Tax Efficiency Advantages for Cross-Border Profits

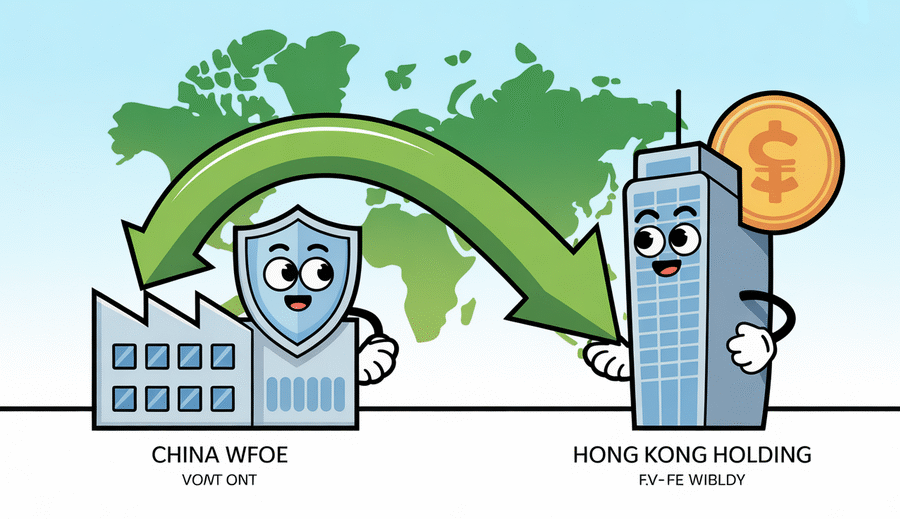

A fundamental benefit of establishing a Hong Kong holding company above your Mainland China Wholly Foreign-Owned Enterprise (WFOE) lies in significantly enhancing tax efficiency for cross-border profit repatriation and management. Rather than directing profits from the WFOE to an ultimate parent company, potentially located in a high-tax jurisdiction or one lacking a favorable tax treaty with China, channeling funds through a Hong Kong intermediary can streamline the process and potentially reduce the overall tax burden. This strategy leverages specific tax principles and agreements involving Hong Kong to create a more fiscally advantageous pathway for your WFOE’s earnings.

One primary advantage is the potential reduction of withholding taxes imposed by China on outbound payments. China levies withholding tax on dividends, interest, and royalties paid to foreign entities. However, the Double Taxation Arrangement between Mainland China and the Hong Kong Special Administrative Region offers preferential rates. For example, dividends distributed from a Mainland WFOE to a Hong Kong parent company can often qualify for a reduced withholding tax rate of just 5%, significantly lower than the standard 10%. This preferential rate is typically contingent upon the Hong Kong entity meeting specific criteria, including holding at least 25% of the WFOE’s capital and satisfying beneficial ownership requirements designed to prevent treaty shopping.

| Payment Path | Typical China Withholding Tax Rate (Outbound) | Hong Kong Withholding Tax (Outbound) |

|---|---|---|

| WFOE > Direct Foreign Parent (Standard Rate/No Treaty) | 10% | N/A |

| WFOE > Hong Kong Holding (Via DTA, subject to conditions) | 5% | N/A |

| Hong Kong Holding > Ultimate Parent | N/A | 0% |

Furthermore, Hong Kong’s territorial tax system provides a substantial advantage for the holding company itself. Under this principle, profits derived from activities conducted entirely outside Hong Kong are generally not subject to Hong Kong profits tax. This means that dividend income received by the Hong Kong holding company from its Mainland WFOE is often exempt from Hong Kong profits tax, provided it qualifies as offshore income according to specific criteria. This critical feature prevents the profits from being subject to a second layer of taxation in Hong Kong before being further distributed or reinvested, thereby preserving more capital within the group structure.

Finally, the flexibility and favorable policies regarding dividend distribution from Hong Kong add another layer of tax efficiency. Hong Kong does not impose withholding tax on dividends paid by Hong Kong companies to their shareholders, regardless of their global location. This allows profits channeled through the Hong Kong holding company to be repatriated to the ultimate parent or reinvested elsewhere without incurring further Hong Kong tax leakage on the distribution itself. This contributes significantly to a more efficient overall tax position for your international operations and facilitates smoother capital movements.

