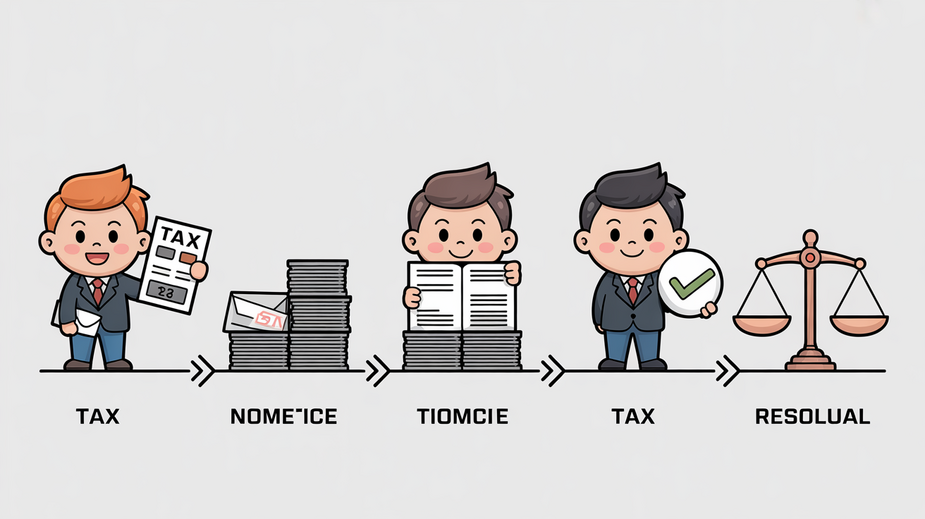

税務調査のタイムライン:開始から解決までの流れ

📋 ポイント早見 調査期間: 標準的な遡及課税期間は6年ですが、詐欺や故意の脱税の場合は10年に延長されます。 調査の所要期間: 実地調査は、複雑さや納税者の協力度によって数ヶ月から1〜3年続くことがあります。 記録保存義務: 事業記録は、内国歳入条例第51C条に基づき最低7年間保存する必要があります。 ペナルティの枠組み: 過失による誤りの場合は未納税額の10〜25%、詐欺の場合は最大300%のペナルティが科され、刑事訴追の可能性もあります。 自主申告のメリット: 調査開始前の完全な自主申告は、ペナルティを決定する際の有利な要素として扱われます。 香港税務局(IRD)による税務調査の対象となった場合、何が起こるのでしょうか。中小企業の経営者、企業の役員、個人の納税者を問わず、税務調査に直面することは最もストレスの多い業務経験の一つとなり得ます。調査のタイムライン、段階、そして開始から解決までに何が予想されるかを理解することは、不安を準備に変える力となります。この包括的なガイドでは、香港の税務調査プロセス全体を解説し、この困難な道のりを自信と戦略的洞察を持って進むための手助けをします。 税務調査はどのように始まるのか:選定プロセス 税務局は、調査対象を特定するために高度な方法を採用しており、これを理解することでご自身のリスクプロファイルを評価する助けとなります。一般的な認識とは異なり、すべての調査が明らかな危険信号から始まるわけではありません。納税者全体のコンプライアンスを維持するために、純粋に無作為に選定されるケースもあります。 4つの主要な選定方法 コンピューター支援リスク分析: 税務局は「Assess First Audit Later(先に査定、後に監査)」システムやリスクベースのアルゴリズムを使用し、業界のベンチマーク、収入パターン、コンプライアンス履歴に基づいて高リスク納税者を特定します。 専門家の判断: 経験豊富な税務職員が、業界知識、新たなトレンド、専門的知見に基づいて案件を審査します。 無作為選定: すべてのセクターにわたる包括的なコンプライアンス監視を確保するため、毎年一定割合の納税者が無作為に選ばれます。 発覚した不備: