Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

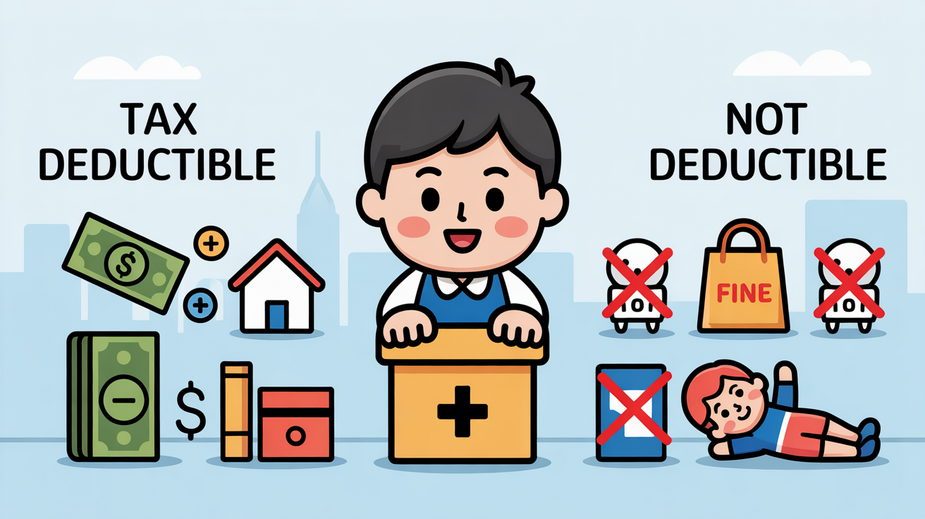

Misclassifying Deductible vs Non-Deductible Expenses in Hong Kong Accurately classifying business expenses is a critical......

Key Facts: Property Tax Audits in Hong Kong Property Tax Rate: 15% flat rate on......

How Recent Court Rulings Are Shaping Hong Kong's Tax Audit Practices How Recent Court Rulings......

Hong Kong's Tax Landscape for Digital Commerce Hong Kong operates under a fundamental and distinct......

Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Key Facts: Property Gifts and Stamp Duty in Hong Kong No Gift Tax: Hong Kong......

How to Leverage Hong Kong's Tax Treaties for Cross-Border Investment Gains Key Facts: Hong Kong's......

Why Hong Kong Attracts Tax-Conscious Expats Hong Kong has long been celebrated as a highly......

Navigating Hong Kong's Capital Gains Tax Exemption for Family Investment Holdings Navigating Hong Kong's Capital......

Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances Understanding the intricacies......

Understanding the Hong Kong-France Double Taxation Agreement The Double Taxation Agreement (DTA) between Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308