Legal Protection and Operational Risk Separation

Beyond the significant tax advantages, incorporating a Hong Kong holding company offers robust legal protection and facilitates operational risk separation for businesses operating a Wholly Foreign-Owned Enterprise (WFOE) in Mainland China. This structural layer is vital for mitigating potential liabilities and enhancing corporate governance across the group. By establishing a Hong Kong entity to hold the shares of your China WFOE, you can effectively shield your ultimate parent company from direct exposure to legal challenges, financial obligations, or operational risks that may specifically arise within the WFOE’s business activities in China.

Should the WFOE encounter legal disputes, regulatory issues, or operational liabilities, the risk can often be contained at the level of the WFOE or its direct owner, the Hong Kong holding company. This ring-fencing protects assets and operations held elsewhere by the group, preventing potential issues in China from directly impacting the parent entity or other international subsidiaries. This separation is a key component of effective risk management in cross-border investments.

Furthermore, introducing a Hong Kong holding company aids in establishing clear corporate governance boundaries. It formalizes the relationship between the international parent entity and the China operations, defining distinct roles, responsibilities, and reporting lines. This clarity in structure helps streamline decision-making processes, improve internal controls, and ensure greater transparency across different levels of the corporate hierarchy. Having a dedicated intermediate holding entity registered in a well-regulated, internationally recognized jurisdiction promotes better organizational discipline and compliance management.

A key benefit derived from this structure is the ability to leverage Hong Kong’s well-established common law framework. Modeled after the English legal system, Hong Kong’s legal environment is internationally recognized for its predictability, transparency, and independent judiciary. Placing the ownership of the China WFOE under a Hong Kong company allows international investors to rely on a legal system they are likely familiar with and trust for matters concerning the holding entity, such as shareholder rights, contractual disputes between the holding company and other parties, and corporate compliance. This provides a significant advantage, particularly when navigating the complexities of cross-border investment and potential dispute resolution, offering a stable and reliable legal platform.

Streamlining International Fund Transfers

Navigating the complexities of moving capital into and out of mainland China can present significant hurdles for foreign-invested enterprises. China’s stringent foreign exchange controls often involve detailed application processes, limitations on transfer amounts, and unpredictable timelines, making it challenging for a WFOE to freely remit profits or transfer funds for international purposes. Establishing a Hong Kong holding company introduces a valuable intermediary layer that can help foreign businesses navigate these controls more effectively.

Instead of attempting complex, direct transfers from the mainland WFOE to a parent company or other international entities in various jurisdictions, funds can potentially be routed more efficiently to the Hong Kong holding company. A key benefit of using a Hong Kong entity in this structure is the SAR’s status as a free port with virtually unrestricted capital movement. Unlike the mainland, Hong Kong boasts an open financial system where funds can generally flow in and out with minimal regulatory barriers or lengthy approval processes. This provides a stark contrast to the mainland’s controlled environment and offers greater certainty and speed in managing capital.

By aggregating funds received from the WFOE within a Hong Kong holding vehicle, businesses gain significantly greater control and flexibility over their capital. Once funds reside in Hong Kong, the process of reinvesting that capital across multiple international jurisdictions becomes considerably simplified. Sending funds directly from a mainland WFOE to various countries often requires navigating separate bilateral regulations and obtaining specific approvals for each transfer. However, with capital held in Hong Kong, which has a well-established international banking system and fewer outward remittance restrictions, sending funds onwards to other global locations for expansion, investment, or operational support is a far smoother process.

This structure effectively transforms the challenge of isolated mainland transfers into a more fluid, international fund management operation centered in Hong Kong. It enhances overall financial agility, reduces administrative burdens associated with numerous cross-border activities, and provides a readily accessible pool of capital for global strategic deployment.

