Hong Kong Salaries Tax Explained: A Step-by-Step Guide for Entrepreneurs

📋 Key Facts at a Glance

- Objection Deadline: 1 month from assessment notice date (strictly enforced)

- Appeal Deadline: 1 month from IRD determination letter (Form IR 133 required)

- 2024-25 Allowances: Basic HK$132,000, Married HK$264,000, Child HK$130,000 each

- Tax Rates: Progressive 2-17% or standard 15-16% on first HK$5 million+

- Key Deductions: MPF (HK$18,000), Home loan interest (HK$100,000), Charitable donations (35% limit)

Received a Hong Kong salaries tax assessment that doesn’t seem right? You’re not alone. Each year, thousands of taxpayers—especially entrepreneurs with complex income streams—find discrepancies in their tax notices. Understanding your rights and the proper procedures can mean the difference between overpaying thousands and achieving a fair assessment. This comprehensive guide walks you through every step of challenging an incorrect salaries tax assessment in Hong Kong.

Understanding Your Salaries Tax Assessment Notice

When that brown envelope from the Inland Revenue Department (IRD) arrives, don’t just glance at the final amount and file it away. Your salaries tax assessment notice requires immediate, detailed attention. For entrepreneurs with multiple income sources, investment returns, or complex business structures, this review is particularly crucial.

The Critical One-Month Deadline

The most important date on your assessment notice is the objection deadline. In Hong Kong, you have exactly one month from the date the notice is issued to formally dispute its contents. Mark this date immediately and work backward to allocate sufficient time for thorough review and preparation.

What to Verify on Your Assessment

Conduct a line-by-line comparison between your assessment notice and your financial records:

- Reported Income: Verify all employment income, business profits, rental income, and other assessable sources match your records

- Allowances Applied: Check that all eligible allowances have been granted using 2024-25 rates:

- Basic allowance: HK$132,000

- Married person’s allowance: HK$264,000

- Child allowance: HK$130,000 per child (additional HK$130,000 in year of birth)

- Dependent parent/grandparent (60+): HK$50,000

- Single parent allowance: HK$132,000

- Deductions Claimed: Confirm all allowable deductions have been factored in:

- MPF contributions: Maximum HK$18,000/year

- Charitable donations: Up to 35% of assessable income

- Home loan interest: Maximum HK$100,000 (up to 20 years)

- Domestic rent: Maximum HK$100,000

- Self-education expenses: Maximum HK$100,000

- Qualifying annuity/voluntary MPF: Maximum HK$60,000

- Tax Calculation: Verify the progressive rates (2-17%) or standard rate (15-16% on first HK$5 million+) have been correctly applied

Initial Steps to Challenge the Assessment

If your review reveals inaccuracies, follow these strategic steps to address them effectively.

1. Informal Contact with IRD

Before initiating formal proceedings, consider contacting the IRD informally. A phone call or simple written query can often resolve minor misunderstandings or clarify points of confusion. This approach is particularly effective for:

- Clarifying how specific income was categorized

- Understanding why a particular deduction was disallowed

- Resolving simple calculation errors

2. Formal Written Objection

If informal contact doesn’t resolve the issue, or if discrepancies are significant, you must lodge a formal written objection. This is a mandatory requirement to officially challenge the assessment.

- Prepare Your Grounds: Clearly state why you believe the assessment is incorrect, citing specific sections of the Inland Revenue Ordinance where applicable

- Gather Evidence: Compile all supporting documents—payslips, bank statements, receipts, contracts, correspondence

- Submit Within Deadline: Ensure your objection reaches the IRD within the one-month statutory timeframe

- Specify Scope: Indicate whether you’re disputing the entire assessment or specific items only

Understanding Payment Obligations During Dispute

A critical consideration is your tax payment obligation while your objection is under review:

| Aspect | Partial Dispute | Full Dispute |

|---|---|---|

| Scope of Challenge | Specific items or amounts only | The entire assessment calculation |

| Tax Payment Status | Undisputed portion typically due by original deadline | Full assessed amount may be required, or payment arrangement needed |

| Financial Impact | Lower immediate cash outflow | Potentially significant cash requirement during dispute |

