Navigating Hong Kong’s Tax Incentives for Green and Sustainable SMEs

📋 Key Facts at a Glance

- Profits Tax Advantage: Hong Kong’s two-tier system offers corporations 8.25% on first HK$2 million, 16.5% on remainder – green investments can reduce taxable income

- Accelerated Depreciation: Green equipment like EVs and solar panels may qualify for faster write-offs, improving cash flow

- Budget Commitment: The 2024-25 Budget allocates HK$1.3 billion for green tech and sustainability initiatives

Did you know that going green could actually save your SME money on taxes? As Hong Kong accelerates its transition to a sustainable economy, small and medium-sized enterprises have a unique opportunity to align environmental responsibility with financial benefits. The government’s commitment to green initiatives isn’t just about compliance—it’s about creating a competitive advantage for forward-thinking businesses. Let’s explore how your SME can navigate Hong Kong’s evolving tax landscape to turn sustainability into profitability.

Hong Kong’s Green Economy: More Than Just Environmental Responsibility

Hong Kong’s strategic pivot toward sustainability represents a fundamental shift in how businesses operate and compete. The 2024-25 Budget demonstrates this commitment with HK$1.3 billion allocated specifically for green technology and sustainable development initiatives. For SMEs, this isn’t just about meeting regulatory requirements—it’s about positioning your business for long-term success in a market increasingly driven by environmental consciousness.

The financial benefits extend well beyond potential tax savings. Businesses that proactively adopt sustainable practices often experience:

- Operational cost reductions: Energy-efficient upgrades typically pay for themselves through lower utility bills

- Enhanced brand reputation: 78% of consumers prefer to buy from environmentally responsible companies

- Access to new markets: Green certifications open doors to government contracts and eco-conscious supply chains

- Talent attraction: Millennial and Gen Z workers increasingly seek employers with strong environmental values

The Tax Advantage for Green SMEs

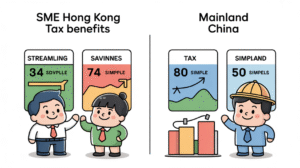

Hong Kong’s tax system offers several advantages that can amplify the financial benefits of going green. The two-tiered profits tax system, introduced in 2018/19 and continuing through 2024-25, provides corporations with a preferential rate of 8.25% on the first HK$2 million of assessable profits, with the remainder taxed at 16.5%. For unincorporated businesses, the rates are 7.5% and 15% respectively. By reducing taxable income through green investments, SMEs can maximize their use of these lower tax brackets.

Key Tax Incentives for Sustainable Business Practices

Hong Kong’s tax framework includes several mechanisms specifically designed to encourage environmental investments. While there isn’t a single “green tax credit” program, multiple provisions work together to make sustainability financially attractive.

| Incentive Category | How It Works | Typical Applications |

|---|---|---|

| Accelerated Depreciation | Faster write-off of capital assets reduces taxable income sooner | Electric vehicles, solar panels, energy-efficient machinery |

| Capital Allowances | Deductions for plant and machinery used in business operations | Pollution control equipment, water recycling systems |

| R&D Deductions | Enhanced deductions for qualifying research activities | Sustainable materials development, clean process innovation |

| Operational Expense Deductions | Standard business expense deductions apply to green initiatives | Energy audits, certification fees, environmental consultancy |

Understanding Accelerated Depreciation

Accelerated depreciation is one of the most powerful tools for green investments. While Hong Kong doesn’t have specific “green depreciation” rates, many environmental assets qualify for capital allowances that provide faster tax relief than standard depreciation. For example:

- Initial allowance: Up to 60% of the cost in the first year for qualifying plant and machinery

- Annual allowance: 10%, 20%, or 30% of the reducing balance each year

- Balancing allowance: Deduction for remaining value when asset is disposed

Eligibility and Documentation Requirements

Successfully claiming tax benefits for green initiatives requires careful planning and documentation. The Inland Revenue Department (IRD) expects clear evidence that investments genuinely contribute to environmental sustainability and are directly related to your business operations.

