Understanding Hong Kong’s Stamp Duty: Special Considerations for Non-Resident Buyers

📋 Key Facts at a Glance

- Major Policy Change: Buyer’s Stamp Duty (BSD), Special Stamp Duty (SSD), and New Residential Stamp Duty (NRSD) were abolished on February 28, 2024

- Current System: Non-resident buyers now pay the same Ad Valorem Stamp Duty rates as Hong Kong permanent residents

- Payment Deadline: Stamp duty must be paid within 30 days from the date of the Sale and Purchase Agreement

- Electronic Option: The IRD’s e-Stamping system allows overseas buyers to complete compliance online

Thinking about investing in Hong Kong property from overseas? The landscape has changed dramatically in 2024. With the abolition of special stamp duties for non-residents, international buyers now face a much simpler and more favorable tax environment. This guide walks you through exactly what you need to know about Hong Kong’s current stamp duty framework, compliance requirements, and how to navigate the process smoothly from anywhere in the world.

Hong Kong’s Stamp Duty Framework: What Changed in 2024

Hong Kong’s stamp duty system underwent a significant transformation on February 28, 2024, when the government abolished three major property cooling measures. This change represents a major shift in policy that directly benefits non-resident buyers. The Stamp Duty Ordinance (Cap. 117) remains the legal foundation, but the application has been simplified considerably.

The current system now applies uniformly to all buyers, regardless of residency status. The territorial scope remains unchanged: the Stamp Duty Ordinance applies to instruments executed in Hong Kong, or instruments executed outside Hong Kong which relate to immovable property situated within Hong Kong or any stock of a company incorporated in Hong Kong.

Current Stamp Duty Structure for Property Transactions

Today, all property buyers in Hong Kong pay Ad Valorem Stamp Duty (AVD) based on the property value. The rates are progressive, meaning higher-value properties attract higher percentage rates. Here are the current rates effective from February 2024:

| Property Value | Ad Valorem Stamp Duty Rate |

|---|---|

| Up to HK$3,000,000 | HK$100 |

| HK$3,000,001 – 3,528,240 | HK$100 + 10% of excess |

| HK$3,528,241 – 4,500,000 | 1.5% |

| HK$4,500,001 – 4,935,480 | 1.5% to 2.25% |

| HK$4,935,481 – 6,000,000 | 2.25% |

| HK$6,000,001 – 6,642,860 | 2.25% to 3% |

| HK$6,642,861 – 9,000,000 | 3% |

| HK$9,000,001 – 10,080,000 | 3% to 3.75% |

| HK$10,080,001 – 20,000,000 | 3.75% |

| HK$20,000,001 – 21,739,120 | 3.75% to 4.25% |

| Above HK$21,739,120 | 4.25% |

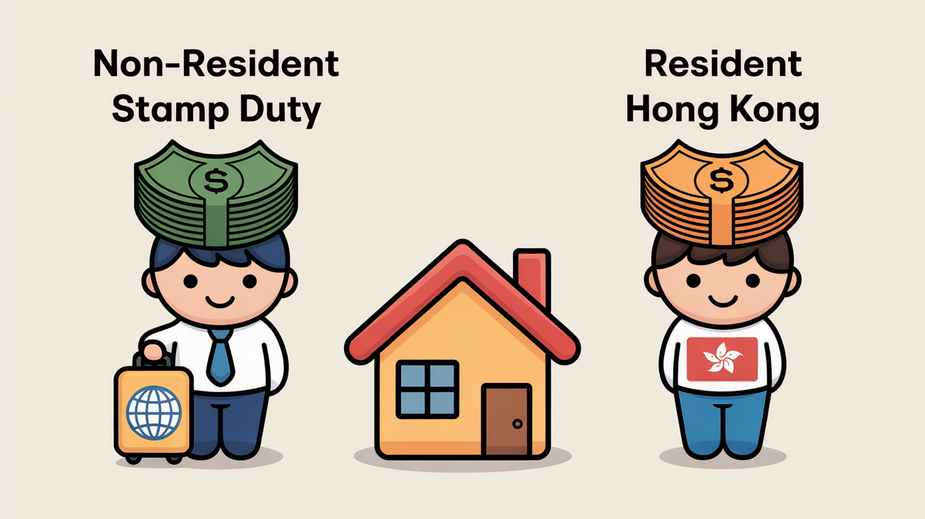

Non-Resident vs. Resident: Equal Treatment Under Current Rules

One of the most significant changes for overseas buyers is the elimination of differential treatment based on residency status. Under the previous system, non-resident buyers faced substantial additional costs through the Buyer’s Stamp Duty. Today, the playing field has been leveled.

| Buyer Type | Stamp Duty Applicable | Key Considerations |

|---|---|---|

| Non-Resident Individual | Ad Valorem Stamp Duty only | Same rates as residents; no additional surcharges |

| Overseas Company | Ad Valorem Stamp Duty only | No corporate surcharge; same treatment as individuals |

| Hong Kong Permanent Resident | Ad Valorem Stamp Duty only | Same rates apply to all buyers |

| Joint Purchase (Mixed Residency) | Ad Valorem Stamp Duty only | No complex calculations; simple AVD applies |

