from Mainland China, understanding and managing Mainland China VAT refund mechanisms is a critical compliance task. While Hong Kong itself does not have VAT, operations involving the movement of goods sourced or manufactured in the Mainland often qualify for VAT refunds on inputs purchased within China. The procedures for claiming these refunds can be intricate, involving specific documentation, submission timelines, and processes dictated by Mainland tax bureaus. Successfully navigating these mechanisms is crucial for cash flow management and maintaining the cost-effectiveness of using Hong Kong as a trade and logistics hub.

Furthermore, businesses must carefully consider the implications of Mainland China’s controlled foreign corporation (CFC) rules. These rules are designed to prevent tax avoidance by attributing profits earned by certain foreign entities controlled by Mainland residents or companies back to the Mainland, even if those profits are not repatriated. Hong Kong entities, particularly those serving as holding companies or passive investment vehicles, may fall under the scope of these rules depending on control, ownership structure, and the nature of their income. Navigating the thresholds, applicable exceptions, and reporting obligations associated with CFC rules requires careful analysis and a thorough understanding of both Mainland and Hong Kong tax laws to ensure full compliance and avoid unexpected tax liabilities.

Future-Proofing Through Greater Bay Area Integration

The strategic landscape for expanding into Mainland China via Hong Kong is increasingly shaped by the dynamic Greater Bay Area (GBA) initiative. This ambitious plan integrates Hong Kong, Macau, and nine cities in Guangdong province into a cohesive and economically powerful hub. For companies planning long-term engagement with the region, understanding the evolving fiscal environment within the GBA is key to future-proofing strategy, particularly concerning emerging incentives and opportunities designed to deepen cross-border synergy and enhance operational efficiency.

A core element of GBA integration involves the establishment of specific development zones offering targeted incentives. Prominent examples include Qianhai in Shenzhen and Nansha in Guangzhou, which provide preferential tax treatments and other benefits to attract businesses, especially in modern services, technology, and innovation sectors. These incentives often include reduced corporate income tax rates (e.g., 15% in Qianhai for qualifying entities), subsidies, or other preferential policies for qualifying activities established within these zones. Leveraging these strategic areas can provide significant advantages for companies establishing or expanding their operational presence within the broader GBA framework.

Beyond general business support, the GBA initiative strongly emphasizes fostering strategic industries such as green finance, technology, and advanced manufacturing. Businesses operating in these sectors can access substantial opportunities via specific subsidies, funding programs, and preferential policies aimed at stimulating innovation, research and development, and sustainable practices. These support mechanisms, often provided at the municipal or regional levels within the GBA structure, can significantly lower operational costs, accelerate development, and drive growth for companies focusing on environmental solutions, cutting-edge technology, or high-value manufacturing.

Facilitating the seamless movement of skilled talent is also a critical focus of GBA integration. The initiative has led to the implementation and expansion of cross-border talent tax allowances, designed to ease the movement of professionals working across different parts of the region. These allowances aim to attract and retain high-skilled individuals by offering favorable tax treatments or subsidies on their income earned in the GBA. This directly supports companies that require flexible deployment of personnel between Hong Kong and their Mainland GBA operations, enhancing efficiency and knowledge transfer within integrated business models.