香港における納税居住者のルール:外国人居住者としてのステータスをどのように判断するか

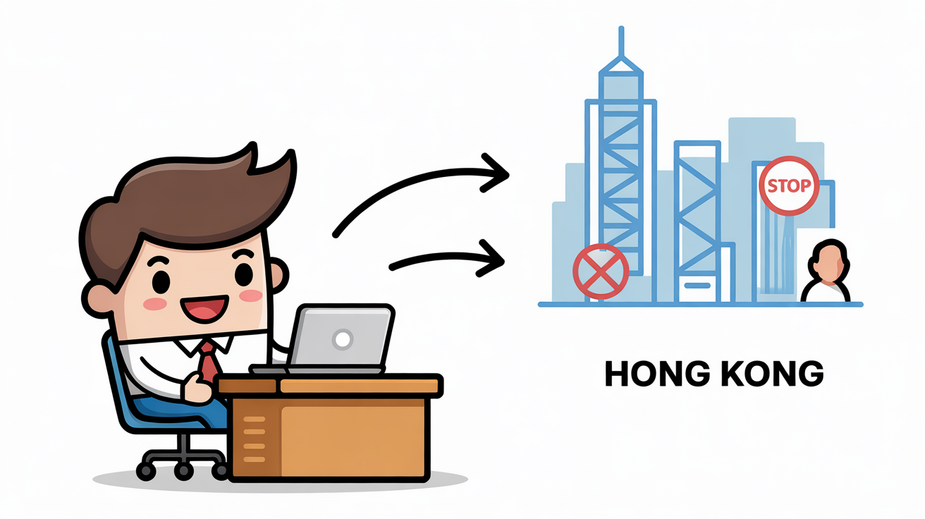

📋 ポイント早見 ポイント1: 1課税年度(4月1日~3月31日)に180日以上滞在すると、税務上の居住者とみなされる強力な指標となります。 ポイント2: 香港は源泉地主義を採用しており、香港源泉の所得のみが課税対象です。居住地に関わらず、この原則は全ての人に適用されます。 ポイント3: 税務上の居住者は、基礎控除(132,000香港ドル)や累進税率(2%~17%)などの控除・優遇措置を利用できます。 ポイント4: 滞在日数が60日未満の場合、香港以外で提供した役務に基づく雇用所得は免税となる可能性があります(60日ルール)。 ポイント5: 香港は45以上の国・地域と包括的租税協定を締結しており、二重課税の回避に役立ちます。 香港で働く駐在員の方々の中には、「自分は香港の税務上の居住者とみなされるのだろうか?」と疑問に思う方も多いでしょう。香港のユニークな源泉地主義税制と、定量的な滞在日数テストと定性的な生活実態評価を組み合わせた居住者判定ルールは、迷路のように感じられるかもしれません。短期の赴任であれ、長期的な移住を計画中であれ、香港税務局(IRD)がどのように税務上の居住者を判定するかを理解することは、税務申告を正確に行い、財務状況を最適化するために不可欠です。 香港の源泉地主義税制:基本原則 居住者ルールを掘り下げる前に、香港の基本的な税制原則である「源泉地主義」を理解することが重要です。全世界所得課税を採用する多くの国とは異なり、香港は香港で源泉を有する、または香港から生じた所得のみを課税の対象とします。この原則は、居住者・非居住者を問わず、全ての人に適用されます。あなたの居住者ステータスは、何が課税対象となるかを変えるものではありませんが、どのように税額が計算され、どのような控除・優遇措置を利用できるかに大きな影響を与えます。 ⚠️ 重要な注意: 香港では、キャピタルゲイン税、配当金(源泉徴収なし)、利息(ほとんどの場合)、相続税、消費税/付加価値税/物品サービス税は課税されません。このため、投資所得については源泉地主義の原則が特に重要となります。 定量的テスト:滞在日数ルール 香港税務局(IRD)は、あなたと香港との結びつきを評価するために、具体的な定量的基準を用います。これらの客観的なテストは、税務上の居住者を判定するための明確な基準を提供します。 滞在日数基準 居住者判定への影響 主な考慮点 単一課税年度で180日以上 その年度の税務上の居住者である強力な指標 課税年度は4月1日から3月31日まで