Tax Deductions for Hong Kong Residents: What You Can and Can’t Claim

📋 Key Facts at a Glance

- MPF Deduction Limit: HK$18,000 maximum per year for mandatory contributions

- Home Loan Interest: Up to HK$100,000 annually for owner-occupied properties

- Charitable Donations: Maximum 35% of assessable income to approved organizations

- Personal Allowances: Basic HK$132,000, married HK$264,000, child HK$130,000 each

- Record Keeping: Must retain tax documents for 7 years for potential IRD review

Did you know that the average Hong Kong taxpayer could be missing out on thousands of dollars in legitimate tax savings each year? With Hong Kong’s progressive tax system offering numerous deductions and allowances, understanding what you can and cannot claim is the key to minimizing your tax burden. Whether you’re an employee, self-employed professional, or business owner, this comprehensive guide will walk you through the essential tax deductions available for the 2024-2025 tax year, helping you maximize your savings while staying fully compliant with IRD regulations.

Essential Mandatory Contributions That Reduce Your Taxable Income

Hong Kong’s tax system recognizes that certain mandatory contributions are necessary expenses that should reduce your taxable income. The most significant of these is the Mandatory Provident Fund (MPF), which both employees and self-employed individuals must contribute to. For the 2024-2025 tax year, you can deduct up to HK$18,000 annually for your mandatory MPF contributions.

In addition to MPF, contributions to other recognized occupational retirement schemes may also be tax-deductible, subject to specific scheme rules and IRD approval. These schemes must be formally recognized under relevant legislation, and deductions are typically limited to contributions required by the scheme’s terms.

| Contribution Type | Annual Deduction Limit (2024-2025) | Key Requirements |

|---|---|---|

| Mandatory MPF Contributions | HK$18,000 maximum | Mandatory portion only, not voluntary |

| Recognized Retirement Schemes | Scheme-specific limits | Must be IRD-approved under relevant legislation |

| Qualifying Annuity/Voluntary MPF | HK$60,000 maximum | For qualifying deferred annuity policies or voluntary MPF |

Documentation Requirements for Contribution Claims

To successfully claim deductions for mandatory contributions, you must maintain proper documentation. For MPF claims, you’ll need annual contribution statements from your MPF trustee. These statements clearly detail your contributions throughout the year. For employees, pay slips showing MPF deductions can also serve as supporting evidence, though the annual trustee statement is the most authoritative document.

Commonly Overlooked Deductions That Can Save You Thousands

Many Hong Kong residents miss out on significant tax savings by overlooking legitimate deductions. Here are the most valuable ones you should be claiming:

Home Loan Interest Deduction

If you own property in Hong Kong that serves as your primary residence and have a mortgage, you can deduct the interest paid on that mortgage. For the 2024-2025 tax year, the maximum deduction is HK$100,000 annually. This deduction can be claimed for up to 20 years of ownership.

Self-Education Expenses

Costs incurred for courses, workshops, or qualifying examinations directly relevant to your current employment or profession may be tax-deductible. The key criterion is that the education must be undertaken to maintain or improve the knowledge or skills specifically required for your existing job. The maximum deduction is HK$100,000 per year.

Charitable Donations

Donations to approved charitable organizations can provide significant tax relief. For the 2024-2025 tax year, you can deduct donations up to 35% of your assessable income. The organization must be recognized as tax-exempt under Section 88 of the Inland Revenue Ordinance.

| Deduction Type | Maximum Amount (2024-2025) | Key Conditions |

|---|---|---|

| Home Loan Interest | HK$100,000 per year | Owner-occupied property only, up to 20 years |

| Self-Education Expenses | HK$100,000 per year | Must relate to current employment |

| Charitable Donations | 35% of assessable income | To Section 88 approved organizations only |

| Domestic Rent | HK$100,000 per year | For rented primary residence in Hong Kong |

Business-Related Expense Claims for Self-Employed Professionals

For individuals operating a business or earning income from a profession in Hong Kong, understanding business-related expenses is crucial. The fundamental principle is that expenses must be incurred “wholly and exclusively” for producing assessable profits. This strict test means the expense should be solely for generating income, with no personal benefit involved.

- Office expenses: Rent for business premises, utilities, office supplies

- Employee costs: Salaries, MPF contributions for employees

- Professional fees: Legal, accounting, and professional subscription fees

- Business travel: Flights, accommodation for business trips (must be solely for business)

- Marketing costs: Advertising, website development, promotional materials

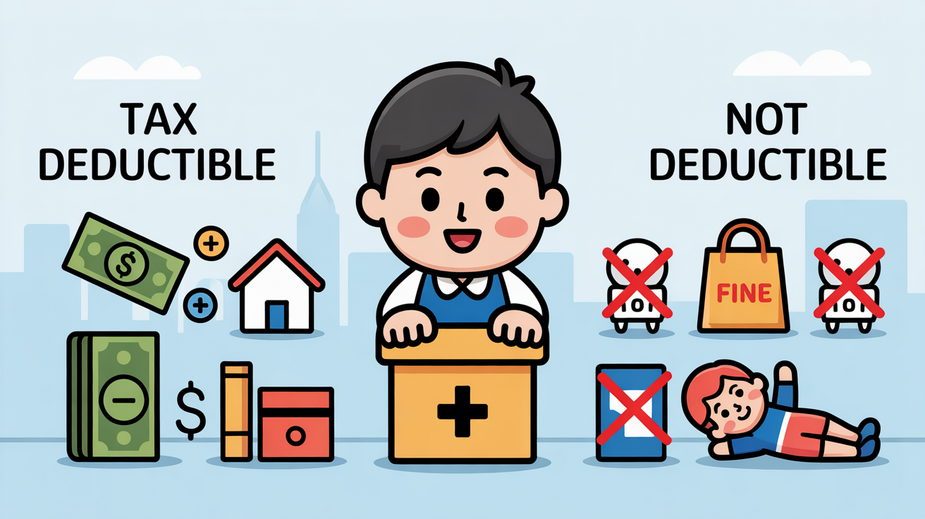

What You Absolutely Cannot Claim: Prohibited Deductions

Understanding what you cannot claim is just as important as knowing what you can. The IRD strictly prohibits deductions for certain types of expenses:

Personal and Family Living Expenses

These are considered part of private life and maintaining your household, distinct from income-generating activities:

- Domestic helper salaries and household maintenance costs

- Personal clothing (unless specifically required uniforms)

- Ordinary meals not related to business activities

- Personal entertainment and leisure expenses

- Elderly residential care fees (though dependent parent allowances exist)

Fines, Penalties, and Political Donations

The tax law expressly prohibits deductions for:

- Fines and penalties: Traffic fines, late tax filing penalties, regulatory fines

- Political donations: Contributions to political parties or causes

- Speculative losses: Gambling losses or speculative investment losses

- Capital expenses: Costs of acquiring capital assets (though depreciation may apply)

Personal Allowances: Your Automatic Tax Reductions

In addition to deductions, Hong Kong offers generous personal allowances that automatically reduce your taxable income. These are particularly valuable as they don’t require actual expenditure – they’re simply subtracted from your income before tax calculation.

| Allowance Type | Amount (2024-2025) | Conditions |

|---|---|---|

| Basic Allowance | HK$132,000 | Available to all taxpayers |

| Married Person’s Allowance | HK$264,000 | For married couples (can be split) |

| Child Allowance (each) | HK$130,000 | Per child, additional HK$130,000 in year of birth |

| Dependent Parent/Grandparent (60+) | HK$50,000 | For each dependent aged 60+ |

| Single Parent Allowance | HK$132,000 | In addition to basic allowance |

Documentation and Record-Keeping: Your Tax Audit Defense

Proper documentation is your best defense in case of an IRD review or audit. While you don’t submit documents with your tax return, you must retain them for potential verification.

- Retention Period: Keep all tax-related documents for 7 years from the end of the relevant tax year

- Charitable Donations: Original receipts from Section 88 approved organizations

- MPF Contributions: Annual statements from your MPF trustee

- Home Loan Interest: Annual interest statements from your lender

- Self-Education: Receipts for course fees, examination fees with clear link to current employment

- Business Expenses: Invoices, receipts, and notes detailing business purpose

Recent Changes and Updates for 2024-2025

Stay informed about recent tax changes that could affect your deductions:

- Domestic Rent Deduction: Continues with HK$100,000 maximum for rented primary residences

- Standard Rate Tax: From 2024/25, 15% on first HK$5 million, 16% on amounts exceeding HK$5 million

- Digital Filing Emphasis: IRD increasingly encourages online tax filing and document submission

- Personal Allowance Increases: Basic allowance increased to HK$132,000 for 2024-2025

✅ Key Takeaways

- Maximize your MPF deduction up to HK$18,000 for mandatory contributions only

- Claim home loan interest (HK$100,000 max) and domestic rent (HK$100,000 max) if applicable

- Utilize personal allowances – basic HK$132,000, plus additional allowances for dependents

- Keep meticulous records for 7 years – documentation is crucial for audit defense

- Understand prohibited deductions: personal expenses, fines, political donations

- Stay updated on recent changes, especially increased personal allowances for 2024-2025

Effective tax planning in Hong Kong requires a proactive approach to understanding and claiming all legitimate deductions and allowances. By systematically reviewing your eligible claims each year, maintaining proper documentation, and staying informed about tax law changes, you can significantly reduce your tax liability while remaining fully compliant. Remember that while this guide provides comprehensive information, complex situations may require professional tax advice tailored to your specific circumstances.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Allowances Guide – Personal allowances and deductions

- GovHK Home Loan Interest Deduction – Specific guidance on mortgage interest claims

- IRD Deductions and Allowances – Comprehensive deduction information

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.