Currency Risk Management Solutions

Operating a WFOE in mainland China exposes your business to the Chinese Renminbi (RMB), a currency subject to volatility influenced by economic conditions and global markets. For international businesses, effectively managing this currency risk is crucial for protecting profitability, ensuring stable financial planning, and preserving capital value. A Hong Kong holding company provides key advantages for navigating these challenges effectively as part of your overall financial strategy.

A significant benefit is the ability to mitigate direct RMB volatility exposure for funds intended for international use. By structuring transactions or holding certain financial assets within the Hong Kong entity, outside the direct mainland environment, you reduce reliance on the RMB for all financial activities. This creates a buffer against sudden, unfavorable currency movements that could diminish the value of mainland earnings when they are converted or repatriated. Holding funds in stable, freely convertible currencies like USD or HKD through the Hong Kong entity helps preserve capital value against RMB fluctuations.

Moreover, Hong Kong’s developed financial market infrastructure offers easier access to sophisticated hedging instruments. Unlike potential complexities faced within mainland China’s financial system for certain types of hedging activities, businesses can readily utilize forward contracts, options, and other derivatives through international banks operating in Hong Kong. This allows companies to proactively lock in exchange rates for future transactions or protect the value of RMB-denominated assets, providing greater certainty over future cash flows and managing cross-border currency risk more effectively and efficiently.

Finally, maintaining USD or HKD liquidity buffers within the Hong Kong holding company provides essential financial flexibility and resilience. These reserves, held in freely convertible currencies, can be rapidly accessed to support the WFOE’s operational needs (subject to mainland regulations for inbound transfers), facilitate international payments, or handle unexpected financial demands across the group. Possessing readily available capital in stable currencies reduces the need to convert potentially volatile RMB holdings during unfavorable periods, thereby enhancing the financial stability of the entire cross-border structure against unpredictable currency fluctuations.

Enhanced IP Protection Strategies

For companies whose operations in Mainland China involve valuable intellectual property (IP), safeguarding these intangible assets is paramount for long-term success and competitive advantage. A Hong Kong holding company can serve as a critical component in a comprehensive IP protection strategy, offering multiple layers of security and strategic advantages that may not be as readily accessible when holding IP directly within the WFOE structure or solely at the ultimate parent level.

A primary benefit stems from leveraging Hong Kong’s well-established legal system. As a common law jurisdiction, Hong Kong provides a familiar and robust framework for the registration, enforcement, and litigation of intellectual property rights, including patents, trademarks, and copyrights. This system is often viewed as offering greater transparency, predictability, and international alignment compared to certain aspects of the mainland Chinese legal environment, providing a more secure foundation for protecting valuable technology, brand identities, and creative works associated with your business operations. Holding IP assets within a Hong Kong entity subjects them to these strong legal protections and provides a reliable venue for dispute resolution.

Structuring the ownership of intellectual property through a Hong Kong entity also presents opportunities for more efficient management of related financial flows, particularly concerning royalty payments. When a Mainland China WFOE utilizes technology, brands, or licensed IP held by the Hong Kong holding company, royalty payments can be structured between the two entities under licensing agreements. This approach can offer tax efficiency advantages depending on applicable treaty networks and specific arrangements, while also providing a clear, auditable trail for the use and licensing of IP, simplifying compliance and reporting for cross-border transactions and justifying the flow of funds.

Furthermore, a Hong Kong holding structure enables the creation of layered intellectual property ownership. Instead of the IP being directly owned by the operating WFOE or even the ultimate parent in a distant jurisdiction, it can be legally housed within the Hong Kong intermediary. This creates an additional buffer, separating the valuable IP assets from the direct operational risks, potential liabilities, and regulatory complexities inherent in mainland business activities. This layering provides an extra level of legal separation and strategic control over your most valuable intangible assets, making them more resilient against potential issues arising solely within the operating environment.

Regional Expansion Gateway Advantages

Beyond its immediate benefits for managing operations specifically within mainland China, structuring your presence with a Hong Kong holding company offers significant strategic advantages should you plan for broader regional expansion across Asia. Hong Kong has long served as a crucial gateway and a central hub for accessing the dynamic markets across the continent, particularly the fast-growing economies of Southeast Asia. Leveraging this established position through your holding structure can provide your business with a clear and efficient pathway for future growth beyond China.

One key advantage lies in the ability to leverage Hong Kong’s extensive trade networks and deep economic ties, especially with the member nations of ASEAN (Association of Southeast Asian Nations). Hong Kong has established agreements and long-standing business relationships with these countries. Operating your regional strategy through a Hong Kong entity allows you to tap into these pre-existing connections, potentially utilize favorable trade frameworks, and benefit from familiar business practices and legal systems that resonate throughout the region. This connectivity can significantly ease market entry and operational logistics when expanding into countries like Singapore, Malaysia, Thailand, Vietnam, or Indonesia.

Furthermore, establishing a Hong Kong holding entity can greatly simplify the process of making future investments across Southeast Asia and other regional markets. Investing directly from a mainland China WFOE into multiple foreign jurisdictions can involve navigating complex and often restrictive capital outflow regulations and varying bilateral investment treaties unique to China. In contrast, using a Hong Kong company typically provides a much more flexible and internationally aligned platform for deploying capital, setting up subsidiaries, or engaging in joint ventures throughout the ASEAN region and beyond. This streamlining of financial and legal processes reduces complexity and can accelerate the expansion timeline.

Finally, a Hong Kong holding structure enables the centralization of regional management functions. Instead of attempting to manage disparate operations across several Southeast Asian countries directly from your mainland China WFOE or a distant head office, the Hong Kong entity can serve as a central administrative, financial, and strategic hub. Consolidating oversight, treasury management, regional sales coordination, or strategic planning under one roof in Hong Kong enhances efficiency, improves governance, and facilitates better synergy across your growing regional footprint. It provides a clear and effective point of control for multinational operations. Utilizing Hong Kong thus strategically positions your company not just within China but as a well-connected player poised for wider Asian growth.

Future-Proofing Against Regulatory Shifts

Operating a Wholly Foreign-Owned Enterprise (WFOE) in mainland China involves navigating an environment where foreign investment regulations can evolve, potentially impacting market access, operations, data handling, or ownership structures. Preparing for such changes is crucial for ensuring long-term stability and continuity. A Hong Kong holding company serves as a strategic intermediate layer offering a degree of future-proofing and enhanced resilience against potential mainland regulatory turbulence.

The presence of a Hong Kong holding entity provides enhanced adaptability to evolving China foreign investment rules. When mainland policies change, potentially impacting foreign businesses or WFOE structures, having the Hong Kong layer allows for strategic adjustments at the holding company level. Such adjustments are often less cumbersome than direct alterations to the WFOE’s registration with mainland authorities. Hong Kong’s separate legal and regulatory system, which is more aligned with international norms for corporate governance and investment, offers alternative pathways for managing the overall investment structure that can help mitigate direct exposure to specific mainland regulatory shifts or compliance hurdles.

This structure also maintains greater flexibility for potential future restructuring options for the group. Should market conditions, business strategy, or ownership needs necessitate changes such as introducing new investors, facilitating a partial sale, or preparing for divestment, undertaking these maneuvers through the Hong Kong holding company can often be significantly simpler and faster than directly modifying the WFOE’s equity structure or undergoing complex liquidation procedures under mainland regulations. The holding company acts as a convenient and internationally recognized point for corporate actions affecting the mainland operations indirectly, offering valuable strategic agility.

Furthermore, operating through a Hong Kong entity helps in aligning with global compliance standards. Hong Kong adheres to internationally recognized financial reporting standards (IFRS/HKFRS) and operates under a common law system, making reporting, auditing, and due diligence processes more straightforward and transparent for global parent companies, potential investors, or partners. This alignment enhances credibility and ensures the overall structure remains robust and acceptable internationally, easing interactions with global banks, investors, and regulatory bodies. This proactive approach provides a buffer against potential future discrepancies between mainland and global compliance expectations, contributing to the long-term stability and attractiveness of your investment structure.