When to Elect Separate vs. Consolidated Taxation for Hong Kong Group Companies

📋 Key Facts at a Glance

- Hong Kong’s Default System: Each company is taxed separately under the territorial principle – only Hong Kong-sourced profits are taxable

- Two-Tiered Profits Tax (2024-25): Corporations pay 8.25% on first HK$2 million, 16.5% on remainder; unincorporated businesses pay 7.5% on first HK$2 million, 15% on remainder

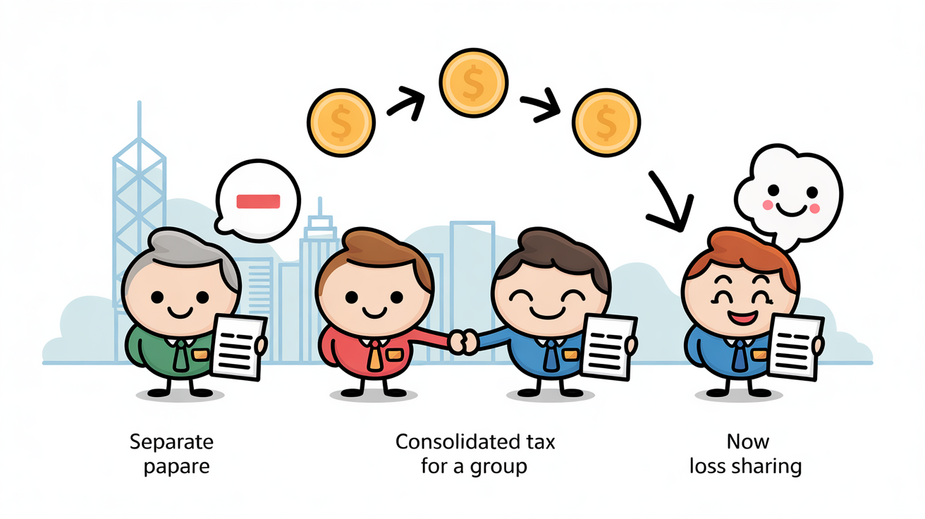

- No Group Loss Relief: Hong Kong generally does NOT allow loss offset between separate legal entities, even within the same corporate group

Imagine your Hong Kong manufacturing group has one subsidiary making HK$3 million in profits while another is losing HK$1 million. Under Hong Kong’s tax system, the profitable company pays tax on its full HK$3 million, while the loss-making entity can only carry forward its losses for its own future use. This is the reality of Hong Kong’s separate entity taxation principle – a system that can significantly impact your group’s overall tax burden. But is there a better way? Let’s explore when separate taxation makes sense and when alternative strategies might help optimize your group’s tax position.

Hong Kong’s Separate Entity Principle: The Default Tax Framework

Hong Kong operates under a territorial tax system, meaning only profits sourced within Hong Kong are subject to profits tax. The Inland Revenue Department (IRD) applies this principle to each company individually, treating every entity as a separate legal and tax entity. Unlike jurisdictions with automatic group consolidation, Hong Kong requires each company to file its own profits tax return and compute its tax liability independently based on its audited financial statements.

The Two-Tiered Profits Tax System (2024-2025)

Hong Kong’s two-tiered profits tax system, introduced in 2018/19, offers reduced rates on the first HK$2 million of assessable profits. For the 2024-25 tax year:

| Entity Type | First HK$2 Million | Remaining Profits | Key Restriction |

|---|---|---|---|

| Corporations | 8.25% | 16.5% | Only ONE entity per connected group can claim lower tier |

| Unincorporated Businesses | 7.5% | 15% | Same restriction applies |

The Critical Limitation: No Intercompany Loss Offset

The most significant implication of separate taxation is the inability to offset losses between group companies. A loss-making entity can only carry forward its losses indefinitely to offset its own future profits (subject to continuity of business tests). This limitation can lead to higher overall group tax liability compared to systems allowing loss consolidation.

| Company | Profit/(Loss) | Taxable Profit | Tax Liability (16.5%) |

|---|---|---|---|

| Company A | HK$1,500,000 | HK$1,500,000 | HK$247,500 |

| Company B | (HK$700,000) | HK$0 | HK$0 |

| Group Total (Net) | HK$800,000 | HK$1,500,000 | HK$247,500 |

Despite the group’s net profit being only HK$800,000, tax is levied on HK$1,500,000 because Company B’s loss cannot reduce Company A’s taxable profit under separate taxation.

Alternative Strategies: When Separate Taxation Isn’t Optimal

While Hong Kong doesn’t offer formal consolidated tax filing, several strategies can help optimize your group’s tax position when separate taxation creates inefficiencies:

1. Strategic Business Restructuring

Consider restructuring your operations to consolidate activities within fewer entities. This approach can help maximize the two-tiered tax rate benefit and simplify compliance. However, restructuring must have genuine commercial substance and comply with transfer pricing rules.

2. Transfer Pricing Optimization

Properly structured intercompany transactions can help allocate profits and losses more efficiently. By ensuring transactions are conducted at arm’s length, you can manage profit distribution while maintaining compliance with Hong Kong’s transfer pricing rules.

3. Utilizing Loss Carry-Forward Strategically

While losses can’t be transferred between entities, you can strategically plan business activities to ensure loss-making entities generate future profits that can be offset by their accumulated losses.

Comparative Analysis: Separate vs. Potential Alternatives

| Feature | Separate Taxation (Hong Kong Default) | Consolidated Systems (Other Jurisdictions) |

|---|---|---|

| Loss Utilization | Limited to individual entity’s own future profits (carry forward only) | Can offset eligible group profits in same year |

| Tax Efficiency | Lower for mixed profit/loss groups | Higher through immediate loss offset |

| Compliance Focus | Individual entity filings and separate accounting | Intercompany transactions, loss transfers, group reporting |

| Administrative Effort | Volume of individual filings | Complexity of group-level computations |

| Ownership Requirements | None for separate filing | Typically 75%+ ownership for consolidation |

Real-World Scenarios: When to Consider Alternatives

| Group Type | Typical Challenge | Recommended Strategy |

|---|---|---|

| Manufacturing Group | Uneven profit distribution (some profitable, some loss-making) | Consider restructuring or transfer pricing optimization |

| Service Conglomerate | Accumulated losses in some entities cannot offset group profits | Strategic business planning to utilize losses within same entity |

| Multinational Group | Complex intercompany transactions and transfer pricing | Robust TP documentation and strategic profit allocation |

| Startup Group | Multiple entities with initial losses | Minimize entity count initially; consolidate activities |

Compliance Essentials for Hong Kong Group Companies

Regardless of your group structure, maintaining robust compliance is essential. Here are key requirements:

- Separate Tax Returns: Each company must file its own Profits Tax Return (BIR51) annually, typically due within 1 month of issue (around early June)

- Transfer Pricing Documentation: Maintain contemporaneous documentation for all intercompany transactions to demonstrate arm’s length pricing

- Record Retention: Keep business records for at least 7 years after the relevant transactions

- Provisional Tax Management: Monitor and manage provisional tax assessments, which can be held over if lower profits are anticipated

- Two-Tiered Rate Election: Ensure only one entity per connected group claims the reduced rate on first HK$2 million

Strategic Planning for Future Tax Optimization

Effective tax planning requires looking beyond current structures. Consider these forward-looking strategies:

- Business Expansion Planning: Model tax implications of new ventures or acquisitions before implementation

- Restructuring Considerations: Evaluate whether mergers or reorganizations could improve tax efficiency

- Cash Flow Management: Use provisional tax holdover applications strategically when anticipating lower profits

- International Considerations: Factor in Hong Kong’s 45+ Double Taxation Agreements when planning cross-border operations

- New Regime Awareness: Stay informed about developments like the Global Minimum Tax (effective January 2025) that may affect multinational groups

✅ Key Takeaways

- Hong Kong taxes each company separately – no formal group consolidation or loss offset between entities

- The two-tiered profits tax system (8.25%/16.5% for corporations) offers savings, but only one entity per connected group can claim the reduced rate

- Strategic restructuring, transfer pricing optimization, and careful entity planning can help mitigate the limitations of separate taxation

- Robust compliance, including separate filings and transfer pricing documentation, is essential for all group companies

- Forward-looking tax planning should consider business expansion, restructuring, and international tax developments

Hong Kong’s separate entity taxation principle presents both challenges and opportunities for corporate groups. While the inability to offset losses across entities can increase overall tax burden, strategic planning around entity structure, transfer pricing, and the two-tiered tax system can yield significant savings. The key is understanding your group’s specific financial dynamics and implementing a tax strategy that aligns with both current operations and future growth plans. Remember, what works for a manufacturing group with uneven profits may not suit a service conglomerate with accumulated losses – each situation requires tailored analysis and planning.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Profits Tax Guide – Detailed information on profits tax rules and rates

- IRD Two-Tiered Tax Rates FAQ – Official guidance on the two-tiered profits tax system

- IRD Territorial Source Principle – Explanation of Hong Kong’s territorial tax system

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.