香港と英国の租税条約:事業拡大のための主要規定

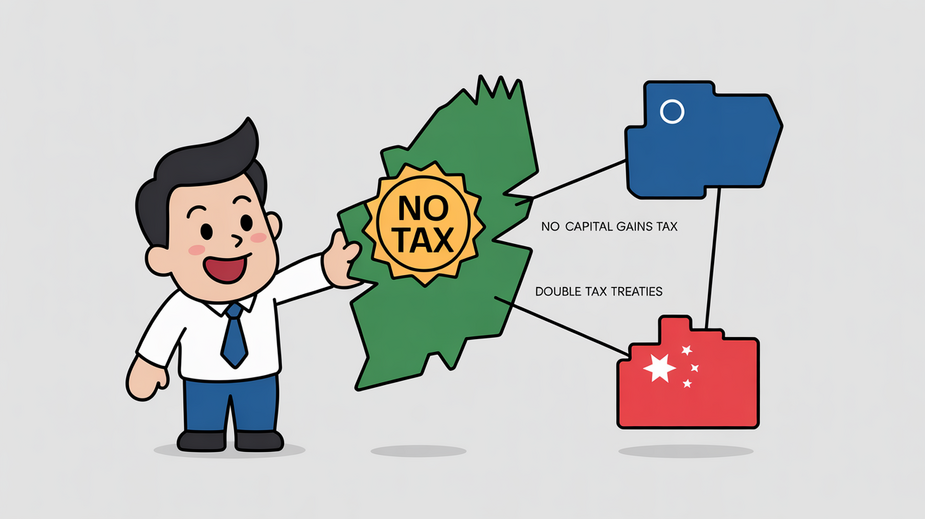

📋 ポイント早見 源泉徴収税の大幅軽減: 香港と英国間の利子・ロイヤルティ支払いは、協定により源泉徴収税0%が適用されます。 配当金の優遇措置: 議決権10%以上の法人株主への配当は源泉徴収税0%、その他は最大15%に制限されます。 包括的な所得カバー: 事業所得、配当、利子、ロイヤルティ、キャピタルゲイン、給与所得、年金などが対象です。 二重課税の排除: 所得は原則として一つの管轄区域でのみ課税され、居住地国で外国税額控除が受けられます。 紛争解決メカニズム: 相互協議手続き(MAP)と拘束力のある仲裁が利用可能です。 香港と英国の間で事業を拡大することをお考えですか?越境取引に伴う税務は複雑になりがちですが、香港と英国の二重課税防止協定(DTA)は、二重課税を排除し、源泉徴収税を軽減する明確な枠組みを提供します。香港が締結する45以上の包括的租税協定の一つであるこの協定は、二大金融ハブをまたぐ事業活動に大きな利点をもたらします。本記事では、この協定がどのように越境事業と戦略的計画に役立つかを探ります。 香港・英国租税条約が事業に重要な理由 香港・英国二重課税防止協定は、両地域間で事業を拡大する企業にとって強力なツールとなります。その主な目的は、二重課税の排除、租税回避の防止、そして越境投資家に対する確実性の提供です。協定は、事業所得、配当、利子、ロイヤルティ、キャピタルゲイン、給与所得、年金など、主要な所得タイプをすべてカバーしています。この包括的なカバレッジにより、所得は原則として一つの管轄区域でのみ課税され、居住地国が源泉地国で支払った税金に対する税額控除を提供します。 業界セクター 主な条約上のメリット 金融サービス 利子支払いの源泉徴収税0%;明確なキャピタルゲイン課税ルール;コンプライアンスコストの削減 専門サービス 明確な恒久的施設(PE)ルール;役務提供収入の課税確実性 テクノロジー&知的財産 ロイヤルティ支払いの源泉徴収税0%;知的財産移転の保護 貿易・製造業 事業所得配分の明確化;サプライチェーン税務の最適化 源泉徴収税の軽減:越境取引における優位性