Using Hong Kong Companies in Estate Planning: Benefits and Compliance Requirements

📋 Key Facts at a Glance

- Tax-Free Succession: Hong Kong abolished estate duty in 2006 – no inheritance tax on assets held through HK companies

- Territorial Taxation: Only Hong Kong-sourced profits are taxed at 8.25% (first HK$2M) and 16.5% (remainder)

- Global Network: Hong Kong has comprehensive double taxation agreements with 45+ jurisdictions for cross-border planning

- No Capital Gains Tax: Profits from asset disposals are generally tax-free if structured correctly

- Privacy & Control: Corporate structures allow separation of ownership and control with enhanced privacy

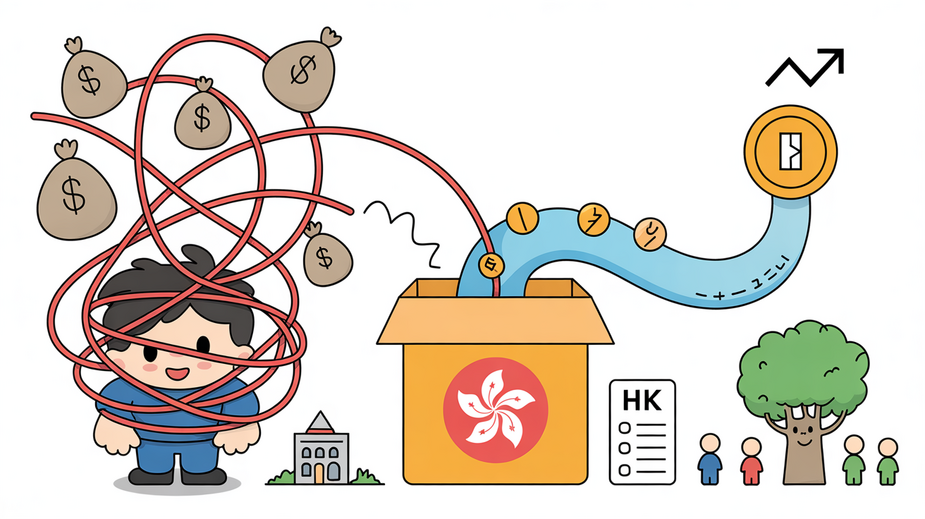

Imagine passing on your global wealth to the next generation without triggering multiple inheritance taxes, lengthy probate processes, or public disclosure of your family’s financial affairs. For high-net-worth families with assets spanning continents, this isn’t just a dream – it’s a strategic reality made possible through Hong Kong’s sophisticated corporate structures. As Asia’s premier financial hub, Hong Kong offers a unique combination of tax efficiency, legal certainty, and global connectivity that makes it an ideal jurisdiction for multi-generational wealth preservation and succession planning.

Why Hong Kong Companies Excel in Estate Planning

Hong Kong’s appeal for estate planning isn’t accidental – it’s built on a foundation of deliberate policy choices and strategic advantages. The territory’s tax-neutral environment is particularly compelling for international wealth management. Unlike many jurisdictions that tax global income, Hong Kong operates on a territorial basis, meaning only profits sourced within Hong Kong are subject to tax. This creates significant opportunities for holding international assets through corporate structures without triggering unnecessary tax liabilities.

The Tax Advantage: What Hong Kong Doesn’t Tax

Hong Kong’s tax framework is remarkably favorable for wealth preservation. The territory abolished estate duty in 2006, meaning there’s no inheritance tax on assets passing to beneficiaries. Additionally, Hong Kong doesn’t tax:

- Capital gains from asset disposals

- Dividends (no withholding tax on distributions)

- Interest income in most cases

- Sales tax, VAT, or GST on transactions

For corporate structures, Hong Kong’s two-tiered profits tax system offers additional benefits. Corporations pay just 8.25% on the first HK$2 million of assessable profits and 16.5% on the remainder. Crucially, only profits sourced from Hong Kong operations are taxable – offshore investment income and capital gains typically remain tax-free.

Overcoming Traditional Estate Planning Limitations

Traditional estate planning methods often struggle with today’s complex, globalized financial realities. Direct personal ownership of assets across multiple jurisdictions creates significant challenges during succession:

| Traditional Approach | Key Challenges | Hong Kong Corporate Solution |

|---|---|---|

| Direct personal ownership | Multiple probate processes, public disclosure, administrative complexity | Single share transfer, private succession, streamlined administration |

| Cross-border assets | Different inheritance laws, tax regimes, and legal requirements | Consolidated ownership, uniform Hong Kong law application |

| Currency exposure | Exchange rate risk during asset conversion and distribution | Holding assets in original currencies, strategic conversion timing |

| Privacy concerns | Public property registers, transparent ownership records | Corporate privacy, controlled information disclosure |

The Corporate Advantage: Separation of Control and Ownership

One of the most powerful features of using Hong Kong companies for estate planning is the ability to separate control from beneficial ownership. Directors manage the company’s assets while shareholders enjoy the economic benefits. This separation enables:

- Professional management of complex asset portfolios

- Gradual transition of control to next generations

- Continuity during incapacity without court intervention

- Strategic asset protection from personal liabilities

Essential Compliance Framework for Hong Kong Companies

While Hong Kong offers significant advantages, maintaining corporate structures requires strict adherence to local compliance requirements. These obligations ensure the company’s legal standing and protect its effectiveness as an estate planning vehicle.

- Annual Auditing & Reporting: Most Hong Kong companies must undergo annual audits by certified public accountants. Audited financial statements, along with annual returns, must be filed with the Companies Registry, while profits tax returns go to the Inland Revenue Department.

- Significant Controllers Register (SCR): Companies must maintain a register of individuals with significant control. This beneficial ownership register must be kept at the company’s Hong Kong registered office and made available to law enforcement upon request.

- Anti-Money Laundering (AML) Compliance: Directors and key personnel must undergo AML checks. Companies must implement proper due diligence procedures to verify the identity and legitimacy of beneficial owners.

- Record Retention: Business records must be maintained for at least 7 years, supporting the company’s financial position and compliance status.

Navigating Cross-Border Tax Implications

International succession planning requires careful navigation of multiple tax jurisdictions. Hong Kong’s corporate structures offer strategic advantages in this complex environment.

Double Taxation Agreements (DTAs)

Hong Kong has established comprehensive double taxation agreements with over 45 jurisdictions, including Mainland China, Singapore, the United Kingdom, Japan, and many European countries. These agreements provide:

- Reduced withholding taxes on dividends, interest, and royalties

- Clear rules for determining tax residency

- Dispute resolution mechanisms between tax authorities

- Prevention of double taxation on the same income

Territorial Taxation in Action

Hong Kong’s territorial tax principle means that profits derived from activities conducted outside Hong Kong are generally not subject to profits tax. For estate planning structures, this means:

| Asset Type | Typical Tax Treatment | Planning Consideration |

|---|---|---|

| International real estate | Rental income taxed locally; capital gains often tax-free in HK | Structure ownership to optimize local and HK tax positions |

| Global investment portfolio | Dividends/interest may have foreign withholding; HK generally exempt | Utilize DTAs to reduce foreign withholding taxes |

| Intellectual property | Royalties taxed locally; potential HK exemption if offshore | Proper documentation of IP development and licensing |

| Business operations | Local corporate taxes apply; HK tax only if sourced in HK | Clear separation of offshore and onshore activities |

Future-Proofing Your Estate Plan

Effective estate planning requires structures that can adapt to changing circumstances, family dynamics, and regulatory environments. Hong Kong corporate vehicles offer several mechanisms for building resilience into your wealth transfer strategy.

Shareholder Agreements and Articles of Association

Well-drafted shareholder agreements and tailored articles of association provide the foundation for smooth succession. These documents should address:

- Share transfer mechanisms upon death or incapacity

- Valuation methodologies for company shares

- Dispute resolution procedures among family members

- Directorship succession plans and governance rules

- Digital asset management protocols for cryptocurrencies and online assets

Adapting to Regulatory Changes

Hong Kong’s regulatory environment continues to evolve. Estate planning structures must adapt to developments including:

| Regulatory Development | Impact on Estate Planning | Adaptation Strategy |

|---|---|---|

| Foreign-Sourced Income Exemption (FSIE) Regime | Requires economic substance for certain offshore income | Ensure adequate staffing and operations in Hong Kong |

| Global Minimum Tax (Pillar Two) | 15% minimum effective tax rate for large MNEs from 2025 | Review group structure and tax positions proactively |

| Family Investment Holding Vehicle (FIHV) Regime | 0% tax rate for qualifying family offices (min HK$240M AUM) | Consider formal family office establishment |

| Enhanced transparency requirements | Increased reporting obligations for cross-border structures | Maintain comprehensive records and compliance systems |

Implementing Your Hong Kong Estate Planning Structure

Establishing an effective Hong Kong corporate structure for estate planning involves several key steps:

- Needs Assessment: Analyze your asset portfolio, family structure, and succession objectives to determine the optimal corporate structure.

- Company Incorporation: Establish the Hong Kong company with appropriate share capital, director appointments, and registered office arrangements.

- Asset Transfer: Legally transfer assets into the corporate structure, ensuring proper valuation and documentation.

- Governance Framework: Draft comprehensive shareholder agreements, articles of association, and succession protocols.

- Tax Optimization: Structure operations to maximize Hong Kong’s territorial tax benefits and utilize applicable double taxation agreements.

- Ongoing Compliance: Implement systems for annual audits, regulatory filings, and record maintenance.

- Regular Review: Schedule periodic reviews to adapt the structure to changing family circumstances and regulatory requirements.

✅ Key Takeaways

- Hong Kong’s tax-neutral environment (no estate duty, capital gains tax, or dividend tax) makes it ideal for international wealth preservation

- Corporate structures enable separation of control and ownership, facilitating smooth multi-generational transitions

- Territorial taxation means offshore income is generally tax-free, while Hong Kong-sourced profits benefit from competitive rates

- Comprehensive double taxation agreements with 45+ jurisdictions prevent international double taxation

- Strict compliance with annual auditing, beneficial ownership registers, and AML requirements is essential for maintaining corporate standing

- Future-proofing through shareholder agreements, governance frameworks, and adaptation to regulatory changes ensures long-term effectiveness

- Professional advice is crucial for navigating complex cross-border tax implications and optimizing your estate planning structure

Hong Kong corporate structures offer a powerful solution for families seeking to preserve and transfer wealth across generations and borders. By combining tax efficiency with legal certainty and global connectivity, these vehicles provide the framework for sophisticated estate planning that can adapt to changing circumstances while protecting family assets. However, the complexity of international tax laws and evolving regulatory requirements means professional guidance is essential. A well-structured Hong Kong company, properly maintained and strategically deployed, can serve as the cornerstone of your family’s wealth preservation strategy for generations to come.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Profits Tax Guide – Corporate tax rates and territorial principle

- IRD Double Taxation Agreements – Comprehensive DTA network information

- IRD FSIE Regime – Foreign-Sourced Income Exemption requirements

- IRD FIHV Regime – Family Investment Holding Vehicle regulations

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.