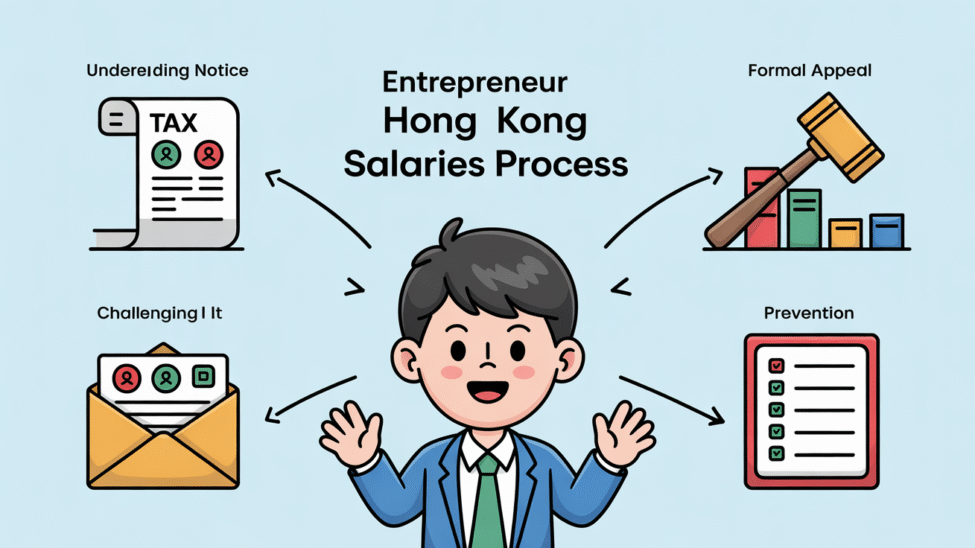

Legal Grounds for Filing an Appeal

To successfully appeal a salaries tax assessment, you must demonstrate specific legal grounds—not just disagreement with the amount. Here are the primary grounds recognized by Hong Kong tax law:

1. Incorrect Application of Tax Laws

This involves proving the IRD misinterpreted or misapplied specific sections of the Inland Revenue Ordinance. Common examples include:

- Wrongly applying tax rules to legally exempt income

- Misinterpreting conditions for specific allowances or deductions

- Incorrectly categorizing capital gains (generally not taxable in Hong Kong) as assessable income

2. Factual Errors in Income or Expense Reporting

This ground applies when the assessment relies on demonstrably incorrect figures. You’ll need to provide verifiable evidence such as:

- Bank statements showing actual income received

- Contracts proving income attribution to different periods

- Documentation showing non-taxable amounts were incorrectly included

3. Unreasonable Disallowance of Expenses

Hong Kong allows deduction of expenses incurred “wholly, exclusively, and necessarily” in producing assessable income. If the IRD disallows an expense meeting these criteria, you can appeal. Success requires:

- Receipts and invoices proving the expenditure

- Detailed explanation linking the expense directly to income-earning activities

- Evidence the expense was necessary for your business or employment

Lodging a Formal Appeal with the Boards of Review

If your objection doesn’t resolve the dispute favorably, the next step is a formal appeal to the independent Boards of Review. This stage requires strict procedural compliance.

| Requirement | Action Needed | Key Consideration |

|---|---|---|

| Specified Form | Complete Form IR 133 (Notice of Appeal) | Available from IRD website or offices |

| Statutory Timeframe | Lodge completed form | Within one month of IRD determination letter (strictly enforced) |

| Supporting Documentation | Submit comprehensive evidence package | Must directly support grounds of appeal |

| Required Deposit | Calculate and pay specified amount | Usually relates to tax in dispute; failure risks dismissal |

Essential Documentation Package

Your appeal submission should include:

- Original assessment notice

- Your formal objection letter and the IRD’s determination

- All relevant contracts, invoices, and bank statements

- Correspondence with the IRD

- Expert reports or valuations (if applicable)

- Any other records supporting your claim

Preparing Your Case for the Appeal Board

Once your appeal is accepted, meticulous preparation becomes critical. Your thoroughness will significantly influence the outcome.

1. Gather Contemporaneous Financial Records

Collect all documents from the time transactions occurred:

- Invoices and receipts (originals or certified copies)

- Bank statements showing transaction flows

- Contracts and agreements

- Correspondence related to income or expenses

- Diaries or appointment books showing business activities

2. Consider Expert Witnesses

For complex cases involving valuations, accounting standards, or industry practices, expert witnesses can be invaluable:

- Chartered accountants for complex financial matters

- Industry specialists for sector-specific practices

- Valuation experts for asset or business valuations

3. Develop Strong Legal Arguments

Engage tax counsel to:

- Contextualize your evidence within Hong Kong tax law

- Identify applicable legal principles and precedents

- Structure written submissions effectively

- Anticipate and counter IRD arguments

Navigating the Hearing Process

The Board hearing is where both parties formally present their cases. Preparation is key to effective participation.

| Activity | Description | Goal |

|---|---|---|

| Present Evidence | Submit organized financial records, documents, and expert reports | Clearly support your arguments and claims before the Board |

| Cross-Examine | Question IRD representatives on their assessment basis and evidence | Challenge opposing views and test validity of their position |

| Address Board Questions | Respond to technical queries from Board members | Provide clarity on facts, law, and case specifics to inform decision |

Effective Hearing Strategies

- Practice Your Presentation: Rehearse explaining complex points simply and clearly

- Anticipate Questions: Prepare for likely questions from both the IRD and Board members

- Stay Focused on Key Issues: Don’t get sidetracked by minor points—focus on your strongest arguments

- Be Respectful but Firm: Maintain professional decorum while vigorously defending your position

Post-Appeal Decision Actions

After receiving the Board’s written decision, your next steps depend on the outcome.

If the Board Rules in Your Favor

The IRD must implement the Board’s decision:

- You’ll receive an amended assessment reflecting the adjustments

- Review it carefully to ensure all directed changes are accurately applied

- The decision may impact assessments for other tax years with similar issues

If the Board Rules Against You

You may consider judicial review by the High Court, but this is complex:

- Focuses on questions of law or procedural fairness, not factual re-examination

- Requires consultation with experienced tax litigation counsel

- Involves substantial costs and time commitment

- Success rates are generally lower than at Board level

Managing Amended Assessments

Regardless of outcome, ensure proper handling of amended assessments:

- Review all amended notices against the final decision

- Ensure correct processing of any refunds or additional payments

- Update your records to reflect the final determination

- Consider implications for future tax planning

Preventing Future Disputes Proactively

The best strategy is preventing disputes before they arise. Implement these practices to minimize future issues.

1. Maintain Meticulous, Audit-Ready Records

Develop a systematic approach to record-keeping:

- Organize documents by tax year and category

- Keep digital and physical copies (Hong Kong requires 7-year retention)

- Ensure records clearly show income sources and expense purposes

- Regularly reconcile records with bank statements

2. Seek Advance Rulings for Ambiguous Transactions

For complex or novel transactions, consider applying for an advance ruling from the IRD:

- Provides official clarification before filing your return

- Eliminates uncertainty about tax treatment

- Offers legal certainty for planning purposes

- Particularly valuable for entrepreneurs with innovative business structures

3. Conduct Annual Tax Position Reviews

Engage a qualified tax professional annually to:

- Review your financial activities and tax implications

- Ensure compliance with current legislation

- Identify potential issues before filing

- Optimize legitimate tax planning opportunities

✅ Key Takeaways

- Always review your assessment notice immediately—the one-month objection deadline is strictly enforced

- Document everything meticulously and organize evidence systematically for any challenge

- Understand the difference between partial and full disputes and their payment implications

- The Boards of Review process is formal and requires strict procedural compliance

- Prevention through good record-keeping and professional advice is more effective than dispute resolution

- Hong Kong’s tax system offers multiple avenues for challenging incorrect assessments, but timing and preparation are critical

Navigating Hong Kong’s salaries tax assessment challenge process requires diligence, organization, and timely action. While the system provides robust mechanisms for disputing incorrect assessments, success depends on thorough preparation and adherence to strict deadlines. For entrepreneurs with complex financial affairs, investing in professional tax advice and maintaining impeccable records isn’t just good practice—it’s essential risk management. Remember: an ounce of prevention in tax compliance is worth a pound of cure in dispute resolution.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Salaries Tax Guide – Comprehensive salaries tax information and rates

- IRD Allowances and Deductions – Official allowances and deductions information

- GovHK Objections and Appeals – Official guidance on tax objection procedures

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.