Practical Example: Cost Comparison

Let’s consider a HK$10 million property purchase:

- Before February 28, 2024: Non-resident would pay 3.75% AVD (HK$375,000) + 15% BSD (HK$1,500,000) = Total HK$1,875,000

- After February 28, 2024: Non-resident pays only 3.75% AVD = HK$375,000

- Savings: HK$1,500,000 (80% reduction in stamp duty cost)

Stamp Duty Exemptions and Special Scenarios

While the main stamp duty rules apply uniformly, certain transactions may qualify for exemptions or special treatment. Understanding these scenarios can help non-resident buyers plan their investments more effectively.

Common Exemption Scenarios

- Intra-Group Transfers: Property transfers between companies within the same corporate group may qualify for stamp duty relief if specific ownership and control criteria are met

- Divorce Settlements: Property transfers between spouses as part of divorce proceedings are generally exempt from stamp duty

- Charitable Institutions: Recognized charities acquiring property for charitable purposes may be exempt

- Government Transactions: Certain transactions involving government entities may be exempt

Compliance Process for Overseas Buyers: Step-by-Step Guide

Navigating Hong Kong’s stamp duty compliance from overseas requires careful planning. Here’s your step-by-step guide to ensure smooth processing:

- Step 1: Document Preparation

Gather certified copies of your passport, the executed Sale and Purchase Agreement, and any Power of Attorney if using a local representative. Ensure all documents are clear and complete. - Step 2: Calculate Stamp Duty

Use the current AVD rates table above to calculate your stamp duty liability based on the property value or consideration amount, whichever is higher. - Step 3: Choose Submission Method

Decide whether to use the IRD’s electronic e-Stamping system or submit physical documents. For overseas buyers, e-Stamping is highly recommended. - Step 4: Submit and Pay

Submit your stamping application and pay the calculated duty within 30 days from the date of the Sale and Purchase Agreement. - Step 5: Receive Certificate

Once payment is processed, you’ll receive an electronic or physical Stamp Certificate as proof of compliance.

Using the e-Stamping System

The IRD’s e-Stamping system is particularly valuable for overseas buyers. Here’s what you need to know:

- Online Submission: Upload scanned copies of required documents through the IRD website

- Electronic Payment: Pay stamp duty using credit cards or bank transfers

- Digital Certificate: Receive an electronic Stamp Certificate immediately upon payment

- 24/7 Access: System available anytime, eliminating time zone challenges

- Document Security: Encrypted transmission ensures document safety

Additional Considerations for Non-Resident Buyers

Beyond stamp duty, non-resident buyers should consider these additional factors:

Legal Representation

While not legally required, engaging a Hong Kong solicitor is highly recommended for:

- Conducting due diligence on the property

- Reviewing and negotiating the Sale and Purchase Agreement

- Handling stamp duty compliance

- Managing completion and registration processes

- Addressing any legal issues that may arise

Financing Considerations

Non-resident buyers should be aware that:

- Hong Kong banks may have different lending criteria for non-residents

- Loan-to-value ratios may be lower for overseas buyers

- Documentation requirements may be more extensive

- Interest rates may differ from those offered to local residents

Ongoing Property Tax Obligations

After purchase, non-resident property owners are subject to:

- Property Tax: 15% on net assessable value [(Rental income – Rates paid) × 80% × 15%]

- Rates: Government charges based on property’s rateable value

- Management Fees: Monthly charges for building maintenance

- Government Rent: Small annual charge for land lease

✅ Key Takeaways

- Non-resident buyers now enjoy equal stamp duty treatment with Hong Kong residents since the abolition of BSD, SSD, and NRSD on February 28, 2024

- All property buyers pay Ad Valorem Stamp Duty based on progressive rates from HK$100 to 4.25% depending on property value

- The 30-day payment deadline is critical – late payments attract severe penalties of 2x to 10x the unpaid duty

- The IRD’s e-Stamping system provides a convenient online solution for overseas buyers to complete compliance remotely

- While stamp duty is simplified, non-residents should still engage local legal and tax professionals for property transactions

Hong Kong’s 2024 stamp duty reforms have created a more welcoming environment for international property investors. With the removal of discriminatory surcharges, non-resident buyers can now participate in the market on equal footing with local residents. However, successful investment still requires careful planning, professional guidance, and strict adherence to compliance timelines. By understanding the current rules and leveraging available electronic systems, overseas buyers can navigate Hong Kong’s property market with confidence and efficiency.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Stamp Duty Guide – Official stamp duty information and rates

- IRD BSD FAQ – Information on abolished Buyer’s Stamp Duty

- GovHK Stamp Duty Rates – Current ad valorem duty rates

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.