Essential Documentation Checklist

Maintain these records for at least 7 years (the standard retention period for tax records in Hong Kong):

- Project justification: Business case showing how the investment supports sustainability goals

- Technical specifications: Details of equipment, including energy efficiency ratings and environmental benefits

- Financial records: Invoices, payment receipts, and contracts showing full costs

- Certification documents: Environmental certifications, energy audit reports, or third-party verifications

- Performance data: Before-and-after measurements of energy consumption, waste reduction, or emissions

Common Certification Pathways

While not always mandatory, environmental certifications can strengthen your tax position and provide independent verification of your sustainability claims:

| Certification | Focus Area | Typical Cost |

|---|---|---|

| BEAM Plus (Hong Kong) | Building environmental performance | HK$20,000 – HK$100,000+ |

| ISO 14001 | Environmental management systems | HK$15,000 – HK$50,000 |

| Carbon Footprint Certification | Emissions measurement and reduction | HK$10,000 – HK$30,000 |

| Energy Efficiency Labeling | Equipment energy performance | HK$5,000 – HK$20,000 |

Real-World Case Studies: Green Success Stories

These examples demonstrate how Hong Kong SMEs have successfully integrated sustainability with financial benefits:

Case Study 1: Manufacturing Energy Retrofit

A Kowloon-based manufacturer invested HK$500,000 in LED lighting, HVAC upgrades, and building insulation. The project resulted in:

- 35% reduction in electricity consumption (HK$180,000 annual savings)

- Capital allowances claimed over 4 years instead of standard 8-10 years

- Payback period: 2.8 years including tax benefits

- Enhanced BEAM Plus certification opened new government contract opportunities

Case Study 2: Logistics Fleet Electrification

Investment: HK$2.4 million for 6 electric delivery vehicles

Tax Benefits: Accelerated depreciation reduced taxable income by HK$1.44 million in first 3 years

Operational Savings: 60% lower fuel costs, 40% lower maintenance costs

Additional Benefit: Qualifies for government EV charging infrastructure subsidies

Strategic Application Process: A Step-by-Step Guide

Follow this systematic approach to maximize your chances of successful green tax claims:

- Pre-Investment Planning: Consult with tax professionals before making green investments to ensure optimal structuring

- Documentation System: Establish a centralized system for tracking all green project documents from day one

- Performance Measurement: Implement baseline measurements before upgrades and track improvements consistently

- Tax Return Preparation: Work with your accountant to properly categorize green investments in your annual tax return

- Ongoing Compliance: Maintain records and continue monitoring performance for potential audits

Future Trends: What’s Next for Green Taxation in Hong Kong

The landscape of sustainable taxation continues to evolve. Here are key developments to watch:

1. Carbon Pricing Mechanisms

While Hong Kong hasn’t implemented a carbon tax, the government is studying carbon pricing options. Early adopters of emission reduction strategies will be better positioned when such mechanisms are introduced.

2. Enhanced Green Finance Incentives

The 2024-25 Budget emphasizes green finance development. Expect more incentives for green bonds, sustainable loans, and environmental, social, and governance (ESG) investments.

3. Digital Sustainability Reporting

Automated environmental accounting tools are becoming more accessible. These can streamline data collection for tax purposes and provide better insights into sustainability performance.

✅ Key Takeaways

- Hong Kong’s two-tier profits tax system (8.25%/16.5% for corporations) creates opportunities to reduce tax liability through green investments

- Accelerated depreciation and capital allowances provide significant cash flow advantages for qualifying environmental assets

- Proper documentation and certification are essential for successful green tax claims and compliance

- The 2024-25 Budget demonstrates strong government commitment to green initiatives with HK$1.3 billion allocated

- Early adoption of sustainable practices positions SMEs for future regulatory changes and market opportunities

Navigating Hong Kong’s green tax landscape requires strategic planning but offers substantial rewards. By aligning environmental responsibility with smart tax planning, SMEs can achieve both sustainability goals and financial benefits. Start by assessing your current environmental impact, identifying priority areas for improvement, and consulting with tax professionals to develop a comprehensive green investment strategy. Remember: going green isn’t just good for the planet—it’s good for business.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- 2024-25 Budget – Green Future – Government green initiatives and funding

- IRD Two-tiered Profits Tax FAQ – Detailed guidance on tax rates

- Hong Kong Green Building Council – BEAM Plus certification and green building standards

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.